It’s been a very quiet start to trading on Monday in what is expected to be a slow couple of days, with traders eyeing up the Jackson Hole event later in the week.

Clarity Sought on Fed’s Interest Rate Plans

With both Mario Draghi and Janet Yellen scheduled to appear on Friday, traders are keen to get more insight into the plans of the two central banks, both of which are now pursuing less accommodative monetary policy. The Fed began its tightening cycle almost two years ago now and next month they’re expected to announce plans to start winding down its balance sheet which currently stands at close to $4.5 trillion.

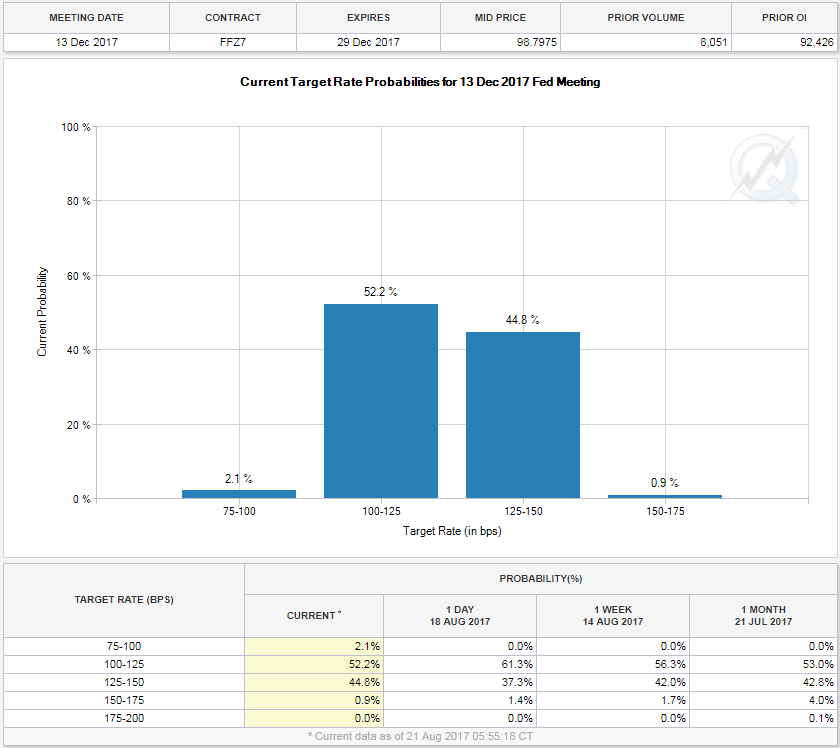

Markets have been largely unresponsive to the prospect of balance sheet reduction, which may come as a surprise given how the opposite was true when the quantitative easing programmes were launched. Still, it seems traders are more interested in what the Fed’s plans are for interest rates rather than its balance sheet, with expectations for another this year still below 50%.

The only thing keeping them elevated even this much has been hawkish comments from William Dudley, typically a dove and close ally of Yellen, who claimed he supports another hike this year if the economy evolves as expected.

Will Draghi Risk Opening Up on Tapering?

The ECB on the other hand is still in the process of ending its QE program, with purchases currently at €60 billion per month, down from €80 billion earlier this year, and likely to be reduced further from the end of this year. That announcement is expected to come in September and people will be looking for clues from Draghi’s speech on whether this will happen or whether it could simply be extended in its current form. While inflation has eased off recently, core inflation is on the rise and while it continues to fall well below target, the trajectory may be enough to convince policy makers that another taper is warranted.

Geopolitics and US Politics to Remain in Focus

The rest of the week is looking a little quieter though, barring any political and geopolitical events that have kept markets on edge over the last couple of weeks.

Scheduled military drills in South Korea, conducted with the US, could heighten the feeling of unrest in the region, despite the drills having been planned long before the recent public war of words. Still, with North Korea having already condemned them as pouring gasoline on fire, there is a risk that a similar show of strength is displayed in response which could trigger further risk aversion.

The political situation at home is providing another distraction for Donald Trump, who will be wanting to put the events of the last week behind him. There had been a lot of speculation that Trump was about to lose Gary Cohn in the aftermath of the events in Charlottesville and his response to them. Instead it was Steve Bannon that departed, a move that some have touted as being a positive for the President’s agenda. Whether he will be the final casualty for now is yet to be seen but as ever, Trump will remain very much in the spotlight.