Russian Blitzkrieg invasion of Ukraine initiated DRAMATIC surges and reversals across markets

The S&P plunged to a 9-month low early Thursday morning (down ~15% from January All-Time Highs) but then rallied hard into Friday’s close.

The DJI tumbled and bounced back ~1,700 points in this 4-day week to close almost precisely where it closed last week! (Like nothing happened!)

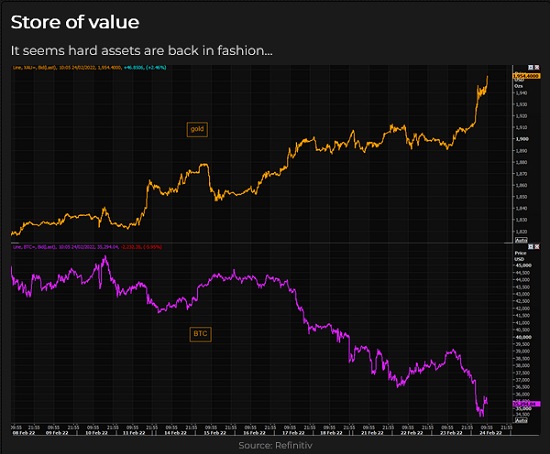

Gold had been trending higher (up ~ $125) since late January but soared another ~$75 early Thursday, only to plunge nearly $100 later the same day.

Gold is leaving Bitcoin in the dust.

WTI crude oil rallied ~50% from early December to mid-February – it soared and collapsed ~$9 on Thursday (after briefly trading above $100 for the first time in eight years.)

Chicago wheat soared to a 12-year high and then tumbled sharply on Friday (soybeans and corn also surged and fell this week.)

The US Dollar Index surged to a new 20-month high (as the euro plunged to a 20-month low), then fell sharply into Friday’s close.

The Russian ruble tumbled to a new All-Time Low Vs. the US Dollar.

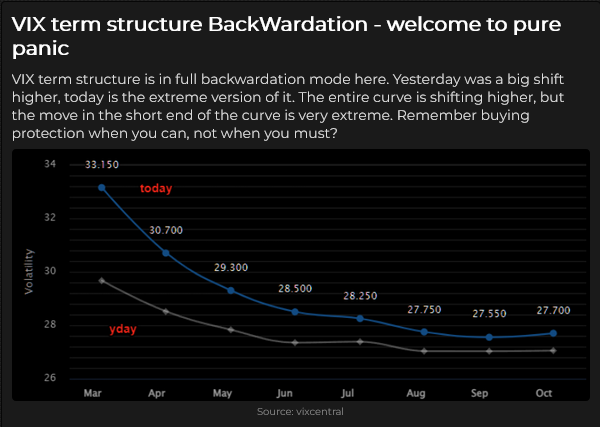

Stock index options volatility soared to nearly the highest levels since the COVID panic in 2020, but fell sharply on Friday.

This chart is from Thursday:

Why the stunning market reversals this week?

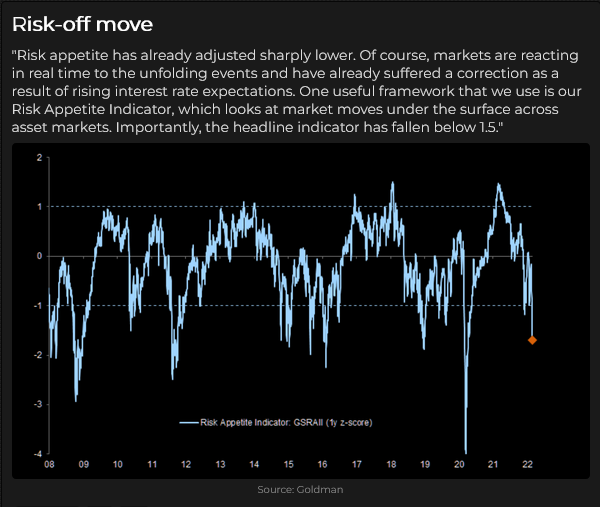

Markets were shocked at the Russian attack’s speed, size, and ferociousness. Everybody knew the Russians had amassed troops and military hardware to the North, South and East of Ukraine, and the "geopolitical stress" had exacerbated risk-off sentiment last week, especially with American and British intelligence services predicting an imminent attack.

This chart was released mid-week:

But "nothing" happened in Ukraine early in the week, and then, suddenly, Wednesday evening, the Russians charged. Markets did what you’d expect: stocks fell, the US dollar, gold, commodities and volatility soared.

Stocks gapped lower when Thursday’s day session began—but Big Tech began to rally immediately while the broader market went sideways to lower.

