- Oil prices continue to struggle as recession fears have curtailed the market is recent months.

- For now, the demand and supply dynamics of the physical oil market remain neutral to bearish at best. This is most true of inventories, which continue to see significant builds and excess supply, a recipe for lower energy prices.

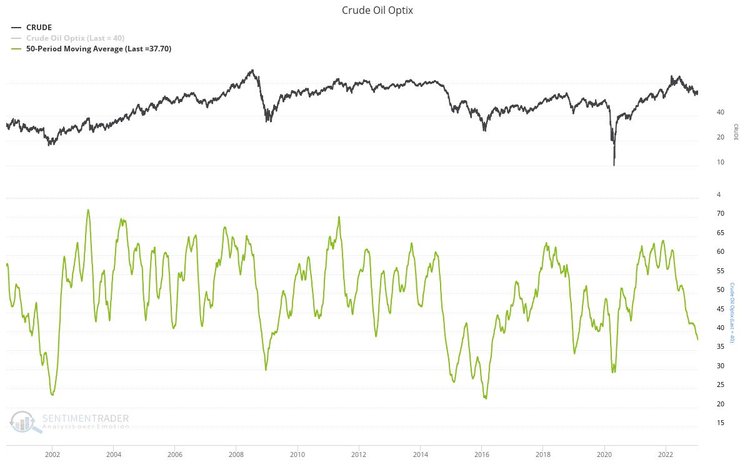

- Longer-term sentiment and positioning are nearing washout levels, a positive outcome for those on bullish oil and energy.

- Within the China reopening underway and the US economy continuing to prove robust, we could see the macro landscape turn from headwind to tailwind, at least for the first half of 2023.

- Should we see a bullish turn in the physical market, there are many reasons to suggest 2023 may be a good year for energy.

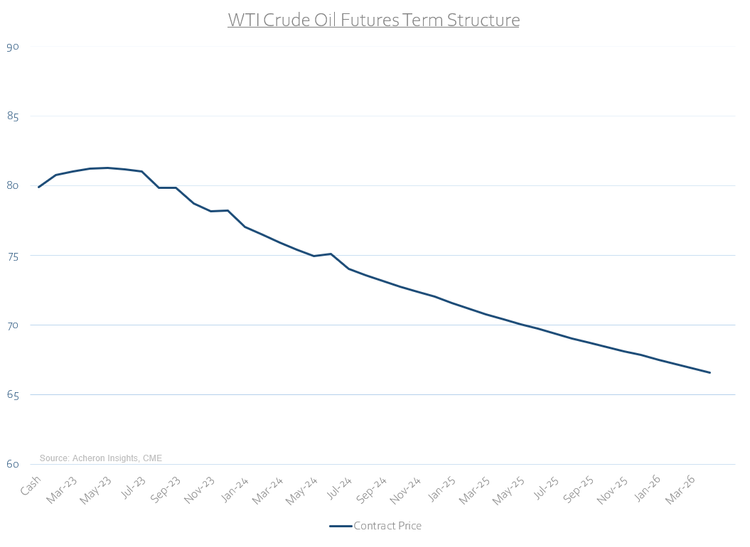

- Backwardation implies there is a supply deficit as market participants are willing to pay a premium for instant delivery. As a result, any deficit will need to be met via drawing down inventories.

- Though backwardation incentivises drawdowns of oil inventories, it does not incentivise producers to increase production and capacity, as they would be forced to sell forward new production at a lower cost than today.

A Neutral Reading From the Physical Market

Given how the crude oil market consists of large number of buyers and sellers of the physical product itself, having an understanding of this landscape and the trends unfolding therein provides great insight into the outlook for oil and energy prices. The physical market provides a strong fundamental anchor for the oil price, and is perhaps best viewed through the lens of the futures term structure.

