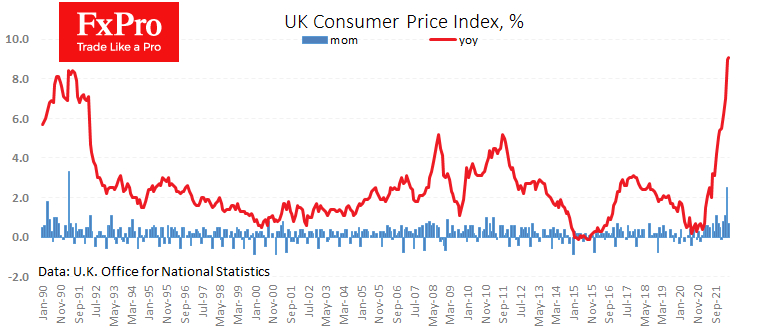

Consumer inflation continues to gain momentum in the UK. Data for May showed that CPI accelerated to 9.1% y/y - a record among the G7 and a 40-year high. The monthly price growth rate was 0.7% compared to 2.5% and 1.1% in the previous two months.

However, apart from the reversal to lower base commodity and energy prices in the last couple of weeks, there is little indication that the Bank of England can relax. Moreover, it needs to double the pace of the rate increase from 25 points at once.

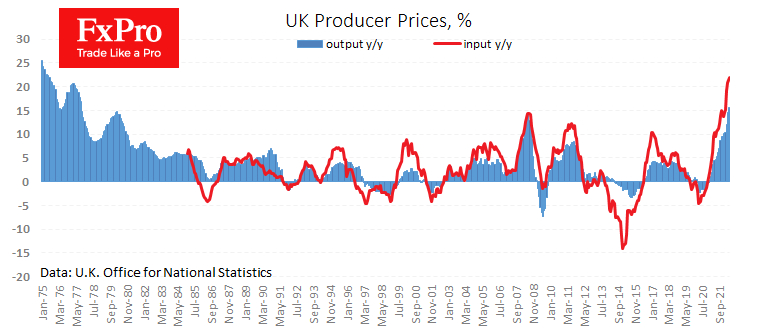

Last month producer input prices rose by 2.1% and output prices by 1.6%, reaching an annual rate of 22% and 15.6%, respectively. Under these conditions, producers and retailers will continue to pass increasing costs down to consumers. Unlike in the early years after the financial crisis, retail sales and employment are strong, which allows such a shift of rising outlays to end consumers.

It could take another two months of waiting for a turning point in inflation, the CPI will reach a high base effect, and in that time, the CPI could get double-digit y/y growth rates.

In this environment, the Bank of England’s moves to raise the rate by 25 points at each meeting are not capable of curbing inflation. Perhaps the main positive effect of this policy is the devaluation of the pound’s purchasing power and the reduction of the debt burden in real terms.

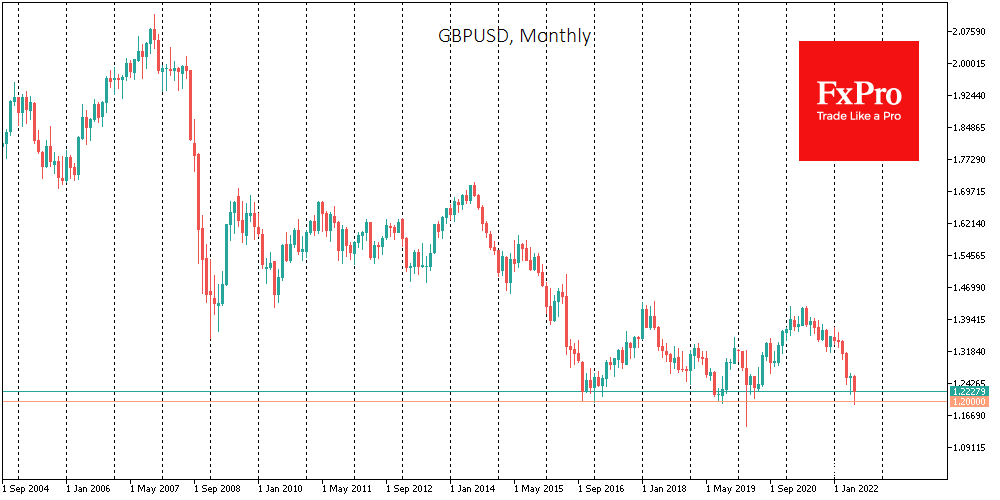

However, the more obvious consequence of such policies is a drop in confidence in local financial markets and the pound, which we see with the Japanese yen at its lows against the dollar in 24 years.

GBP/USD is now trading at 1.22 - near the psychological low of 1.2000, where it received critical support in 2017 and 2020. But that support may not survive the third test of strength due to an increasingly threatening gap between inflation and interest rates, which would devalue debt.

But this is a risky policy that could undermine confidence in the financial system, which will require decisive and brutal measures for the economy to restore.