Daily Forex Market Preview, 18/10/2018

The Fed released its meeting minutes yesterday covering the monetary policy meeting from September. Officials maintained the view that further gradual rate hikes were necessary. The hawkish tone of the minutes sent the USD to rise.

UK's inflation data released yesterday showed that consumer prices rose at a much slower pace. Headline inflation was seen rising 2.4% on an annualized basis in August. This was slower than the median forecasts of 2.6%. Inflation eased from 2.7% in August. Core CPI which excludes the food and energy prices rose 1.9% down from 2.1% in August.

Australia's unemployment data showed that the official unemployment rate fell to a six-year low at 5.0%. This beat estimates of no change at 5.3%. The number of jobs added was slower at 5.6k which was below estimates of 15.2k.

In Japan, the export data showed a decline for the first time in two years. The decline in exports came amid the business concerns about the trade wars as well as natural disasters.

The day ahead will see the retail sales figures from the UK coming out. Headline retail sales are forecast to fall 0.4% on the month following an increase of 0.3% previously.

The EU's economic summit continues for the second day today. On the agenda will be the Brexit issue. The NY trading session will see the release of the Philly Fed manufacturing index. Economists forecast that the Fed manufacturing index eased to 18.7 from 22.9 previously.

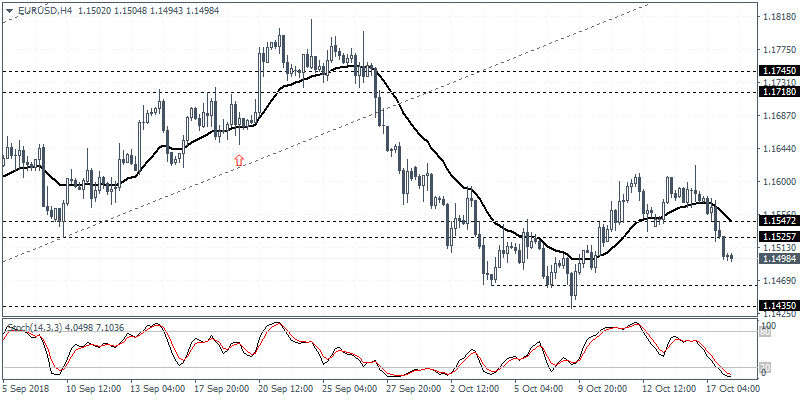

EUR/USD intraday analysis

EUR/USD (1.1498):

The EUR/USD was bearish yesterday as price action fell past the support level of 1.1547 - 1.1525. We expect the declines to push the common currency down to the lower support level at 1.1435. This would mark a retest of this level that was previously established. The declines are most likely to stall at this point following which the EURUSD currency pair could be seen attempting to post a rebound.

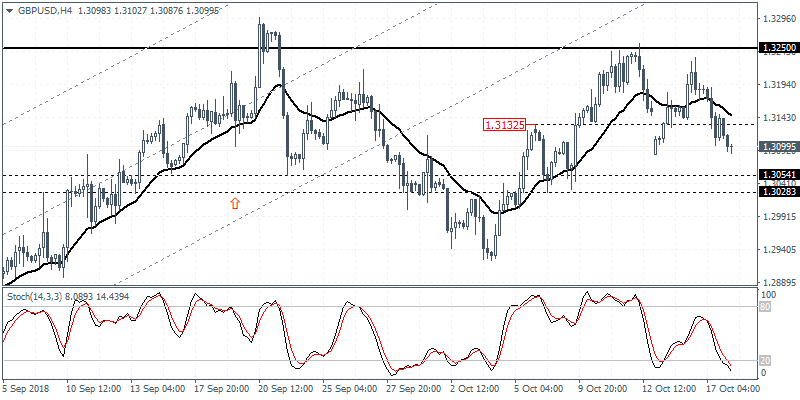

GBP/USD intraday analysis

GBP/USD (1.3099):

The GBPUSD currency pair closed below the 1.3132 level of support following the failure to post a new high on the rebound. The declines could send the British pound lower as price action could test the support level at 1.3054 - 1.3028. In the short term, we expect the currency pair to maintain a range within the said levels. A breakout from these levels could trigger further direction. To the downside, the next lower support at 1.2808 remains in focus, while to the upside, the price will need to break past 1.3250 resistance to post further gains.

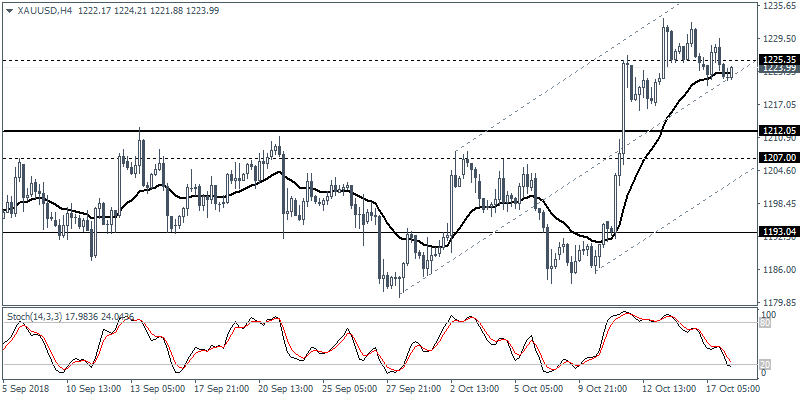

XAU/USD intraday analysis

XAU/USD (1223.99):

Gold prices were seen easing back on the bullish momentum. Price action is currently attempting to retrace some of the losses. However, we expect the minor resistance level at 1225.35 to hold the gains in the short term. A reversal off this level could trigger the downside. Gold prices will most likely fall back to retest the breached resistance level region of 1212.05 - 1207.00 ahead of further gains. Alternately, if price action breaks past 1225.35, then gold prices could be seen resuming the bullish momentum.