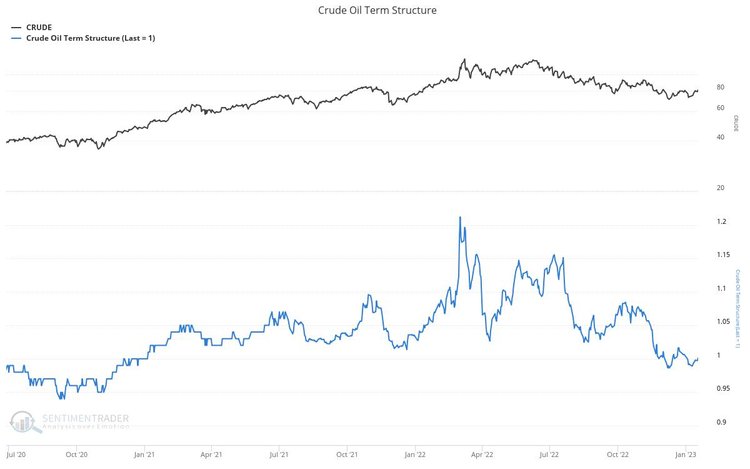

While specific prices of the various futures contracts are themselves not useful predictors of future prices, the shape of the futures term structure does provide valuable information into the underlying fundamentals of the oil market at any given time. Generally:

Crude oil prices tend to see their best risk adjusted returns during periods of falling contango and backwardation, with the biggest losses usually occurring following shifts from backwardation to contango. However, extreme levels of backwardation also tend to mark intermediate tops in price, similar to what occurred during March of last year.

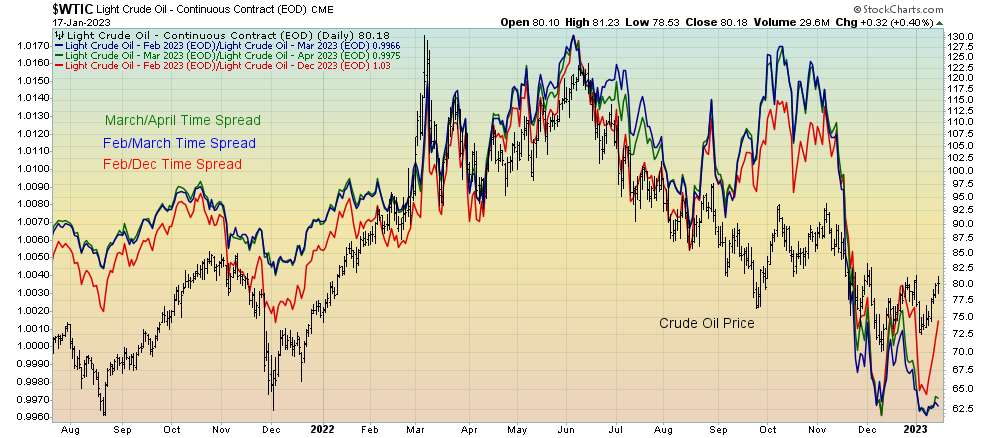

The term structure has flirted with contango since December, and as such prices have unsurprisingly seen losses during this time. As of right now, we largely returned to state of backwardation, though there remains some contango at the very front end of the curve. The physical market is still fairly tight, but not to the extent seen during much of 2022.

In terms of time spreads (another way to assess the term structure and thus the physical market), the message, too, remains somewhat mixed. Notably, some of the short-dated spreads have not confirmed the recent highs in price.

Overall, the physical market is by-and-large indicating a neutral outlook for now, but one that still remains bullish as we extend our time horizons beyond the next couple of months. On a more positive note however, 3-2-1 crack spreads, which are another measure of the physical market, have again moved higher.

