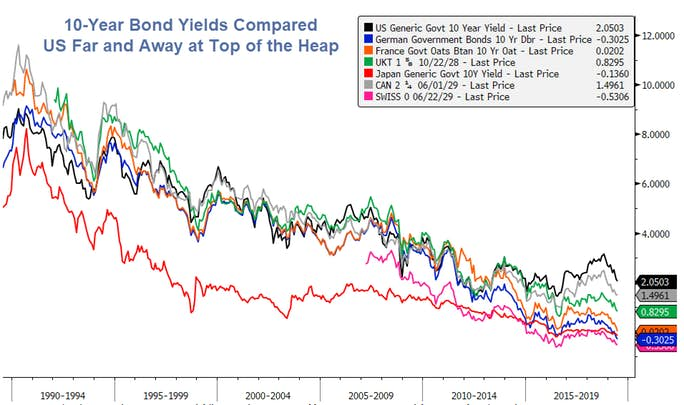

In a global comparison of 10-year government bonds, three countries have negative-yields and France is on the cusp.

The chart is courtesy of Chris Puplava at Financial Sense following an request by me. The data is from Bloomberg.

10-Year Yield Comparison

- U.S.: 2.05%

- Canada: 1.50%

- U.K.: 0.83%

- France: 0.02%

- Japan: -0.14%

- Germany : -0.30%

- Switzerland : -0.53%

100-Year Bond Yield Madness

I failed to ask about Austria.

Please note a 100-Year Austrian Bond Yields 1.2%.

If you needed any more proof that the world of fixed income has gone mad in the rabid hunt for yield, look no further than the Republic of Austria. If you liked its 100-year debt issued two years ago with a 2.1% return, how about settling for the same maturity for 1.2% now? Yes, you read that right: A 100-year bond yielding about 1.2%.

If you wanted to buy any of those 2.1% 2117 Austria bonds right now, you’d have to pay 60% more than their issue price; they’ve been a great success.

Got that? If you bought 2117 bonds two years ago yielding 2.1%, you are now sitting on a 60% gain.

Flattest Curve in World History?

A quick check shows that Austria's 10-year bond yields -0.02%

Investors get just over 1 basis point per year over the course of 100% years.

Good Reasons?!

Axios attempts to rationalize negative-yield bonds in the Resurgence of Negative-Yielding Debt.

The big picture: The benchmark 10-year bond yield is negative in Germany, the Netherlands, Switzerland and Japan; it's also this close to going negative in France. Even Greece has seen its 10-year bond yield fall to just 2.4%, an all-time low.

Be smart: You'll see a lot of chatter about how the investors in these bonds would get a better return were they to just stash cash under a mattress. Ignore that chatter. If you're an institutional investor managing trillions of dollars in assets, you can't convert that money into cash, and while a bank will probably pay you 0% for that money, you still end up taking significant counterparty risk. Bonds have negative yields for good reason.

Negative Yields Logically Impossible

In the real world negative-yield bonds are impossible. No one would prefer a dollar ten year from now to a dollar today.

Bond yields are negative only via direct, constant manipulation by central banks for no good reason at all.

In fact, negative yields hurt bank profits and savers as well.

I suspect but cannot prove, a negative yield derivatives mess is partially responsible for the collapse of Deutsche Bank (DE:DBKGn).

Regardless, whereas the Fed bailed out U.S. banks by paying interest on excess reserves, the ECB charged banks interest on excess reserves (hoping to spur lending) but it didn't, and won't.

I do not agree with Fed-sponsored bank bailouts, but the ECB policy is pure madness.