On Thursday’s gap lower opening Microsoft (NASDAQ:MSFT) was down >20% from its November high. Apple (NASDAQ:AAPL) was down >16% from its January high. Alphabet (NASDAQ:GOOG) was down ~18% in less than a month. Amazon (NASDAQ:AMZN) was down ~26% from its November highs. Tesla (NASDAQ:TSLA) was down >40% from its early January highs, and NVIDIA (NASDAQ:NVDA) was down ~38% from its November highs. Meta Platforms (NASDAQ:FB) was down>40% in less than a month.

Somebody started buying Big Teck with both hands when the market opened sharply lower Thursday morning. It was probably hedge funds covering shorts, which sparked the monster rally.

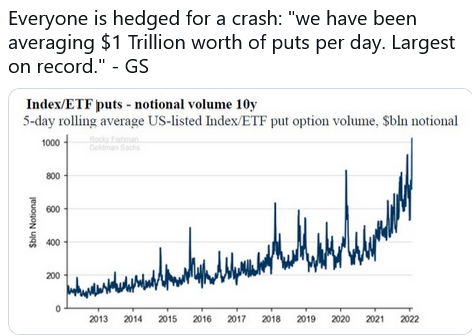

Market liquidity was thin—a war had just started—and option volatility had soared. As Big Tech started to rally, options dealers turned buyers to manage gamma risk—and as markets continued to rally, people who had previously bought puts began selling them, adding fuel to the fire.

When market sentiment becomes extremely risk-off (like when a war starts), correlations between assets go to one. With Big Tech leading the stock markets higher (the NASDAQ 100 was HUGELY out-performing the Dow), people started selling the spike rallies in gold, crude, grains and the US dollar. People who had bought those markets (thinking they would have massive rallies because of the war) were positioned wrong and had to sell, accelerating the reversals from the spike highs.

One of the characteristics of bear markets is that they have face-ripping "bear market rallies,"—which we saw on Thursday and Friday. (One of the great market chestnuts is that everybody loses money in a bear market.)

It is critical to understand that the rally was NOT caused by people assuming that the war in Ukraine was "no big deal." The war may end this weekend—or it may continue for months—but it is still a huge deal even if it does end this weekend. Putin has taken the gloves off, and a new cold war has started, which will have a HUGE impact on markets.

Russia is now a severe problem. Russia is not monolithic, and Russia is NOT Putin—who has been exposed as a cold-hearted liar. Thousands of Russian citizens have been arrested for protesting the war. The speed of the attack may have made Russia appear invincible, which may be far from the truth. The assumption that Putin will have unwavering support from China may also be wrong. (Wouldn’t it be interesting if Xi turned his back on Putin the Pariah?)

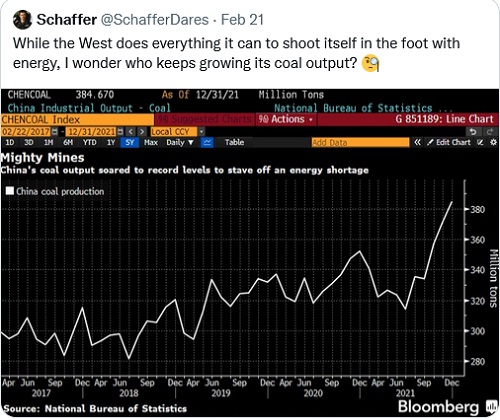

Russia will be isolated and will likely retaliate against the sanctions. Think cyber-attacks against the West. Commodity exports from Russia will be reduced—buyers will have to source products from other commodity-producing countries.