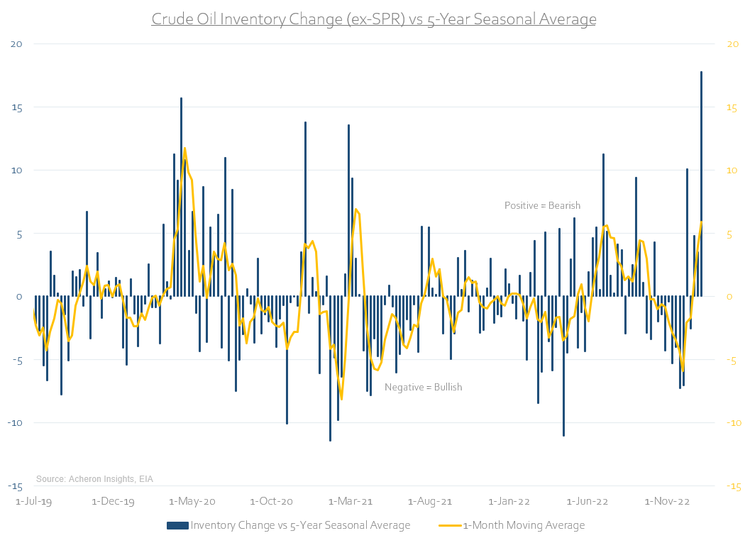

For now, Inventories Remain a Headwind for Higher Energy Prices

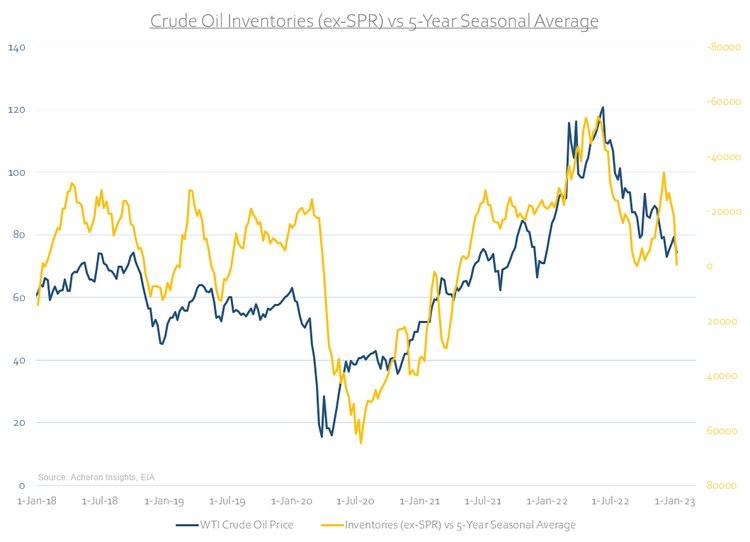

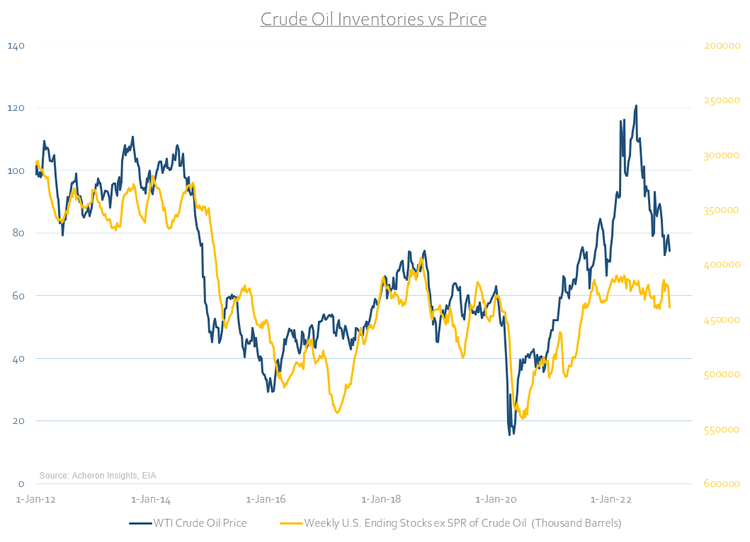

From an inventory perspective, the current movements within the crude oil spectrum are ostensibly bearish for now.

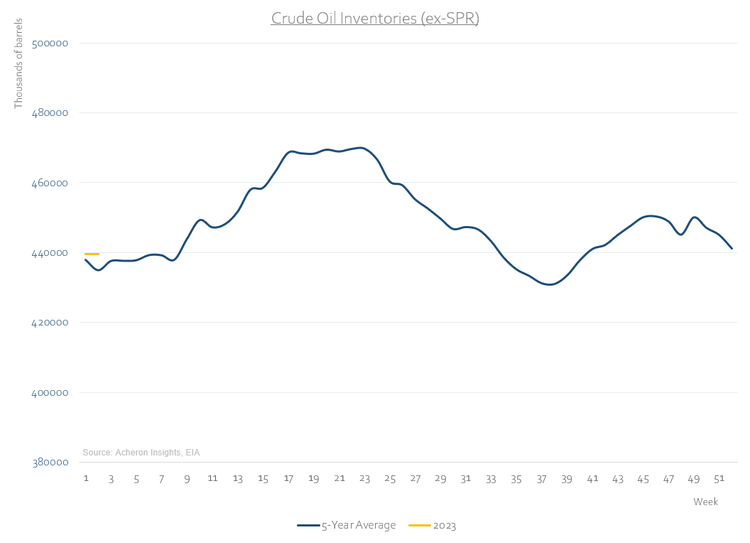

Like most commodities, in assessing movements in inventory levels we can obtain a decent proxy for real time supply and demand. For crude oil, the past few weeks have seen some of the largest inventory builds in years. This is especially true when compared to the five-year seasonal average. Such levels of surplus stock are not a recipe for higher prices.

