• The US economy has recovered again on the back of a reversal of headwinds from higher oil prices and the Japanese earthquake. Declining yields have contributed to a lift in the housing market.

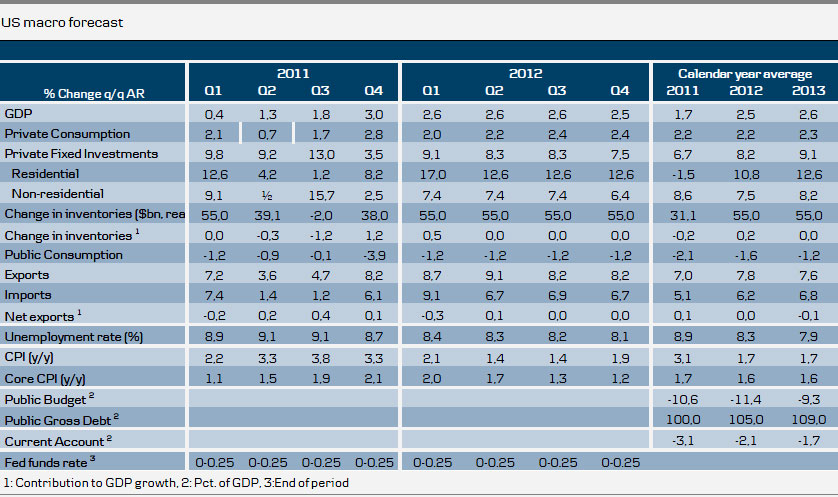

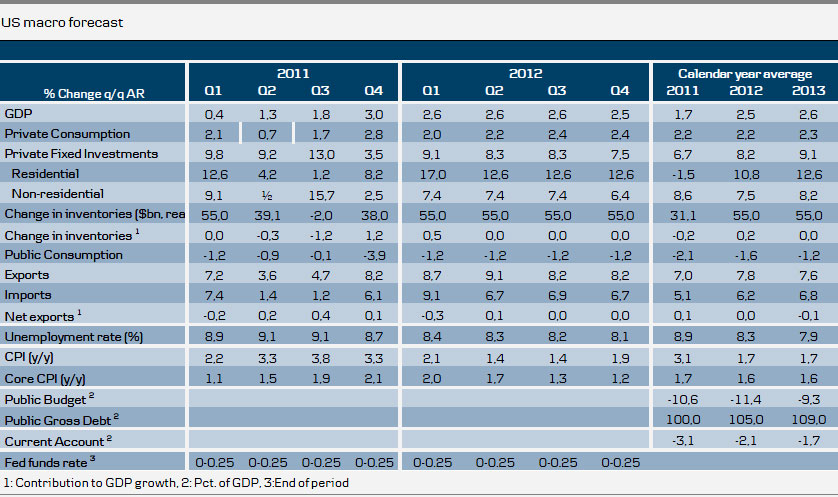

• We estimate growth was 3% in Q4 and expect it to continue at cruising speed, with 2.5% in 2012 and 2.6% in 2013, as stronger dynamics are kept in check by a slight tightening of fiscal policy.

• Risks are no longer mainly skewed on the downside but are more evenly balanced. The improvement in housing and positive surprises in the labour market give a rising probability of a recovery with stronger momentum than currently expected.

• We expect the Fed to be on hold throughout 2012. Thus, we do not expect QE3. In our view, the Fed is likely to use its upcoming projections for the Fed funds rate to steer monetary policy through its effect on longer term yields.

• We expect both headline and core inflation to fall during 2012 on the back of lower direct and indirect effects of commodity prices.

Consumption engine pulls again as shocks dissipate

Entering 2012 the US economy is on a much stronger footing than seen for most of 2011. Growth in Q4 11 is tracking slightly above 3% as private consumption has recovered and the inventory cycle has turned more supportive of economic activity. Net exports have also improved as export growth gained some steam towards the end of 2011 while import growth remained subdued. It seems the very weak USD is increasingly supporting net trade.

So why did fears of a recession prove excessive and instead the economy improved? As we wrote in Global Scenarios: Long period of slow growth ahead (14 September 2011), the headwinds that caused the downturn were fading and turning to tailwinds. Private consumption, in particular, was hurt in the first half of the year by the shocks that hit the economy. However, as the shocks have dissipated, private consumption growth has recovered.

First, gasoline (petrol) prices reversed sharply during the year, falling from a peak of around USD4 per gallon in early May to USD3.37 per gallon currently. This has given a decent boost to real income growth as the consumer deflator has fallen from 3.9% in Q1 to an estimated 0.5% in Q4 – a direct lift to real income growth of about 3.5 percentage points.

