Parade To Uncharted Territory

US futures are trading mildly higher while the Fed would kick off their two-day monetary policy. The parade towards the uncharted territory would begin soon. Shrinking the size of the balance sheet is something which is untested and no back test records exist for such scale. However, the Fed has prepared the market for this event by telegraphing their message consistently, and no forthwith wild moves are expected immediately when they will take this course. But the fact is that the Fed doesn’t know the actual implications of this and they have made it clear that they will be learning about it as it goes.

The important thing when it comes to the Fed’s balance sheet is not so much the timing, but the equilibrium level. We do not know what that level is and this remains the wild question. However, the Fed is going to make sure that the process would stay as smooth as possible and this would likely push them to hold their gradual approach in hiking the interest rates. The odds of a December rate hike are standing at 40 percent but a hawkish tone by the Fed could strengthen the dollar index.

Wild Cards For Market Meltdown

We do think that Trump’s speech to the U.N, the counter-reaction from North Korea, and Trump’s decision on the Iranian nuclear deal are the wild cards which have the potential to trigger a full-blown market meltdown scenario.

One could say that geopolitical tensions have eased off and are no longer at the boiling point given that there have been no more missile tests from North Korea. However, we do think that it would be naive to underestimate them and ignore the facts which have the ability to propel them to their climax level. The issues with North Korea were clearly directed to the U.N by President Donald Trump. In his speech yesterday, he has made it very clear that the expenses for the U.N have gone up, while the US makes a meaningful contribution to this bill, and the mismanagement has surged too.

Iran’s nuclear deal is something which investors should watch very closely as President Trump stated yesterday that he will be letting the world know about his decision very soon. We know that he has never been happy with the Iranian deal and given that there are also warnings from Iran that if the US back outs from the deal, it would have serious consequences, which provides us an indication about the upcoming events and how they will unfold.

Therefore, we do think that it is immensely important not to neglect the importance of hedging the risk. The record high headlines could easily deviate the attention.

Trump’s speech to the U.N today could spark some new concerns and that could trigger a fresh demand for gold.

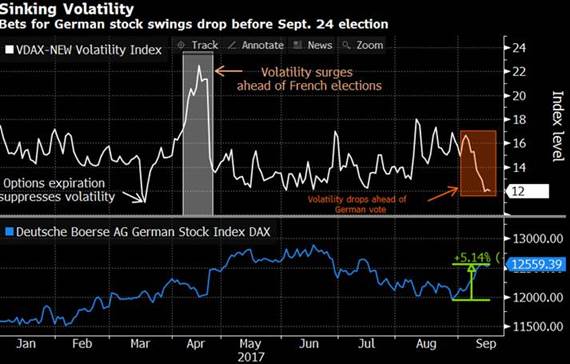

DAX Showing No Sign of Vulnerability; VDAX Plunged

Macron’s victory crushed the anti-euro parties over in Europe and investors are no longer as worried about this as before. The fresh evidence of this can be seen by looking at the performance of the DAX index. The German elections are due on Sunday and if you look at the equity market, there are no signs of anxiety. The index is on track to log September as the best month within the developed world. This is also evident in the DAX volatility index which has plunged the most prior to the German election. The situation was not the same before the French Election, when we experienced a number of large bets coming to the market looking to hedge their bets.

EURO ZEW Sentiment Knocked Euro

The Eurozone ZEW sentiment took the wind out of the euro-dollar pair which broke the 1.20 mark earlier. The weaker number tells us that the economic growth or the sentiment are not necessarily at the same boiling point across the Eurozone. The German ZEW number showed that neither businesses nor consumers have any concerns about the upcoming elections (confirming our earlier argument).