What’s at stake: Almost a year after the UK voted to leave the European Union, its economic performance has showed mixed results. The risks of a Brexit-induced recession do not seem to be materializing. On the contrary, up until the end of 2016 the UK saw a continuation of strong consumer spending and strong output in consumer-focused activities. However, the UK economy is showing signs of slowing down in the first quarter of 2017, with weak growth in the services sector and business investments. In addition, strong consumption growth started to cool down as individuals’ purchasing power declines due to a weaker exchange rate. This leads to a question whether it is the beginning of the Brexit slowdown. We review the contributions made on this topic in the last year.

What Do The Numbers Say?

The UK economy grew by 0.3% in the first quarter of 2017, a reduction from 0.7% in the last quarter of 2016 according to the Office of National Statistics. Slow growth results mainly from the services sector, which grew by 0.3% in the first quarter of 2017 compared to 0.8% in the last quarter of 2016. The biggest negative contributions to growth came from consumer-focused industries, such as retail trade and accommodation. The slowdown in these sectors mostly come from an increase in prices. However, some of the reductions were partly offset by positive contributions from food and beverage service activities. On the production side, manufacturing increased by 0.5% in the first quarter particularly in the motor vehicles industry.

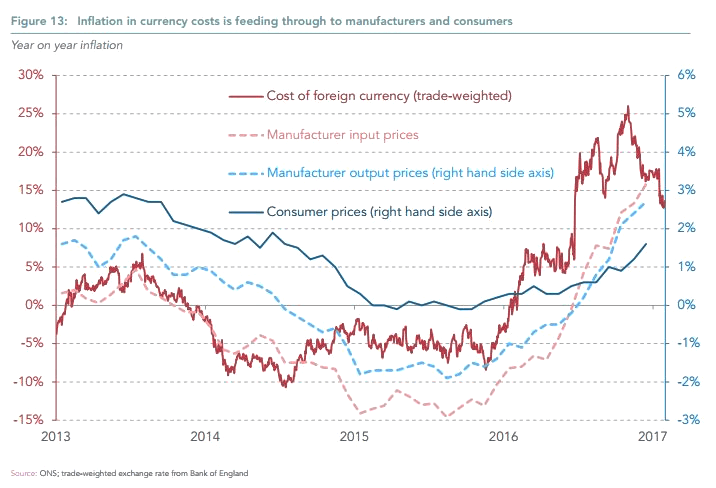

According to the Resolution Foundation, the UK’s short low-inflation spell might be coming to an end. The trade-weighted value of pound sterling has declined between 15% and 20% post-Brexit compared to a year earlier. Even though current (December 2016) inflation of around 1.6% (an increase from 0.5% in June 2016) is below Bank of England’s target of 2%, inflation is expected to rise further.

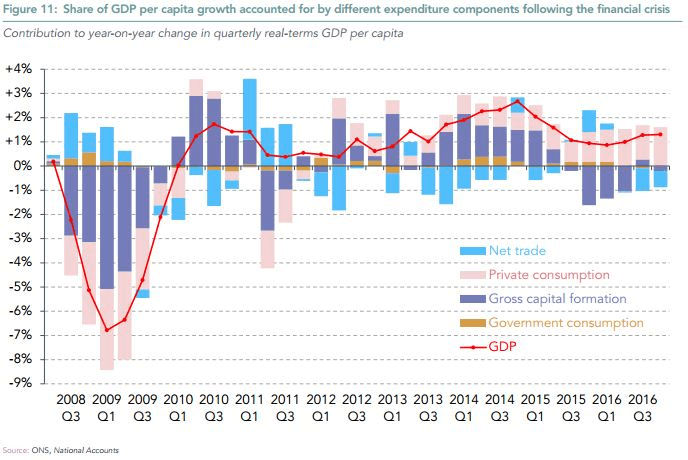

Exchange rates are starting to feed through to production costs and then to consumer prices. In the meantime, throughout 2016 private consumption has accounted for most of the total GDP growth, while other elements, such as trade and gross fixed capital formation acted as drags on output. However, there is reason to believe that income growth has slowed, resulting from sliding employment after a peak and increasing inflation resulting from a declining value of pound sterling.

