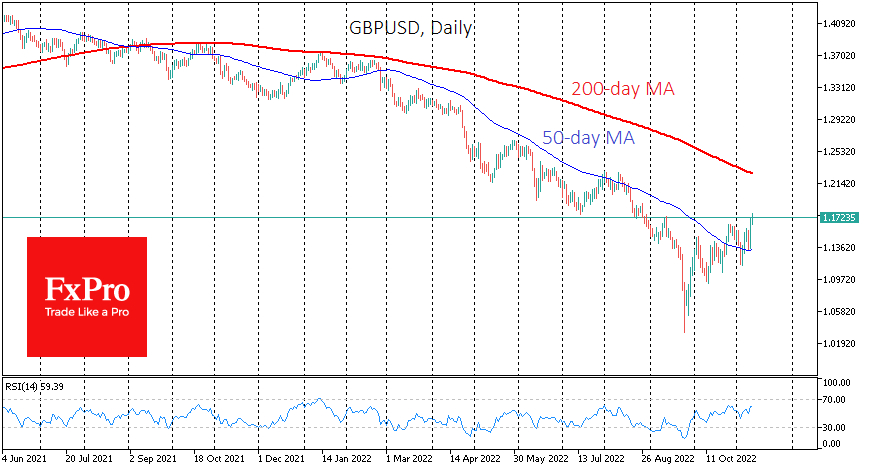

The GBP/USD rally gained new momentum on Friday morning, following a respite after the 3% rise on Thursday. The British currency was supported predominantly by better-than-expected economic data and comments from the Governor of the Bank of England on the intention for further rate hikes.

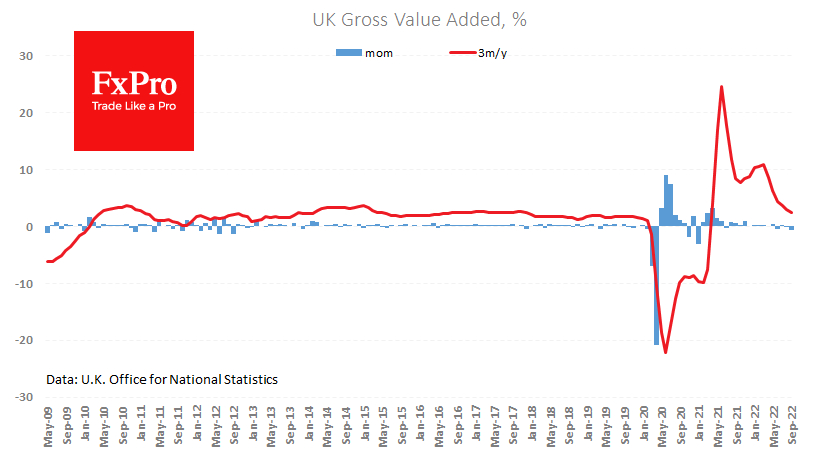

The UK economy contracted by 0.2% in the third quarter - noticeably less than the forecasted drop of 0.5%. One year ago, growth in the same period diminished to 2.4% after 4.4% in the second quarter and +2.1% expected. For September, the economy contracted by 0.6%, following a decline of 0.1% in August.

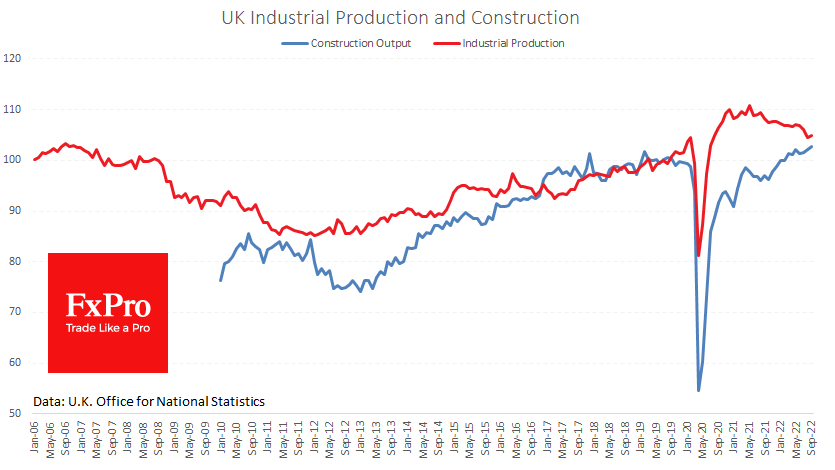

Industrial production added 0.2% in September, losing 3.1% y/y. Manufacturing is more challenging, holding on to volumes in September after contracting by a cumulative 2.9% in the previous three months.

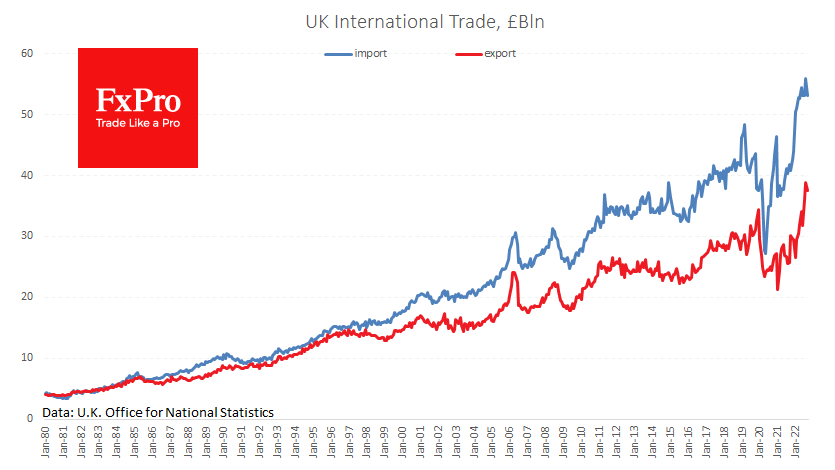

Separately, there is an improvement in the balance of foreign trade. The monthly deficit decreased to 15.6bn compared to 17.2bn a month before, 16.1bn a year ago, and a peak of 23 in January. However, this is well above 'normal' levels from 2013 to 2019, near 12bn. Exports are up 46% y/y or 11.8bn, and imports are up 27% ,or 11.4bn.

The UK economy has started to contract without surprises, evidenced by earlier labor market figures. So far, it is a softer landing than previously feared.

Nevertheless, it is essential for market participants that the published data shows a less tragic slowdown trajectory and that the decline in commodity prices in recent months is easing the pressure on imports and industry.

In this environment, there are more and more reasons for long-term buying of the British pound, which renewed its historic low against the dollar in September. As a result, the GBP/USD is now above 1.1750, having beaten off losses since August.

The rise in the British currency also shows signs of breaking the downtrend as GBP/USD has surpassed previous local highs and has consolidated above the 50-day average.

On the technical analysis side, GBP/USD may encounter little resistance up to the 1.20 area by the end of the month, where the bulls will still have to prove their strength.