Particularly when the first quarter of the year generally sees inventory levels be restocked in preparation for the summer driving season, a time when we usually see increased demand for crude’s refined products.

The right-tail risk to inventories is of course the China reopening (which I will discuss in detail below) along with the White House potentially beginning to refill the Strategic Petroleum Reserve in the months ahead. But for now, inventories are a significant headwind for crude prices.

From a sentiment and positioning perspective, things a looking better

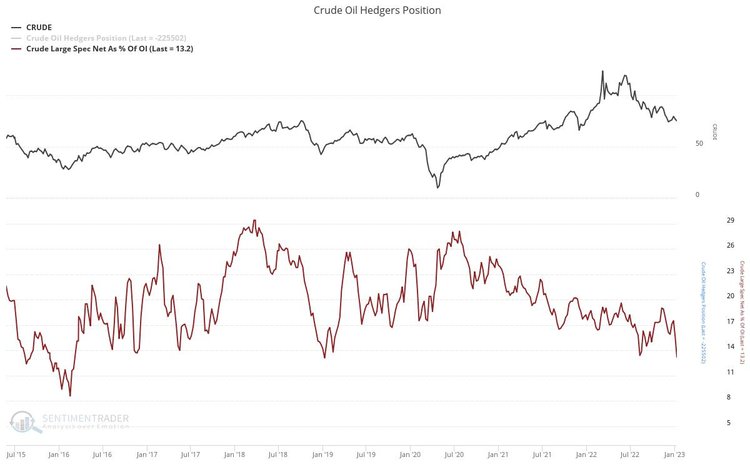

Indeed, from a medium to long-term perspective, positioning and sentiment are close to washout levels indicative of excellent contrarian buying opportunities. Speculators are the least-bullish they have been in years, while sentiment is also the most pessimistic since the March of 2020. Though both can of course go lower and are of little use from a trading perspective, for those bullish energy long-term things are looking constructive.