The National Institute of Economic and Social Research, a London-based economic think tank, says in their latest report that consumer price inflation is expected to reach 3.4% at the end of 2017, breaking the 3% and entering a “walking inflation” phase. On 11 May, the Bank of England published its new Inflation Report in which it has stated that the CPI has increased above the 2% target and it is expected “to rise further above in the coming months, peaking a little below 3% in the fourth quarter”. And inflation figures seem overall to increase at a fast pace since the end of 2016: headline CPI jumped from 1.2% in the fourth quarter of 2016 to 2.3% in March 2017. With wage growth remaining below inflation figures, Simon Kirby from the NIESR said that UK households will therefore face a reduction in their disposable incomes and their purchasing power.

How To Interpret The Numbers?

Simon-Wren Lewis also notes the strong consumption growth, which overperformed expectations in the second half of 2016. In the meantime, most of the GDP growth in 2016 was down to consumption growth and if consumption is growing while other components of GDP are not, then it implies that consumers are eating away their savings. This is unsustainable. There are three expectations why GDP growth has slowed down to 0.3% in the first quarter of 2017 after strong growth in the second half of 2016.

First, that it might be a one-quarter occasion with growth resuming later on by firms continuing to take advantage of the temporary “sweet spot” created by pound depreciation. Second, consumers are realizing that they face a fall in their future incomes and starting to adjust their consumption. Third, consumers are buying overseas goods before imports become expensive. However, looking outside the short term, we can assume that Brexit will make the average UK citizen worse off due to the fact that real household incomes will deteriorate further. Even if GDP growth does not deteriorate, the incomes of the average household will remain at best flat.

Tyler Cowen advises not to believe the positive news coming from the manufacturing and services sectors in the second half of 2016. The lack of a short-term recession, he writes, does not mean that the country will not pay the economic price. On the contrary, most of the losses will be felt more slowly, which would probably prove to be worse than a recession. If the plunge in the pound sterling continues, British assets will be worth less and net household wealth will see a decline. This decline will then be exacerbated by the rising costs of imports because of the weaker pound.

In the long-run, according to rough calculations, the cost of Brexit would be around 360 billion pounds, or 5,625 pounds per capita. But, since it will be spread over many years, the loss will be psychologically less painful. He writes that under all plausible post-Brexit projections, exports were increasing in the short-run and that British production capacity is still present which will see increased orders from abroad due to weaker pound. However, it is too early to pat ourselves on the back in the face of long-run negative impact of Brexit on the UK economy, which might prove more severe than a short-run recession.

Ben Broadbent from the Bank of England, writes that the current economic situation in the UK is what can be called as “post-referendum” but “pre-Brexit”. The implication is that this timing creates a “sweet spot” for exporters. This results from both the weak pound and unchanged costs in terms of exports, that is before the tariffs are re-negotiated and rules re-drawn. But this window is unlikely to last long, so while at this point short-term investment pays off, the uncertainties involved in the future profits will make firms cut back on future investment. The Bank of England has projected lower growth of 1.7% by the last quarter of 2017 compared to 2% in the last quarter of 2016. All in all, the negative effect on consumption, through import prices and household income is expected to outweigh the positive effects on current demand.

Curious Case Of “Shrinkflation”

However, consumers might be already being hit by the current economic environment. As mentioned by Sarah Butler and Zoe Wood, “shrinkflation” is becoming trendy in the UK. What does “shrinkflation” stand for? It is an attempt by retailers to limit the impact of high inflation on consumers by maintaining stable prices while decreasing the quantity of a good offered at a specific price. For example, Doritos reduced the size of its large bags by 10% but kept the price at a similar level (average price of GBR1.99). Coco Pops applied the same method by shrinking the size of its big boxes by 80g. The depreciation of the pound combined with a low real wage growth makes the UK economic environment a good candidate to still see “shrinkflation” in the future.

