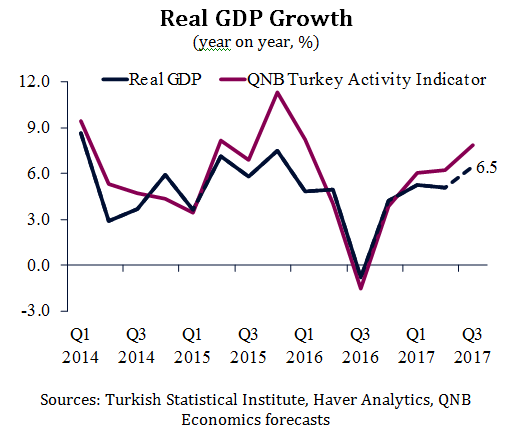

In the first half of 2017, Turkey’s growth rebounded to 5.1% and optimism surrounding the economic outlook is strengthening. Turkey’s leading sentiment survey is at a four year high and portfolio inflows have more than doubled compared to a year earlier. The result is attributable to government stimulus measure sand surging export growth. We expect these factors to drive a further acceleration in growth to 6.5% in Q3, slated to be released next week.

The Turkish authorities have enacted a number of fiscal and credit stimulus measures to support domestic demand. Transfers to households and capital spending have increased and the authorities have cut taxes on some durable goods such as household electronics and property purchases.These fiscal measures have helped partially revive consumption. The biggest boost to the domestic economy in 2017 has come from a government credit guarantee programme which has made approximately USD70bnavailable in loans to Turkish corporates. The result has been a sharp rise in credit to the private sector, growing at 21.5% at end-Q2, which in turn, spurred real investment growth of 9.5% in the quarter.

The export pickup has come on the back of a weaker lira and robust external demand. The lira’s decline has boosted the competitiveness of Turkey’s manufacturing exports which account for around 75% of total exports. Nearly half of Turkey’s manufacturing exports are destined for Europe.Higher-than-expected European growth has been an additional tailwind for the sector. Through the first eight months of the year, Turkey’s goods exports to Europe were up 12.2% in value terms compared to 7.6% over the first eight months of 2016. Tourism has also rebounded in 2017,partly due to the lira weakness. Tourist arrivals have exceeded their early 2016 levels and pushed service export growth to 7.3% through the first eight months compared to a decline of 18.7% over the same period in 2016.

Real GDP Growth (year on year, %)

Sources: Turkish Statistical Institute, Haver Analytics, QNB Economics forecasts

Our projection for growth to rise further to 6.5% in Q3 is based upon a historical relationship between our monthly activity indicator of the Turkish economy and Turkey’s real GDP growth.Our activity indicator combines three monthly measures:industrial production, retail sales volumes and the lira. Industrial production and retail sales have strengthened further in July and August as a result of the stimulus measures. While the lira, the driver of net exports, has stabilised since the start of the year, but remains supportive for exports.In short, Q3 is likely to be the strongest quarter of the year on the back of stimulus and strong exports.