In the first part of this research series, published yesterday, we explored rising yields and how my team and I expect markets to react to the new level of fear that may begin to enter the global credit markets. Rising yields suggest investors believe the future risks to the global economy don’t support lower yield rates. The talk that investors expect a super-heated global economy may have some truth to it, but we feel the rise in yields is related more to global credit risks than any type of super-heated global economy.

Today, we will explore the potential for a Crazy Ivan event in the global markets. This would be represented as a price revaluation event, causing the global markets to suddenly attempt to revalue price levels based on new levels of fear and more data.

The Crazy Ivan Outcome: What To Expect

The most likely event related to the Crazy Ivan set up over the next 6 to 12+ months is a moderate price revaluation event. This takes place when traders/investors suddenly realize the risk levels in the markets are elevated and they quickly take stock of their positions, profits, and future expectations. Right now, many stocks are trading at Nx multiples of earnings.

This type of set up happens when traders and investors feel exuberant related to future expectations, and is often called a “bubble rally” or an “excess phase rally.”

There are two likely outcomes from this Crazy Ivan event: (1) a broad market revaluation event; or (2) a sideways continued “melt up” event.

We don’t believe the “melt up” event will prompt any big upside price trends right now. The recent move in Treasury yields has set up a sideways market trend which we believe could continue through March/April before reaching a peak—depending on what yields do.

If yields continue to rally higher by even a little bit, then we believe the magenta downside targets (see the chart below) are likely to be the immediate outcome over the next few weeks and months. If yields fall back below the Breakdown Threshold level, then we believe the green “melt-up” trend is the most likely outcome.

Again, to make this very clear for all of you, the upside price trend in yields has already completed the set up for a Crazy Ivan event. What matters is what yields do next. If they continue higher, then a broad market correction—a Crazy Ivan event—will likely come quickly.

If yields stall and move lower, then the Crazy Ivan event will be pushed further out into the future and the markets may move sideways a bit, possibly trending a bit higher, then setting up another upward move above the Breakdown Threshold. Take a look at the first chart in this article to learn how this set up plays out over time. It all depends on what yields do over the next 6+ months.

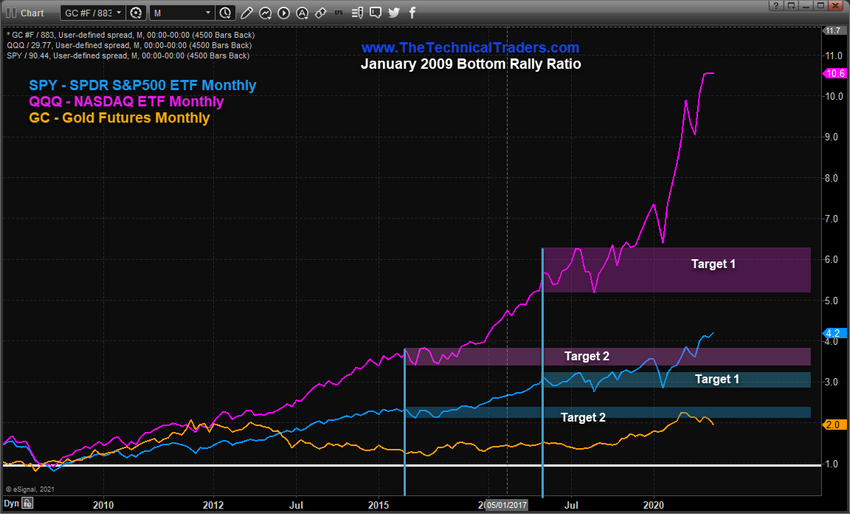

January 2009 Ratio Targets For The Crazy Ivan Event

Our research team has identified two key levels that are likely to prompt moderate support in the broad markets if a Crazy Ivan event takes place this year. First, the rotation range from 2018, Target 1. This rotational price range on the SPY and QQQ is highlighted on the chart below, which suggests the QQQ may attempt to fall more than -35% to -45% from current levels if the Crazy Ivan event takes place. The SPY may attempt a -25% to -30% decline as well to reach the Target 1 levels if the Crazy Ivan event takes place.

The Target 2 levels are drawn from the 2015~16 price rotational range and suggest a much deeper price correction could take place if the Target 1 levels fail to act as strong support. The Target 2 levels suggest a deeper -60% to -75% correction in the QQQ may take place and a -45% to -50% correction may take place in the SPY.

The last time the yields set up this type of process—2007, 2008, and 2009 (the Housing Crisis)—the QQQ fell -55% over the course of 13 months and the SPY fell -57% over 17 months. So, the target levels we have identified are not excessive based on historical price relationships.

Since the 2008-09 crisis event, global central banks have engaged in a massive credit infusion process to support the global economy’s recovery efforts. This has led to a resurgence in various market sectors over the past 12+ years, ranging from emerging markets, corporate debt/credit, Technology, BioTech and many others. It seemed everything was starting to move beyond the 2008-09 crisis event after the 2015-16 market rotation, then COVID-19 hit the global markets.

This global pandemic constricted global economies and consumers. It pushed global central banks into another “crisis mode” where they attempted to ease credit facilities and push money into the hands of corporations and consumers. This last burst of easy credit prompted a recovery and rally in the QQQ and SPY (as well as some other global assets) while the yields collapsed back to below ZERO levels again (remember, they first collapsed below ZERO in 2019). You can see from the second, more detailed yields chart (above) how this move prompted a very strong rally/recovery prior to COVID-19 and after COVID-19.

Now, we’ve reached the point where yields must move lower to avoid a Crazy Ivan event and to support a moderate “melt up” in the markets. If not, then fear and greed will take over as yields continue to rise which will prompt a global revaluation event that'll likely be similar to the 2007-09 Housing Crisis. If the markets start to roll over and volatility rises, we can benefit from it with our Options Trading Signals which we use non-direction trades to sell premiums. This allows options traders to profit from volatility and not worry about which way the market moves.

Traders and Investors must prepare for these eventual outcomes right away. This Crazy Ivan event will likely become one of the biggest opportunities of your lifetime to protect and grow your wealth if you are able to navigate it properly. Simply put, these big rotations in global asset prices present massive opportunities for traders/investors to create profits.

We believe we may be starting an extended “capital shift” process which may last well into March/April 2021 before real opportunities set up possibly in May or June. The markets will do what they always do, react to traders, capital, and global central bank influence. There are times when certain sectors enter a euphoric phase and there are times when the global markets revalue risk. We may be nearing an end to a euphoric phase and starting a revaluation phase.

What we expect to see is not the same type of market trend that we have experienced over the past 8+ years—this is a completely different set of market dynamics. Don’t miss the opportunities in the broad market sectors in 2021, which will be an incredible year for traders of the BAN strategy. Staying ahead of sector trends is going to be key to success in volatile markets.