But the ghost of a rise in prices is never far away. Suppliers of food, toiletries and household goods are currently facing rising prices of commodities due to a falling pound. With higher costs of production, suppliers are trying to pass on prices increase to retailers, which creates business disputes. The recent case of Unilever (LON:ULVR) halting deliveries to Tesco (LON:TSCO) precisely depicts this story.

Unilever, the supplier, tried to augment the prices of a vast spectrum of its goods by 10% but did not manage to reach an agreement with Tesco, the retailer. As a sanction, Unilever took the decision to stop providing some of its branded goods (Dove, Marmite, Knorr for instance) to Tesco. The latter had to cope with a large decrease in its stocks and could not offer some Unilever products to the consumers. In trying to keep the prices as low as possible, retailers try to remain competitive but face the risk of not having suppliers anymore, which affects the range of available goods for consumers.

Impact On Finance

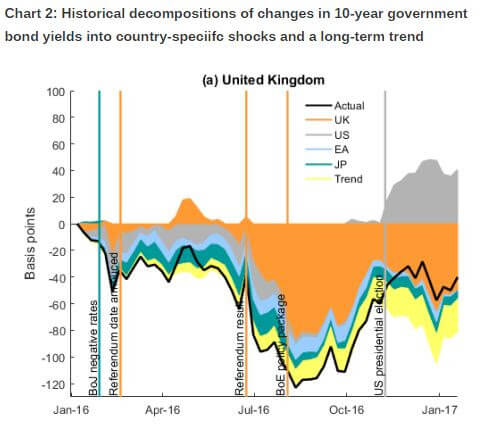

Brexit related shocks had an impact on the equity and bond markets of other advanced economies beyond the home country effect according to Raczko, Wazzi and Yan, writing in the Bank of England staff blog. In their model the authors decompose 10-year government bond yields and equity prices from the UK, US, euro area and Japan into country specific shocks since the beginning of 2016. The finding suggests that UK bonds yields were 60 basis points lower at the end of 2016 compared to the beginning of 2016. After the surprise referendum results global markets responded by selling risky assets (equities) and purchasing safer assets (bonds) which led to falling bond yields and equity prices.

The trend continued and in the five weeks following June 24, 2016, UK bonds yields fell further, reaching a trough of 0.6%. Bank of England responded by decreasing the Bank Rate, introducing a new Term Funding Scheme, expanding government bonds purchases and purchasing corporate bonds. The policy response managed to reverse two-thirds of the initial post-referendum shock. In addition, negative shocks coming from euro area and Japan partially drove the decline in UK bonds and equities. However, the drop in yields would have been higher if there wasn’t US specific shock, driven by the US presidential election, which in fact pulled UK yields up.

Paul Krugman says that the weak pound should not be necessarily viewed as an additional cost from Brexit, but rather part of the adjustment process. Pre-Brexit UK was suffering from a form of the Dutch disease, whereby the City’s financial services sector kept the currency strong while hindering the manufacturing sector’s competitiveness. The weak pound now helps British manufacturing and the incomes of the people who directly and indirectly depend on manufacturing. Faced with Brexit and increased transaction costs between the UK and the rest of Europe, financial services have an incentive to move away from the smaller economy (UK) to the larger (Europe). As such, a weaker currency is in fact desirable to partially offset this adverse effect.

The weak exchange rate has also deflated the property price-exchange rate carry trade, writes Ashoka Mody. London’s housing market was believed to be safe and offered quick capital gains, as such attracting a large amount of foreign speculative investment. Foreign investors expected gains from both rising prices and an appreciating pound. Post-referendum there was a strong correlation between depreciating pound and weakness in the property based asset prices (FTSE property index and Real Estate Investment Trust index). Brexit disrupted the process whereby property was pulling capital in, pushing up value of the pound and undermining British competitiveness.