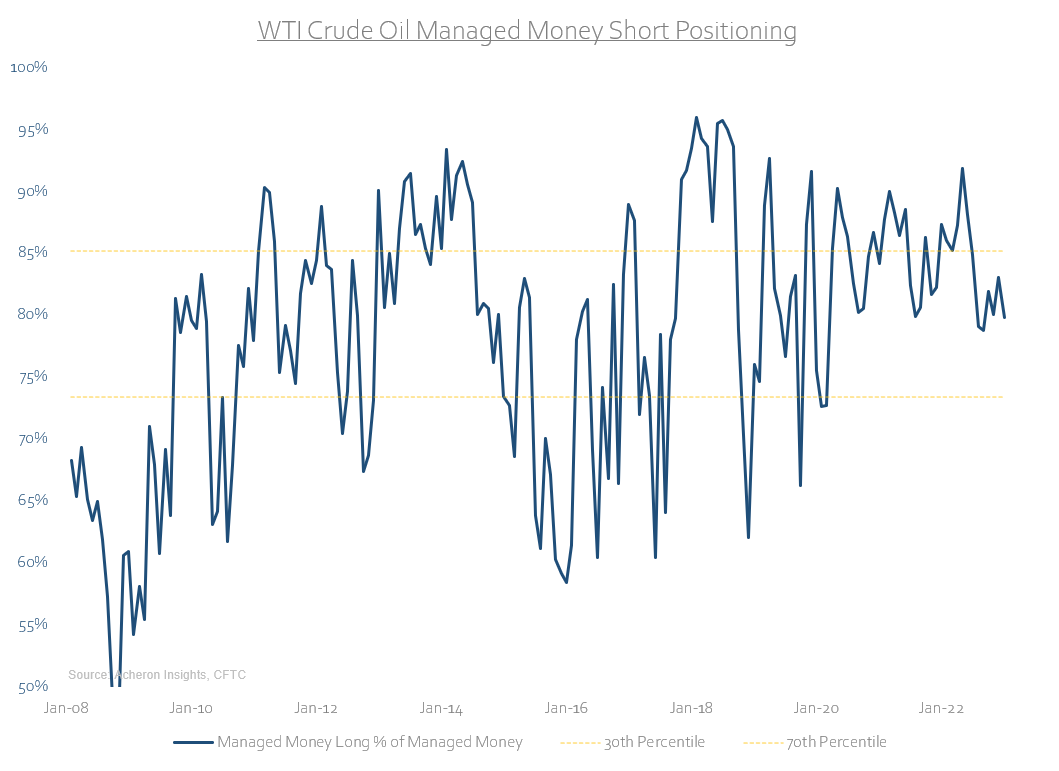

On a shorter-term basis, however, the positioning of the managed money category within the futures market (consisting largely of hedge funds and CTA’s) is looking a bit more neutral. Ideally, I would like to see these leveraged players decrease their long positions up to around the 70-75% of total managed money open interest, as this would provide a significant amount of fuel to squeeze the market higher as they are unwound, though there is scope for this to occur at current levels.

The Macro Outlook: From Headwind to Tailwind?

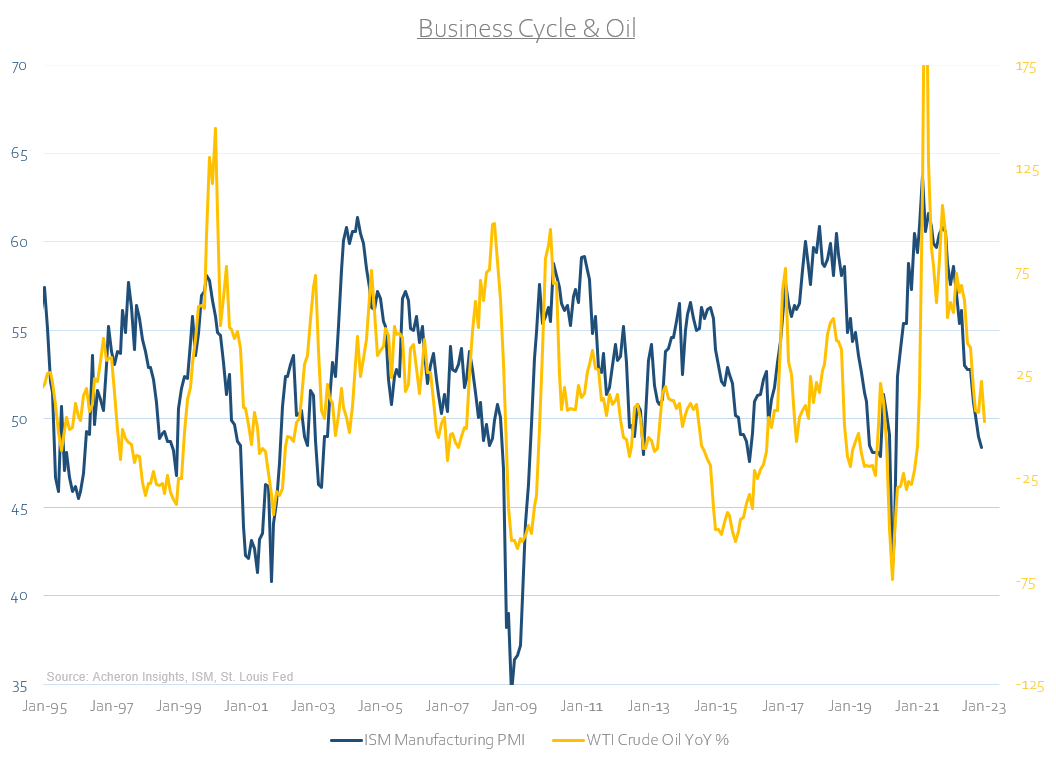

From a macro perspective, over the past nine months crude oil has behaved exactly how you would have expected in the face of a non-existent China and slowing US and European economies. As we can see below, oil prices have adjusted lower in-line with where the business cycle has been heading. Going forward, given the leading indicators of the business cycle suggest we may see a 40-45 PMI reading by the second half of 2023, there remains potential for further downside in crude prices.

