The U.S. Energy Department has given its final approval to Golden Pass export terminal, a joint venture (JV) of Qatar Petroleum, ExxonMobil Corporation (NYSE:XOM) and ConocoPhillips (NYSE:COP) , to ship 2.21 billion cubic feet domestically manufactured liquefied natural gas (LNG) per day, to other countries.

The Federal Energy Regulatory Commission has taken into account the security, economic, and environmental aspects while reviewing the application for the license. The macroeconomic studies regarding the export of LNG revealed the benefits to the U.S. economy. The authorization of Golden Pass brings the country one step closer to becoming a key player in the global energy market, which is generally dominated by nations like Russia, Qatar, and other Gulf countries.

The U.S. Department of Energy has sanctioned exports of a total of 544 million cubic meters of natural gas to non-free trade agreement (FTA) countries. This will be supplied from planned facilities in Florida, Georgia, Louisiana, Maryland, and Texas.

According to the JV's evaluation of the facilities, it expects to generate 45,000 direct and indirect jobs over the next five years. It will also create 3,800 direct and indirect jobs over the next 25 years after the production starts. The cumulative effect of development and 25 years of production at Golden Pass is estimated to contribute up to $2.4 billion in the federal tax revenues and $1.2 billion in the state tax revenues.

In the year 2009, Golden Pass was established to import LNG from abroad. The boom in domestic gas production through hydraulic fracturing and horizontal drilling proved to be favorable for the JV, which played a major role in the Department of Energy's current decision. Golden Pass is a joint venture between Qatar Petroleum (70%), ExxonMobil (17.6%) and ConocoPhillips (12.4%).

About the Companies

ExxonMobil is involved in the exploration and production (E&P) of crude oil and natural gas. It also manufactures petroleum products, and transports and sells crude oil, natural gas and petroleum products. The company is also engaged in the exploration, mining and sale of coal, copper and other minerals. The company is headquartered in Irving, TX.

ConocoPhillips is a major global E&P company with operations all over the world. The company is headquartered in Houston, TX.

Price Performances

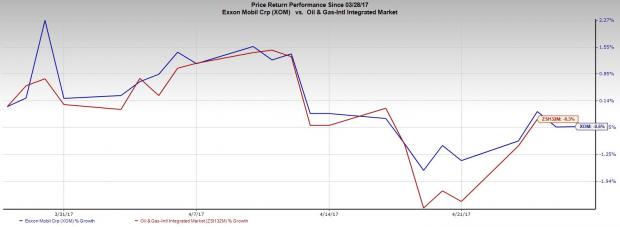

In the last one month, ExxonMobil's shares’ performance was similar to the Zacks categorized Oil and Gas - International - Integrated industry. The company’s shares fell by 0.53% whereas the industry recorded a decrease of 0.33%.

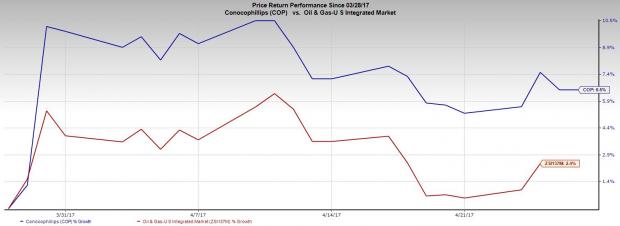

On the other hand, during the same time period ConocoPhillips’ shares gained 6.52% while the Zacks categorized Oil and Gas - U.S. - Integrated industry witnessed an increase of 2.42%.

Zacks Rank and Stocks to Consider

Both ExxonMobil and ConocoPhillips presently have a Zacks Rank #3 (Hold). Some better-ranked stocks in oil and energy sector include Global Partners LP (NYSE:GLP) and Antero Resources Corporation (NYSE:AR) . Both these two stocks flaunt the Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Global Partners is expected to witness sales growth of 8.63% year over year in 2017. The partnership had an average positive earnings surprise of 96.55% in the last four quarters.

Antero Resources is expected to record 7.82% year-over-year growth in 2017 sales. The company had an average positive earnings surprise of 239.10% in the last four quarters.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 "Strong Sells." Even though this list holds many stocks that seem to be solid, it has historically performed 6X worse than the market. See these critical buys and sells free >>

Global Partners LP (GLP): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post

Zacks Investment Research