Last week ended with a lack of risk appetite in the market and the anti-risk US Dollar benefitted as a result, while short traders in the EUR/USD and GBP/USD were able to take a good profit.

Investors are awaiting the inauguration of Joe Biden, who ascends to the US presidency on Wednesday with a speech outlining his approach to the health and economic crisis. The current rebound in the dollar may persist going into the US Presidential inauguration but we will pay close attention to the technical picture in order to shape near-term expectations. Looking however ahead, the dollar remains vulnerable to further losses over the course of the year.

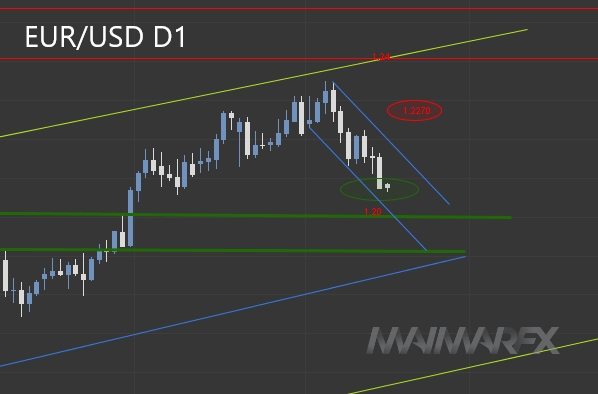

EUR/USD

The euro gave up on its high price levels and the reason for the pullback was not only a stronger dollar, but also weaker GDP growth in Germany, another political crisis in Italy as well as a slow Covid-19 vaccine rollout in the EU.

Technically, the pair seems to be on its way towards a test of 1.20, or at least 1.2050 from where euro bulls could possibly try to lift the euro out of its current oversold territory. On the upside there is a lower resistance now at around 1.2160 that could limit near-term upward movements. A break above 1.2180, however, could reinvigorate bullish momentum towards 1.2270.

GBP/USD

The cable gave up all of its recent gains after failing to overcome the 1.37-barrier. It will now be interesting whether the 1.3540-30 area serves as a support, providing some relief for sterling bulls. If the pound drops below 1.3530 we expect further losses towards 1.3450 and possibly even 1.34. For bullish momentum to accelerate we will need to see the pound breaking above 1.3660-70 but more importantly above 1.37.

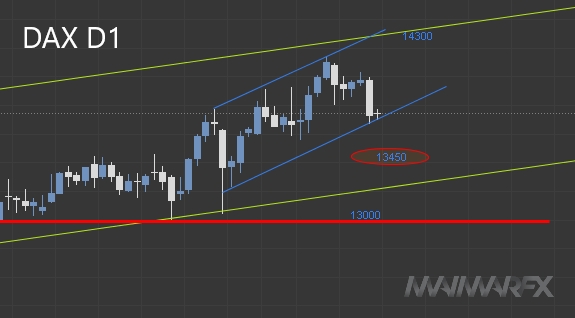

DAX

The DAX edged lower after failing to stabilize above the 14000- threshold. We see a lower support at 13450 whereas on the upside, the 14300-level remains of interest.

It could be a quiet start to the new week with US markets being shut today for the Martin Luther King Jr. holiday.

Another key event this week will be the European Central Bank policy decision on Thursday but little is expected with all the ECB’s monetary settings likely to remain unchanged.

Disclaimer: All trading ideas and expressions of opinion made in the articles are the personal opinion and assumption of MaiMarFX traders. They are not meant to be a solicitation or recommendation to buy or sell a specific financial instrument.