Obviously the title of this post is a riff on the classic book, Triumph of the Optimists by Dimson, Marsh and Staunton (2002). The book describes 100 years of investment returns across a range of markets, making a number of important conclusions. Unsurprisingly, the financial marketing complex narrowly focused its attention on the strong returns the authors observed in equity markets over the post WWII period.

However, more balanced readers would have noted the authors' belief that the historical indexes analyzed in the book overstate long-term performance because they are contaminated by survivorship bias. The authors are clearly of the opinion that long-term stock returns are seriously overestimated, due to a focus on periods that with hindsight are known to have been successful, while markets that were unsuccessful were not included. In other words, the analysis assumes that an investor would have known which markets would succeed and which would fail in advance.

Many of the most important countries at various stages of the past dozen decades were not included in the study because of a lack of consistent data. For example, Russia, China, Latin America, Eastern Europe and Southeast Asia were all largely ignored. Several of these countries experienced terminal collapses of equity markets and/or bond markets and/or currencies, which explain some of the discontinuities in the data.

Triumph of the Ostriches refers to the current situation in global markets where 'Ostrich' investment managers have been killing it. Recall that (according to the untrue but pervasive myth) an ostrich sticks his head in the sand at any sign of danger; presumably the ostrich perceives that if it doesn't see the danger, then it doesn't exist. In the same way, Ostrich managers ignore any and all signs of market risk in the hope that these risks won't materialize on their watch.

Throwing caution to the wind has been very profitable - so far. But if history is any guide, there are many reasons for investors to consider taking a much more cautious stance.

Here are the facts: according to every valuation metric that matters (i.e. with statistical significance through history), stocks are quite expensive. Further, when stocks are this expensive, returns to in future periods have been very low.

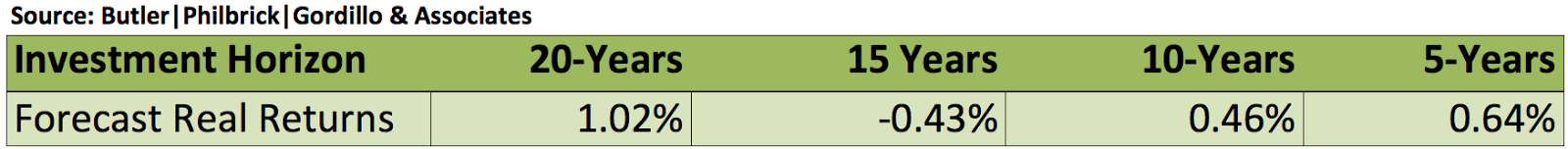

How low? The following table summarizes the statistical midpoint of future returns over the next 5, 10, 15, and 20 years based on an ensemble of valuation metrics including the Q ratio, cyclically adjusted PE, aggregate corporate market capitalization to GNP, and long-term price residuals. Those wishing to explore the mechanics behind this analysis are invited to read the full report here. Those looking for a second, third, fourth or fifth opinion from other well known firms will find them here.

Table 1. Statistical Return Forecasts for U.S. Stocks Over Relevant Investment Horizons

If you read the report, you will note that the valuations metrics cited most often by analysts and commentators to suggest the market is cheap - price to current or forward earnings for example - have almost no statistical significance. It doesn't matter at all whether these valuations suggest that markets are fairly priced; they carry no information about likely future stock market returns.

Critically, the table above has no bearing whatsoever on what will happen to markets over the next year or two, or perhaps longer. A. Gary Shilling said in 1993, "Markets can remain irrational longer than you can remain solvent", and they certainly did. In 1994 the U.S. stock market traded to valuation levels never before witnessed over the prior century, but price multiples almost doubled again from the lofty 1994 levels before the U.S. market peaked in early 2000.

Of course, despite the most aggressive global monetary experiment in modern history in 2000 - 2003 and 2008 - present, markets since the 2000 peak have delivered very poor returns, in the range of 3% per year through the end of April 2013. What will happen to stock market returns as interest rates eventually normalize? History suggests investors will be in for a rough ride.

We have yet to see any evidence-based argument for why the valuation based analysis presented above is not relevant. What do we mean by 'evidence based'? Show us numbers to support an alternative hypothesis, and then show us how those numbers have served to forecast returns in other periods with statistical significance.

Those Ostriches who do attempt to defend their perpetually bullish stance often cling to arguments based on the Equity Risk Premium (ERP), but this methodology has a serious flaw in the current environment which invalidates it. Specifically, the ERP is measured as a spread to risk-free rates; but risk free rates have been held at artificially low levels by central banks - this is their express goal, and they have committed well over $150 billion per month to this objective. How can we calculate a meaningful spread where one end of the spread is corrupt?

Less analytical market prophets loudly proclaim that the current environment has no analog in modern financial history, so comparisons with other periods are not useful in making judgments about expectations. To these Ostriches we humbly ask, "If we can't use historical context to frame the current market environment, what exactly are we supposed to use?"

Other memes relate to the idea of a 'permanently high plateau' (incidentally, the great 20th century economist Irving Fisher coined that phrase in 1929, just three days before the crash that preceded the Great Depression). Purveyors of this delusion cite the current 'pollyanna' environment for global corporations as validation for stratospheric equity valuations. "Corporations have high record cash positions", they crow, "get ready for the great buy back and merger wave that's coming!" "Profit margins are high, corporate taxes are near all-time lows, wage pressures are non-existent - corporations have never had it better! Oh and financing is effectively free!"

Unfortunately the wailing equity zealots do not factor in Stein's Law, which states, "If something cannot go on forever, it will stop." In a period of record fiscal duress, what is the probability that corporations will continue to receive favourable tax status? According to GMO's analysis, corporate profit margins are one of the most mean-reverting series in finance, so why would be value markets under the assumption that they will stay high forever? Further, how valuable is the cash on corporate balance sheets if there is an equally large debt balance on the other side of the ledger (there is)?

The Ostriches aren't concerned with valuation metrics or Stein's Law, and let's face it, they've been right to stick their head in the sand - at least so far. The problem is that in markets we won't know who is right until the bottom of the final cyclical bear in this ongoing secular bear market. Only then will we see just how far from fundamentals the authorities have managed to push prices, and only then will we see whether it really is different this time.

Until then, investors can choose facts or faith. The facts say that investors are unlikely to be compensated at current valuations for the risks of owning stocks over the next few years. The church of equities says, 'don't worry about it'. So far the Ostriches have it, but all meaningful evidence suggests that over the next few years the Ostriches are going to feel like turkeys - at Thanksgiving.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Triumph Of The Ostriches: The State Of Global Markets

Published 05/30/2013, 08:54 AM

Updated 07/09/2023, 06:31 AM

Triumph Of The Ostriches: The State Of Global Markets

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.