The US dollar is mixed against major pairs ahead of the March Federal Open Market Committee (FOMC) meeting. The Fed is expected to deliver its fist interest rate lift under Chair Jerome Powell. The Fed will publish its rate statement on Wednesday, March 21 at 2:00 pm EDT. Strong data has fueled the dollar revival but the drama in the White House and tariff uncertainty are keeping the currency down against safe haven currencies. The CME FedWatch is showing a 94.4 percent probability of a 25 basis points rate hike, which has already been priced into the USD, with a market eager to hear Chair Powell’s thoughts on the future path of monetary policy during his first post FOMC press conference.

- Fed expected to hike interest rates by 25 bps

- Brexit and Bank of England (BoE) to guide GBP

- CAD will look to retail sales and inflation data for support

Dollar to Look for Chair Powell for Guidance

The EUR/USD lost 0.15 percent in the last five days. The single currency is trading at 1.2284 with a rising USD ahead of the Federal Open Market Committee (FOMC) on Wednesday. The Fed has forecast three to four rate hikes this year depending on the economic growth indicators with Fed members supporting the message through different statements.

The Fed appears on track to deliver the first rate hike of the Powell era, taking the interest rate to a range of 150–175 basis points. Economic data and the central bank have been dollar positive, but the personal moves in Washington and the uncertainty on trade have reduced some of the dollar gains.

The tariffs announced by the US President have begun to elicit retaliatory responses from nations that have not been excluded, even if the full list of exclusions are not public yet. The protectionist measures have created controversy even within the Republican party as it brings a trade war closer to a reality.

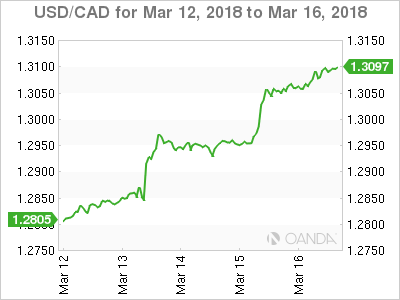

The USD/CAD rose 2.23 percent in the last five trading days. The currency pair is trading at 10.3095 touching 8 month lows as trade with the US is still an uncertain topic and the head of the Bank of Canada (BoC) has signaled that higher rates will be slower in coming. The Fed on the other hand is getting ready for its first interest rate lift under the stewardship of Jerome Powell.

The Canadian economic calendar will have few major entries and only until the end of the week. Retail sales and the consumer price index (CPI) will be released on Friday, March 23 at 8:30 am EDT. Core retail sales fell by 1.8 percent last month and a recovery is expected while inflation rose by 0.7 percent.

The loonie has been under pressure all year. The tariffs announced by the White House did not hit Canada but is still influencing the forecast on the future of NAFTA with Donald Trump still active on twitter singling out the surplus with its northern neighbor. The slowdown of the economy was anticipated but the two factors combined have the currency at a 8 month low as the monetary policy divergence is only going to get wider.

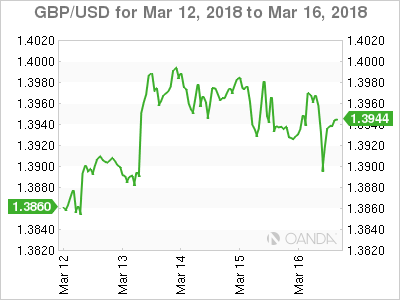

The GBP/USD gained 0.62 percent during the week. Cable is trading at 1.3935 ahead of the Brexit summit next week. The hopes for reaching a transition deal are up and have boosted the currency. The Bank of England (BoE) warned this week that regulators in the UK and the EU are not doing enough to prevent material risks from the derivatives market even if there is a transition deal in place.

With optimism riding high about reaching a deal the central bank will publish its Monetary policy summary on Thursday, March 22 at 8:00 am EDT. The BoE is forecasted to leave the rate at 0.50 percent with a vote count showing a unanimous 9 for keeping rates untouched.

UK inflation data and average earning will be released during the week setting the stage for the central bank and the Brexit summit on Thursday and Friday.

Market events to watch this week:

Monday, March 19

8:30pm AUD Monetary Policy Meeting Minutes

Tuesday, March 20

5:30am GBP CPI y/y

Wednesday, March 21

5:30am GBP Average Earnings Index 3m/y

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Economic Projections

2:00pm USD FOMC Statement

2:00pm USD Federal Funds Rate

2:30pm USD FOMC Press Conference

4:00pm NZD RBNZ Rate Statement

8:30pm AUD Employment Change

Thursday, March 22

5:30am GBP Retail Sales m/m

8:00am GBP MPC Official Bank Rate Votes

8:00am GBP Monetary Policy Summary

8:00am GBP Official Bank Rate

Friday, March 23

8:30am CAD CPI m/m

8:30am CAD Core Retail Sales m/m

8:30am USD Core Durable Goods Orders m/m