When the BLS unemployment numbers “improved” to 8.2% on Friday, I thought enough is enough. Come on boys and girls, yah gotta be smarter than to believe this garbage! Nothing in the world of logic or specific data point in the BLS database supports ANY drop in the unemployment rate this month.

Literally half of the drop in the unemployment rate over the last year is due to shrinking the size of the workforce – in other words unemployed are no longer being counted as they are removed from the workforce.

Bad decisions are made when understanding is obfuscated. Is unemployment falling – generally yes, but specifically this month – NO. The size of unemployment is not correctly understood because of silly definitions and moveable baselines which prevent comparative analysis to other periods of time.

There are a variety of reasons exact understanding of unemployment is necessary. The primary reason for me is understanding economic slack. A large unemployed population puts downward pressure on wages, and it is an economic pulse point.

The problem begins with who is defined as unemployed. Per the BLS.

Persons are classified as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work. Actively looking for work may consist of any of the following activities:

- Contacting:

- An employer directly or having a job interview

- A public or private employment agency

- Friends or relatives

- A school or university employment center

- Sending out resumes or filling out applications

- Placing or answering advertisements

- Some other means of active job search

- Checking union or professional registers

If not receiving unemployment benefits, you stop looking for a job if your home area is short jobs. There are many regions of the country which are short jobs and it is a wasted effort to look. This happens to many couples when only one loses a job – and the other still has a good job. Even though I believe any person without a job is unemployed, the definition of unemployment is not my primary concern with unemployment numbers.

The unemployment data is obtained by sampling – approximately 60,000 households and 110,000 individuals. I have no real concerns with good sampling (even though I ponder who polls the people who have dropped out of society which seems to be growing).

My problem is what is done with the survey results. By definition percentages are a fraction of a “whole”. The “whole”, in unemployment, is the ESTIMATED size of the workforce.

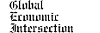

From the red line in the graphic above, you can see that the workforce as defined by the BLS has essentially stopped growing since the recession. In the history of the BLS data base, this has never happened until now. Strange? Have a growing percentage of American’s all of a sudden dropped out of the workforce?

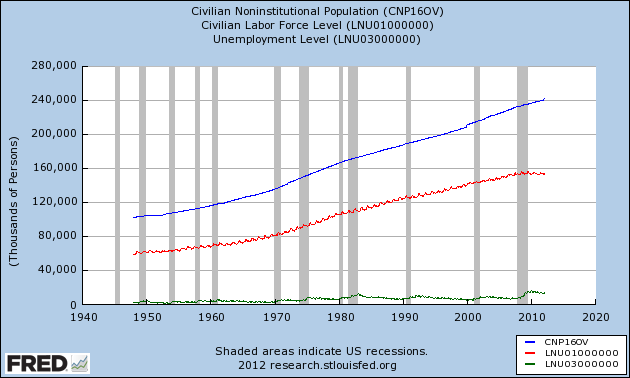

Using 2009 workforce to Civilian Population (over 16) ratios, 5.5 million Americans have disappeared from the workforce through the end of March 2012 – and therefore are not being counted as unemployed either. This alone sets the current unemployment rate 0.3% too low.

The magic in the continually improving unemployment rate is to shrink the size of the workforce. The real unemployment statistics for context:

- Currently 63.1% of the civilian population over 16 is employed – it was 64.0% one year ago, and the trend remains down.

- In normal economic times , 66% of the civilian population over 16 is employed.

- The number of people unemployed have changed little since October 2011 – yet the unemployment rate continues to fall.

- There are currently 12.9 million unemployed according the the BLS – and likely this number should be 18 million.

The civilian population over 16 is provided by US Census. There are no backward revisions each month. Unemployed is simply subtracting employed from the population.

This is my primary issue with the unemployment numbers. Anyone who is responsible for directing real work knows that an extrapolated estimated number divided by another extrapolated estimated number is garbage. This is how the headline unemployment rate is derived.

Other Economic News this Week:

The Econintersect economic forecast for April 2012 shows a less good growth. There has been a degradation in our government and finished goods pulse points.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

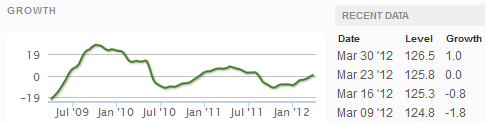

This week ECRI’s WLI index value improved to 1.0 – the best index value since August 2011. This is the eleventh week of index improvement. This index is now indicating the economy six months from today will be marginally better than today.

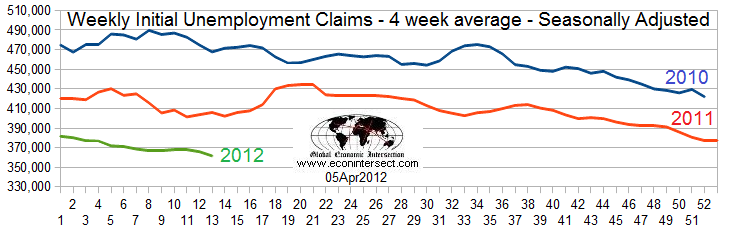

Initial unemployment claims essentially fell from 363,000 to 357,000 – a number last seen in April 2008. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – fell from 366,000 to 361,750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) were rail movements and CFNAI. Depending on the color of your glasses, one could draw several conclusions – my take is that all is still good but I am at a higher alert level looking for economic outliers as the data is mixed.

Click here to view the scorecard table below with active hyperlinks

Bankruptcy this Week: WorldGate Communications, Pinnacle Airlines, AFA Investment

Failed Banks this Week: None