A second factor that supported private consumption in the second half of 2011 was a rise in car sales. This came after a significant decline in car sales in Q2 following the earthquake in Japan, which led to supply disruptions that hit the auto industry especially.

Looking into 2012, we continue to look for decent growth in private consumption. A simple model of private consumption based on real income growth and housing wealth suggests private consumption should grow about 3% in 2012. In the model we assume a rise in the PCE deflator to around 2%, which would be compensated by a pickup in non-farm payrolls to an increase of 150,000-200,000 per month.

We prefer to be a little on the cautious side though and forecast an increase in private consumption growth of 2.5% in 2012. This leaves some scope for a small increase in the savings ratio, which declined over the second half of 2011.

Housing set to start supporting growth...

Another positive surprise in the US in recent months has come from the housing market. Both sales and building activity have been better than expected and inventories of homes are coming down fairly rapidly now.

The housing market is supported by the rapid decline in bond yields as well as rising incomes. This has led to a further increase in affordability, which is running at very high levels. A barrier to a turn in the housing market has been the very low confidence among households. However, as unemployment has started to fall and more stories of improving housing activity hit the media, we expect sentiment to improve gradually and look for a further thawing of the housing market in terms of a gradual increase in house prices and a pickup in construction spending. Housing will thus increasingly move from a drag on to a boost to the overall economy and help strengthen the recovery.

As construction is at very low levels (now only 2.5% of GDP), we believe the direct growth contribution will continue to be limited. We expect construction spending to move from a neutral factor for growth to a positive contribution to growth of 0.3 percentage points in both 2012 and 2013.

...and be counterweight to fiscal tightening

This will prove an important counterweight to the fiscal tightening, which is likely to continue in 2012. We still do not know how much the tightening will be, as it is uncertain what the budget looks like. However, we assume that the payroll tax cuts given in 2010, which were extended by two months in December last year, will be extended further to last throughout 2012. We estimate that overall fiscal policy will subtract around 0.5-1.0pp from growth in 2012.

It is uncertain how much fiscal policy affected growth in 2011 but we estimate the fiscal effect to be of a similar magnitude to in 2010. The structural deficit estimated by IMF rose to -6.4% in 2011 from -7.0% in 2010 pointing to a drag of approximately 0.5pp. Also, looking at government consumption and investment in the National Accounts, this component gave a negative growth contribution of 0.5pp in 2011. This has to be compared with an average boost from this component of +0.4%. Hence, relative to a normal year government consumption and investment contributed close to 1pp less to GDP growth. One has to add, though, a positive effect from tax cuts given in early 2011 (the cuts that have now been extended by two months).

As these contributed close to 0.5pp to growth it points to a net drag from fiscal policy of a little more than 0.5pp. On top of this, is there is an indirect effect of the decline in government employment in 2011. The government shed 250,000 jobs in 2011, having added 200,000 jobs per year on average per year over the previous 10 years. Judging from these data, we judge that fiscal policy subtracted 0.5-1.0pp from GDP growth in 2011 and we expect a similar drag in 2012. This means that fiscal policy should be neutral for the change in the growth rate from 2011 to 2012. Looking into 2013, the fiscal effect is uncertain but we have assumed a fiscal drag of 1pp as the fiscal tightening needs to be increased to stem the rise in the public debt.

Exports set to gain speed in 2012

Another supportive factor for growth in 2012 will be exports. With emerging markets slowing down and the euro area entering recession, export sales slowed in 2011, although they remained fairly strong. In Q2 and Q3 exports grew by just over 4% annualised, following 8% export growth in the previous two quarters. In 2012, we expect exports to grow close to 8% again, as emerging markets gain pace and the euro recession tapers off. In general, the end to global inventory adjustment will lead to bounce back in world trade.

Over the past couple of years, the US has actually outperformed many of its peers in terms of export performance (see chart to the right). US competitiveness has improved quite significantly over the past five years as high productivity growth has kept unit labour costs down and the historically weak dollar has made US companies much more competitive. This is not only benefiting exports but also leading to lower import growth as domestic companies are also more competitive on the home market than foreign competitors.

Inflation outlook more favourable

We believe headline inflation is likely to have reached a peak back in September and we expect it to continue the path lower over the coming quarters from the current level of 3.4%. We look for inflation to reach just below 2% in mid-2012 as the base effects of the decline in commodity prices kick in. Inflation has already slowed considerably on a q/q basis but it takes longer for it to kick into the y/y inflation rate.

we expect a similar drag in 2012. This means that fiscal policy should be neutral for the change in the growth rate from 2011 to 2012. Looking into 2013, the fiscal effect is uncertain but we have assumed a fiscal drag of 1pp as the fiscal tightening needs to be increased to stem the rise in the public debt.