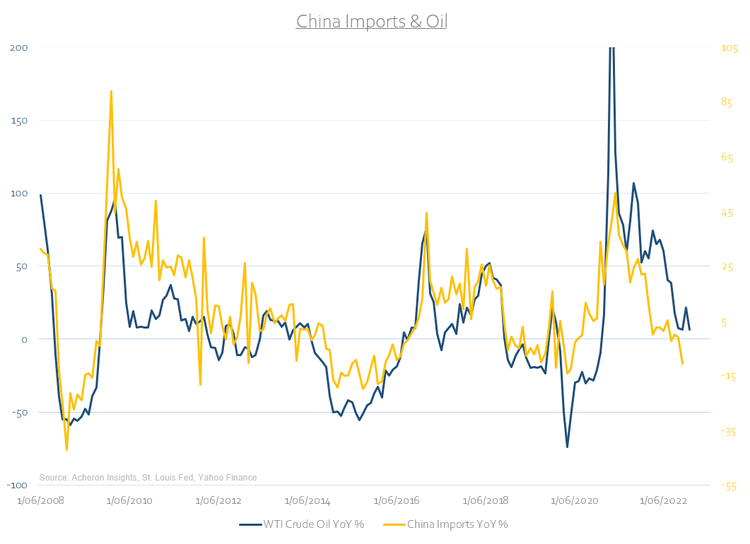

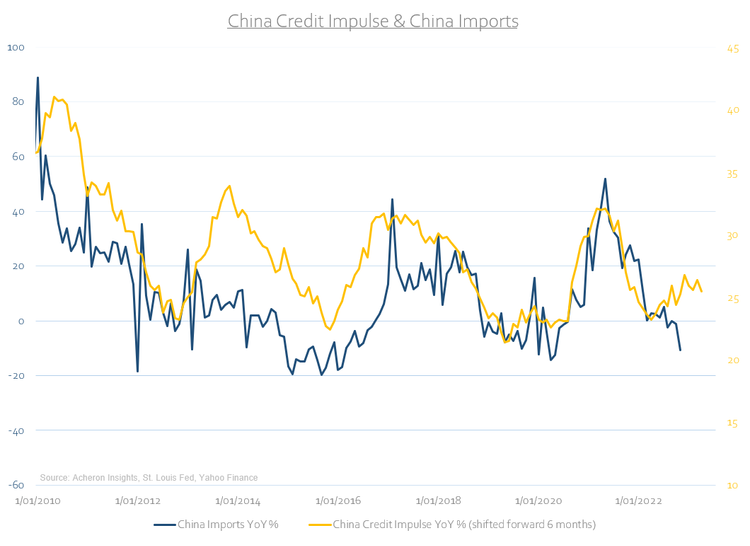

However, I say that to say this, a China reopening will go a long way to offset some of the macro headwinds coming out of the US. Based on how closely the oil price tracks Chinese economic activity (proxied below via the growth in Chinese imports), and how Chinese economic activity tends to lag the Chinese credit impulse by around six months, the recent moves higher in the latter and the continued rhetoric from Chinese authorities prioritizing growth and easy credit conditions, this should portend bullishly for oil prices over the next six months or so.

The second half of 2022 saw a significant supply side response in the oil market, thanks primarily to the SPR releases. With this now largely behind us, a China reopening could usher in the demand response. Pierre Andurand - perhaps the world’s greatest oil trader - certainly thinks this will be the case.

