The junior gold stocks on our list are leveraged to the gold price and are undervalued on an EV/oz basis

SmallCapPower | July 3, 2018: Gold prices have weakened over the past few months, falling as low as US$1,235/oz. The junior gold stocks we’ve uncovered today are all low EV/oz companies with high betas. This means that they have exaggerated correlations with the rest of the market and can be extremely volatile. However, with risk comes reward and these companies may present an opportunity for investors looking to get exposure to the gold space.

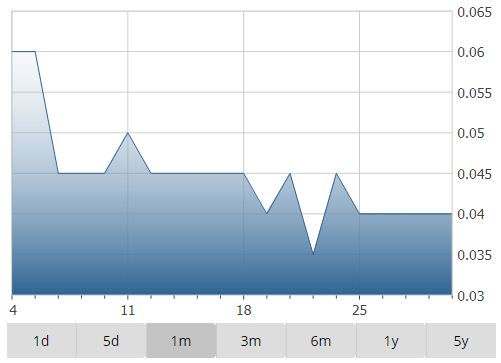

Alexandria Minerals Corporation (V:AZX) – $0.04

Gold

Alexandria Minerals is a Canada-based junior gold exploration company with a focus on under-explored mineral properties in gold and base metal mining districts of Quebec, Ontario, and Manitoba, Canada. The Company’s flagship property is the Cadillac Break Property Group, which is located in Val d’Or, Quebec.

- Market Cap: $19.2 Million

- Daily Beta – 90 Day: 2.67

- Enterprise Value/oz: $9

- YTD Total Return: -50.0%

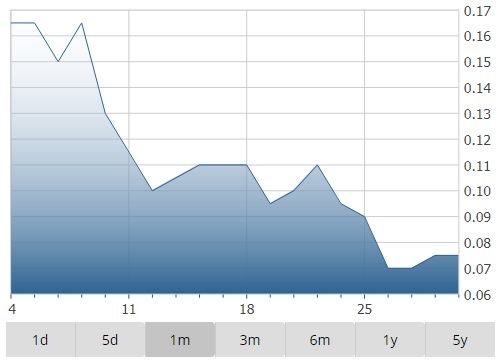

Meadow Bay Gold Corp (SNX:MAY) – $0.08

Gold

Meadow Bay Gold Corporation is a gold exploration company based in Canada. The Company is focused on the exploration and development of its Atlanta Gold and Silver Mine property consisting of more than 10,000 acres of mineral claims located in Lincoln Country Nevada, approximately 250 kilometers northeast of Las Vegas, Nevada.

- Market Cap: $3.8 Million

- Daily Beta – 90 Day: -4.55

- Enterprise Value/oz: $8

- YTD Total Return: -62.5%

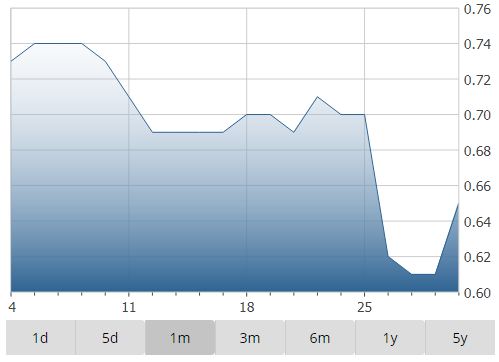

Atacama Pacific Gold Corporation (V:ATM) – $0.61

Gold

Atacama Pacific Gold Corporation is an exploration-stage gold mining company. ATM operates the Cerro Maricunga Project located 700 kilometers north of Santiago, Chile. The property covers over 15,000 hectares and was estimated to host 3.74M ounces of Proven and Probable Reserves in a 2014 Pre-Feasibility study. The Company also has four other mineral properties within proximity to the Cerro Maricunga Gold Project and one further north in Chile.

- Market Cap: $58.9 Million

- Daily Beta – 90 Day: 0.92

- Enterprise Value/oz: $8

- YTD Total Return: -12.9%

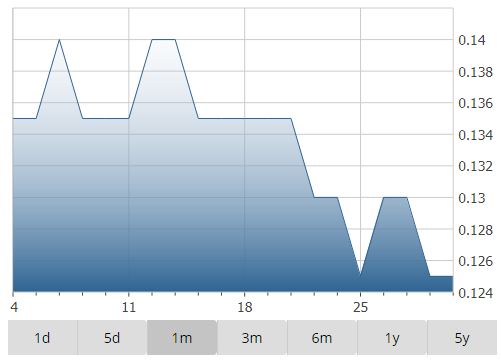

Rockhaven Resources Ltd (V:RK) – $0.13

Diversified Mining

Rockhaven Resources is a Canada-based gold exploration-stage company. The Company has interests in one mineral exploration property, the Klaza project, located in Yukon Territory, Canada. The property consists of about 570 mineral claims and covers an area of approximately 120 square kilometers.

- Market Cap: $19.2 Million

- Daily Beta – 90 Day: 1.71

- Enterprise Value/oz: $11

- YTD Total Return: -19.4%

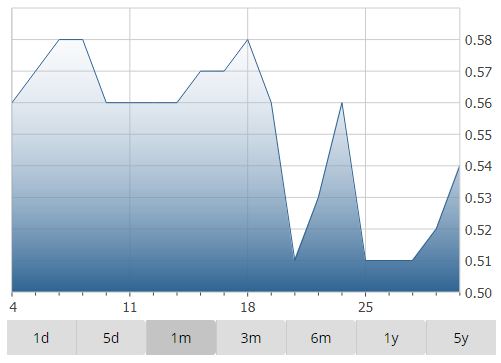

Falco Resources Ltd (V:FPC)– $0.52

Copper & Gold

Falco Resources is a Canada-based exploration-stage company, focused on the exploration and evaluation of its mineral properties in the Rouyn-Noranda district in the Province of Quebec. The Company holds about 72,800 hectares of land in the Rouyn-Noranda mining camp, including approximately 10 former gold and base metals mine sites.

- Market Cap: $98.3 Million

- Daily Beta – 90 Day: 1.52

- Enterprise Value/oz: $15

- YTD Total Return: -40.2%

Disclosure: Neither the author nor his family own shares in any of the companies mentioned above.