Exports set to gain speed in 2012

Another supportive factor for growth in 2012 will be exports. With emerging markets slowing down and the euro area entering recession, export sales slowed in 2011, although they remained fairly strong. In Q2 and Q3 exports grew by just over 4% annualised, following 8% export growth in the previous two quarters. In 2012, we expect exports to grow close to 8% again, as emerging markets gain pace and the euro recession tapers off. In general, the end to global inventory adjustment will lead to bounce back in world trade.

Over the past couple of years, the US has actually outperformed many of its peers in terms of export performance (see chart to the right). US competitiveness has improved quite significantly over the past five years as high productivity growth has kept unit labour costs down and the historically weak dollar has made US companies much more competitive. This is not only benefiting exports but also leading to lower import growth as domestic companies are also more competitive on the home market than foreign competitors.

Inflation outlook more favourable

We believe headline inflation is likely to have reached a peak back in September and we expect it to continue the path lower over the coming quarters from the current level of 3.4%. We look for inflation to reach just below 2% in mid-2012 as the base effects of the decline in commodity prices kick in. Inflation has already slowed considerably on a q/q basis but it takes longer for it to kick into the y/y inflation rate.

With this in hand, the Fed also has a new tool to steer long-term yields. If the Fed wishes to push down long yields and add stimulus this way, it can thus move its forecast of the first hike further into the future. This way it can stimulate without increasing its balance sheet through for example quantitative easing. We expect the first hike from the Fed in mid-2013 as unemployment has crept lower and inflation is close to 2%.

• We estimate growth was 3% in Q4 and expect it to continue at cruising speed, with 2.5% in 2012 and 2.6% in 2013, as stronger dynamics are kept in check by a slight tightening of fiscal policy.

• Risks are no longer mainly skewed on the downside but are more evenly balanced. The improvement in housing and positive surprises in the labour market give a rising probability of a recovery with stronger momentum than currently expected.

• We expect the Fed to be on hold throughout 2012. Thus, we do not expect QE3. In our view, the Fed is likely to use its upcoming projections for the Fed funds rate to steer monetary policy through its effect on longer term yields.

• We expect both headline and core inflation to fall during 2012 on the back of lower direct and indirect effects of commodity prices.

Consumption engine pulls again as shocks dissipate

Entering 2012 the US economy is on a much stronger footing than seen for most of 2011. Growth in Q4 11 is tracking slightly above 3% as private consumption has recovered and the inventory cycle has turned more supportive of economic activity. Net exports have also improved as export growth gained some steam towards the end of 2011 while import growth remained subdued. It seems the very weak USD is increasingly supporting net trade.

So why did fears of a recession prove excessive and instead the economy improved? As we wrote in Global Scenarios: Long period of slow growth ahead (14 September 2011), the headwinds that caused the downturn were fading and turning to tailwinds. Private consumption, in particular, was hurt in the first half of the year by the shocks that hit the economy. However, as the shocks have dissipated, private consumption growth has recovered.

First, gasoline (petrol) prices reversed sharply during the year, falling from a peak of around USD4 per gallon in early May to USD3.37 per gallon currently. This has given a decent boost to real income growth as the consumer deflator has fallen from 3.9% in Q1 to an estimated 0.5% in Q4 – a direct lift to real income growth of about 3.5 percentage points.

A second factor that supported private consumption in the second half of 2011 was a rise in car sales. This came after a significant decline in car sales in Q2 following the earthquake in Japan, which led to supply disruptions that hit the auto industry especially.

Looking into 2012, we continue to look for decent growth in private consumption. A simple model of private consumption based on real income growth and housing wealth suggests private consumption should grow about 3% in 2012. In the model we assume a rise in the PCE deflator to around 2%, which would be compensated by a pickup in non-farm payrolls to an increase of 150,000-200,000 per month.

We prefer to be a little on the cautious side though and forecast an increase in private consumption growth of 2.5% in 2012. This leaves some scope for a small increase in the savings ratio, which declined over the second half of 2011.

Housing set to start supporting growth...

Another positive surprise in the US in recent months has come from the housing market. Both sales and building activity have been better than expected and inventories of homes are coming down fairly rapidly now.

The housing market is supported by the rapid decline in bond yields as well as rising incomes. This has led to a further increase in affordability, which is running at very high levels. A barrier to a turn in the housing market has been the very low confidence among households. However, as unemployment has started to fall and more stories of improving housing activity hit the media, we expect sentiment to improve gradually and look for a further thawing of the housing market in terms of a gradual increase in house prices and a pickup in construction spending. Housing will thus increasingly move from a drag on to a boost to the overall economy and help strengthen the recovery.

As construction is at very low levels (now only 2.5% of GDP), we believe the direct growth contribution will continue to be limited. We expect construction spending to move from a neutral factor for growth to a positive contribution to growth of 0.3 percentage points in both 2012 and 2013.