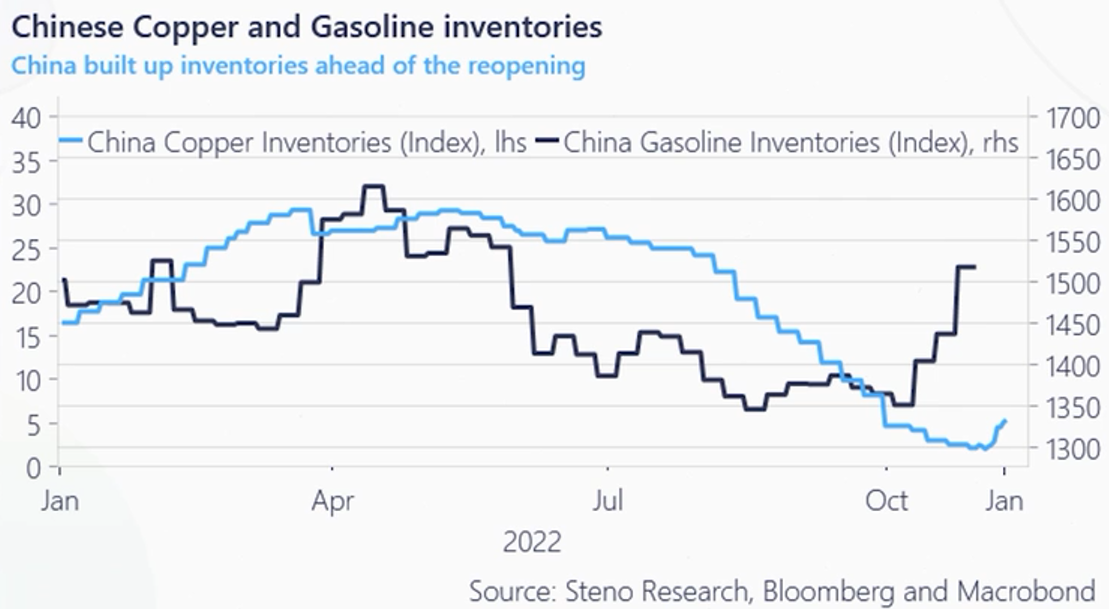

However, it is important to remember China tends to stock their inventories for most commodities in advance. So much so, during November and December we saw a significant stockpiling of gasoline, likely in preparation for the grand reopening. As a result, it may mean the pending Chinese demand for commodities may be more impactful for industrial and base metals such as copper as opposed to oil and its refined products.

Source: Steno Research

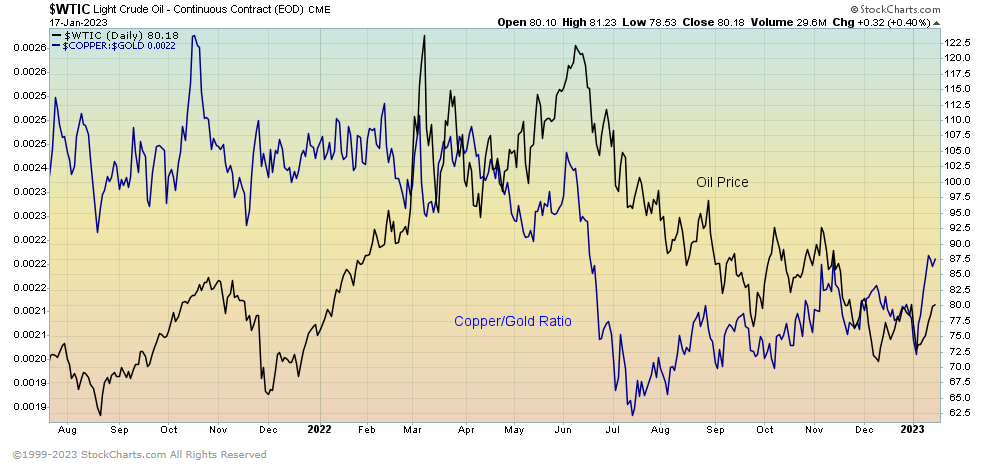

Regardless of how much demand does eventuate from China, should the US economy itself continue to prove robust in the face of the largest tightening of financial conditions in history and the disinflation trend continue, we could well see a transitory goldilocks period for the first half of the year. This would likely be a positive outcome for oil and commodities overall, and one the copper-to-gold ratio is certainly suggesting is on the cards.