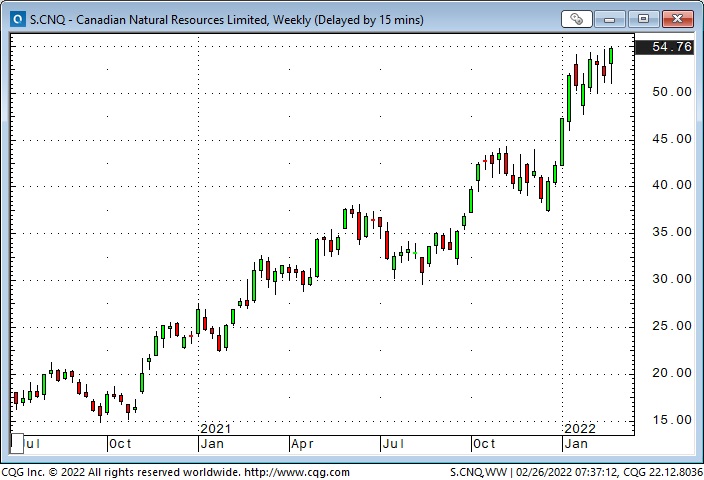

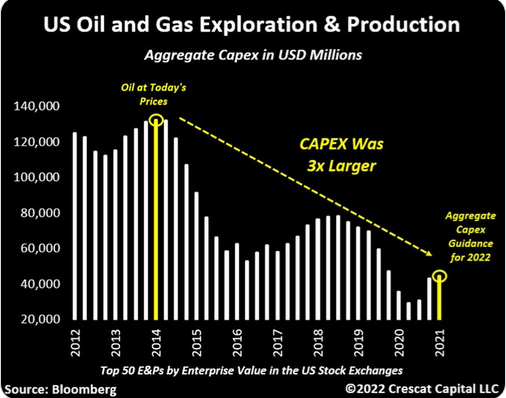

Western governments may be shocked into abandoning virtue-signaling ESG driven energy policies and start encouraging the development of reliable energy supplies. The USA, for instance, may promote the development of domestic fossil fuels and Canadian oil sands. (Note: CNQ closed at All-Time Highs Friday – despite WTI closing $9 below Thursday’s high.)

Biden has the State of the Union address on Mar. 1, and this will be his opportunity to turn around his and the Democratic party’s fading popularity.

My short term trading

I got off to a slow start this week after the 3-day President’s Day weekend. I was flat at the end of last week and in no hurry to find a trade just for the sake of "doing something."

I bought the S+P Tuesday and closed the trade for a small gain. I bought the Dow futures Wednesday and closed the trade for a slight loss.

I bought the S+P early Thursday morning as the market rallied back from the overnight lows but was stopped for a small gain. I rebought it a few minutes later as the market recovered from a brief setback and covered it on the close for a 110 point gain. I thought that the rally was a bear market short squeeze, and 110 points was a great move. The market rallied another 100+ points Friday without me.

The S+P rallied almost 300 points from early Thursday morning to Friday’s close. To put that stunning move into perspective: since the market turned up from the COVID panic lows in March 2020, there have only been three entire weeks with a 300 point high/low range.

I was flat going into the weekend, and my P+L was up ~1.2% on the week.

On my radar

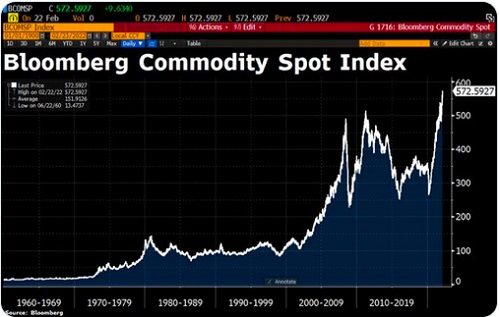

The spectacular commodity rally that saw the indices gain >200% since the March 2020 lows may have made an important top this week. The same thinking may apply to crude oil. I’m not saying the BIG commodity rally is over, but a correction is overdue.

I think the stock market rally off this week’s lows is a bear market rally, and it will run out of steam and rollover.

My son Drew points out that oil bulls might consider writing December ATM puts. Dec closed Friday at ~$81, an $11 discount to front-month April. The Dec $81 strike puts trade at around $11. Net/net if you sell the puts and get exercised at the end of November, you will effectively be long WTI at ~$70, which is ~$22 below the current front month price of $92. Backwardation creates opportunities. (This is not investment advice. Remember, WTI dropped from $147 in July 2008 to $33 in December.)

If WTI and commodities have the correction I expect, and then steady, I will look at writing forward dated WTI puts.

Thoughts on trading

This week was a great week for "making peace" with the fact that I can’t catch every move. I wanted to sell gold up $80 Thursday morning, and I wanted to sell WTI at $100. But I already had "the trade" on by being long the S+P. I noted above that correlation goes to one when sentiment is extreme. In that sense, in this environment, being long S+P was the "same thing" as being short gold or WTI. If I made the gold or WTI trade, I would be "concentrating" my risk exposure—and that’s great if you’re right, deadly if you’re wrong.

Of course, you can never have enough on when the market is soaring in your favor!

I’ve noticed my trading time horizon has shrunk as short-term price ranges have increased, which is purely intuitive risk management. I never used to be a day trader—but with today’s intra-day price swings more significant than what we used to see in a week or a month—well, it seems we’re all day traders now!

Quotes from the notebook

“Old school media want your top picks – they don’t care about or want to hear about your process.” Keith McCullough – Hedgeye, RTV interview 2019

“Commentator’s (ie, chief strategists) success is linked to how often they are right or wrong. (They don’t have a P+L.) They are therefore entertainers…their fame is the result of their presentation skills.” Nasim Taleb – Fooled By Randomness

“I keep an eye on 'the news' and 'commentary' to get an idea of 'positioning.' I want to have some idea of how much mispricing will be exposed if markets move contrary to the 'commentary.' I want to front-run that re-positioning.”

Victor Adair, notes to myself, 2019