...and be counterweight to fiscal tightening

This will prove an important counterweight to the fiscal tightening, which is likely to continue in 2012. We still do not know how much the tightening will be, as it is uncertain what the budget looks like. However, we assume that the payroll tax cuts given in 2010, which were extended by two months in December last year, will be extended further to last throughout 2012. We estimate that overall fiscal policy will subtract around 0.5-1.0pp from growth in 2012.

It is uncertain how much fiscal policy affected growth in 2011 but we estimate the fiscal effect to be of a similar magnitude to in 2010. The structural deficit estimated by IMF rose to -6.4% in 2011 from -7.0% in 2010 pointing to a drag of approximately 0.5pp. Also, looking at government consumption and investment in the National Accounts, this component gave a negative growth contribution of 0.5pp in 2011. This has to be compared with an average boost from this component of +0.4%. Hence, relative to a normal year government consumption and investment contributed close to 1pp less to GDP growth. One has to add, though, a positive effect from tax cuts given in early 2011 (the cuts that have now been extended by two months).

As these contributed close to 0.5pp to growth it points to a net drag from fiscal policy of a little more than 0.5pp. On top of this, is there is an indirect effect of the decline in government employment in 2011. The government shed 250,000 jobs in 2011, having added 200,000 jobs per year on average per year over the previous 10 years. Judging from these data, we judge that fiscal policy subtracted 0.5-1.0pp from GDP growth in 2011 and we expect a similar drag in 2012. This means that fiscal policy should be neutral for the change in the growth rate from 2011 to 2012. Looking into 2013, the fiscal effect is uncertain but we have assumed a fiscal drag of 1pp as the fiscal tightening needs to be increased to stem the rise in the public debt.

Exports set to gain speed in 2012

Another supportive factor for growth in 2012 will be exports. With emerging markets slowing down and the euro area entering recession, export sales slowed in 2011, although they remained fairly strong. In Q2 and Q3 exports grew by just over 4% annualised, following 8% export growth in the previous two quarters. In 2012, we expect exports to grow close to 8% again, as emerging markets gain pace and the euro recession tapers off. In general, the end to global inventory adjustment will lead to bounce back in world trade.

Over the past couple of years, the US has actually outperformed many of its peers in terms of export performance (see chart to the right). US competitiveness has improved quite significantly over the past five years as high productivity growth has kept unit labour costs down and the historically weak dollar has made US companies much more competitive. This is not only benefiting exports but also leading to lower import growth as domestic companies are also more competitive on the home market than foreign competitors.

Inflation outlook more favourable

We believe headline inflation is likely to have reached a peak back in September and we expect it to continue the path lower over the coming quarters from the current level of 3.4%. We look for inflation to reach just below 2% in mid-2012 as the base effects of the decline in commodity prices kick in. Inflation has already slowed considerably on a q/q basis but it takes longer for it to kick into the y/y inflation rate.

we expect a similar drag in 2012. This means that fiscal policy should be neutral for the change in the growth rate from 2011 to 2012. Looking into 2013, the fiscal effect is uncertain but we have assumed a fiscal drag of 1pp as the fiscal tightening needs to be increased to stem the rise in the public debt.

Exports set to gain speed in 2012

Another supportive factor for growth in 2012 will be exports. With emerging markets slowing down and the euro area entering recession, export sales slowed in 2011, although they remained fairly strong. In Q2 and Q3 exports grew by just over 4% annualised, following 8% export growth in the previous two quarters. In 2012, we expect exports to grow close to 8% again, as emerging markets gain pace and the euro recession tapers off. In general, the end to global inventory adjustment will lead to bounce back in world trade.

Over the past couple of years, the US has actually outperformed many of its peers in terms of export performance (see chart to the right). US competitiveness has improved quite significantly over the past five years as high productivity growth has kept unit labour costs down and the historically weak dollar has made US companies much more competitive. This is not only benefiting exports but also leading to lower import growth as domestic companies are also more competitive on the home market than foreign competitors.

Inflation outlook more favourable

We believe headline inflation is likely to have reached a peak back in September and we expect it to continue the path lower over the coming quarters from the current level of 3.4%. We look for inflation to reach just below 2% in mid-2012 as the base effects of the decline in commodity prices kick in. Inflation has already slowed considerably on a q/q basis but it takes longer for it to kick into the y/y inflation rate.

With this in hand, the Fed also has a new tool to steer long-term yields. If the Fed wishes to push down long yields and add stimulus this way, it can thus move its forecast of the first hike further into the future. This way it can stimulate without increasing its balance sheet through for example quantitative easing. We expect the first hike from the Fed in mid-2013 as unemployment has crept lower and inflation is close to 2%.