The Technical Picture

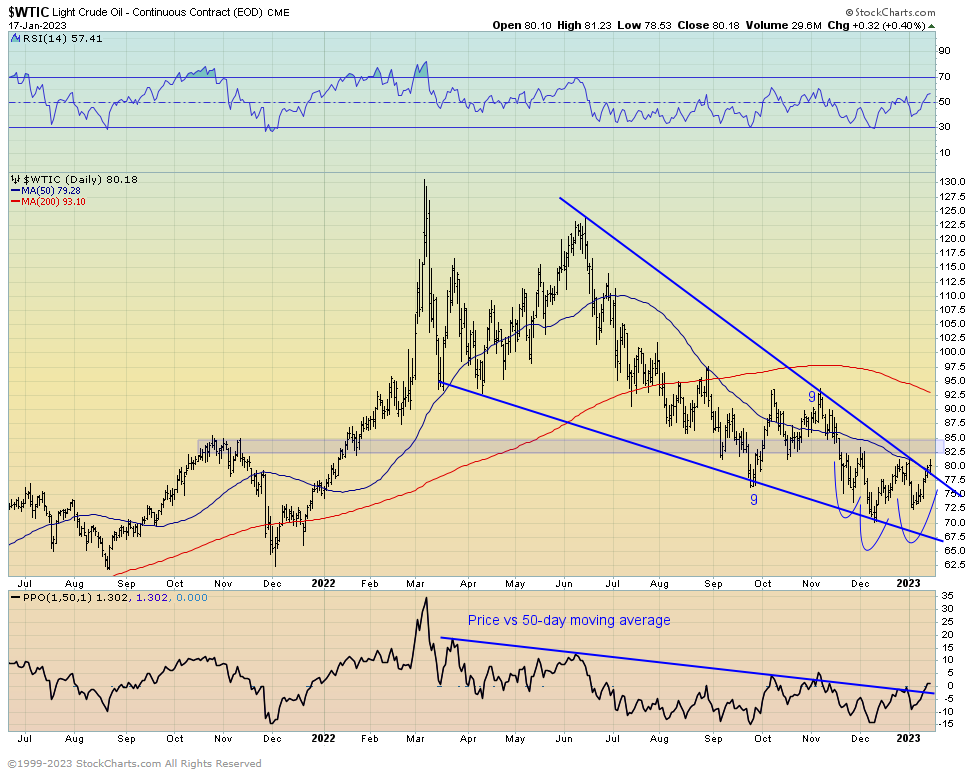

From a technical perspective, recent price action on the daily chart appears quite constructive. Crude prices look to be breaking out bullishly from the descending wedge patter that has been forming from nearly 12 months. There also looks to be somewhat of a head-and-shoulders bottom seemingly in play. Key overhead resistance resides around the $82-$84 area, and should we break above, a test of the 200-day moving average at the very least seems likely.

On the weekly chart, the technical picture is textbook. The $75-$80 long-term support level continues to hold following a false breakdown in December (generally a bullish development), and seems like an excellent level to add to long-term positions for those so inclined. Furthermore, long-term momentum (as measured via price versus the 200-day moving average) looks to be breaking out.

Overall, the technical picture is developing nicely.

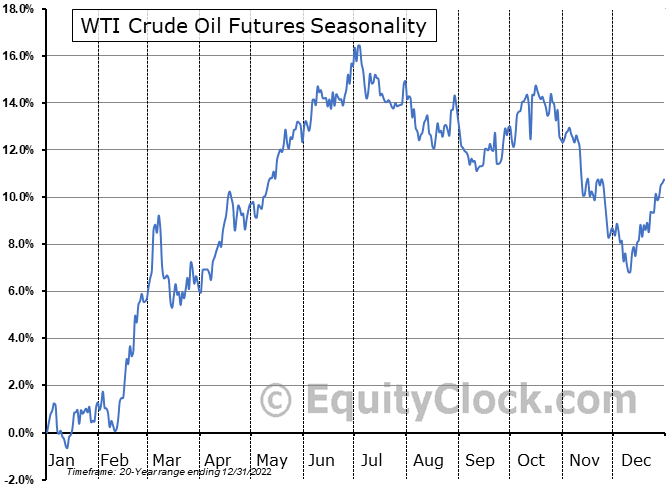

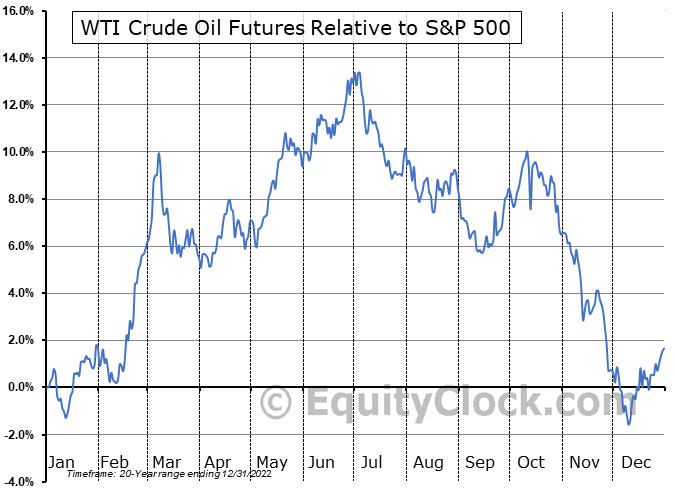

Meanwhile, we are nearing a very favourable seasonal period for oil prices come the latter stages of February through June, both on an absolute basis and relative to the stock market. Again, should we see greater tightness return to the physical market and the bearish inventory dynamics ease in the coming weeks, the first half of the year could be a very positive period for energy.

Regardless of where energy is headed in 2023, the long-term fundamental outlook remains as strong as ever and is likely to continue to reward investors handsomely in the years ahead.