We need to talk about a rare double discount in the stock market that’s out there now—just waiting for us to jump on it.

And doing so couldn’t be easier. It all comes down to 3 funds primed to spike when one of these discounts closes—and then spike again when the second one snaps shut!

Both of these ridiculous markdowns are already starting to narrow, so we need to make our move soon.

One other thing: these 3 funds pay massive dividends—from 7.4% to 11.7%!

Before I reveal the names of these funds, let’s talk about the first discount: the massive undervaluation of the stock market—and when we can expect investors to go from extreme fear to extreme greed.

Discount No. 1: A Cheap Market in Disguise

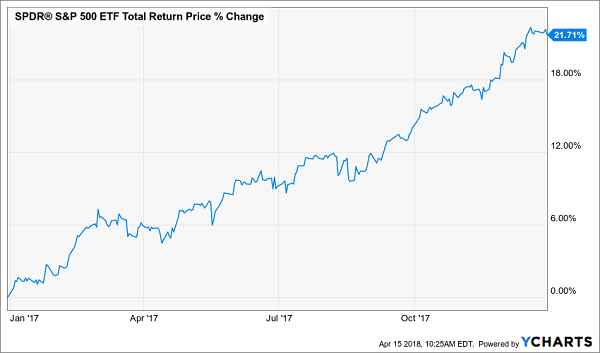

Regular readers know I’ve been bullish on stocks for a long time, even though, back at the start of 2018, I expected some profit taking. It was inevitable after the SPDR S&P 500 ETF (SPY (NYSE:SPY)) did this in 2017:

A Massive Spike

Then, as if on cue, the market did this in the first few months of 2018:

Start of a Ho-Hum Year?

That’s got plenty of folks worried that stocks will do nothing—or worse—this year. But there’s another side of the equation they’re not paying nearly enough attention to: corporate profits.

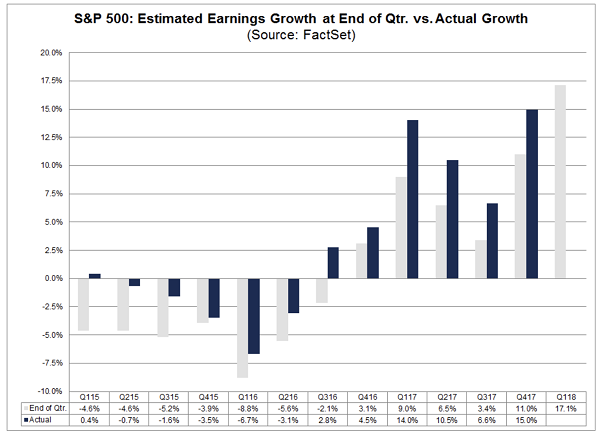

I know I don’t have to tell you that profits are the driving force of stock-market gains, and they’re still marching higher—at an even faster clip than in 2017—even as stock prices have gone basically nowhere in the first few months of 2018:

The Market Misses the Big Picture

According to FactSet, the S&P 500 saw 15% earnings growth in the last quarter of 2017, and that was expected to jump to 17.1% in the first quarter of 2018, when analysts made this estimate back in December.

Today they’re predicting an even better earnings gain for the first quarter: a whopping 20%!

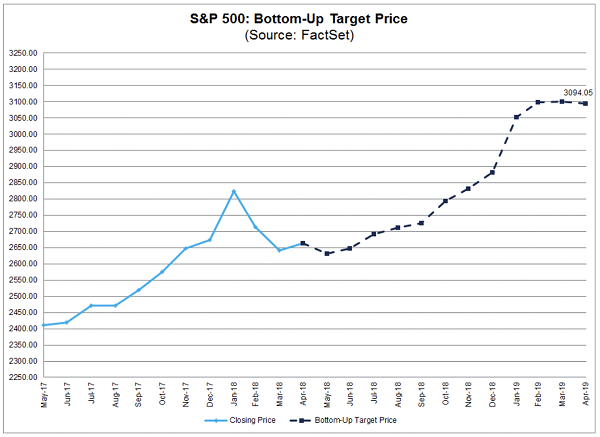

And why not? Jobless claims are still down, unemployment is at its lowest point in nearly a decade, wage gains are getting stronger and a weaker dollar is juicing US exports. No wonder the S&P 500 is expected to rise over 16% by the end of 2018 (with upside forecast starting next month)—even with the doldrums we’ve seen year to date.

Countdown to Liftoff

The average investor, however, isn’t convinced.

Why?

Because they are fed a constant stream of noise—from fears of a shooting war with North Korea to a trade war with China—that distracts them from what matters: corporate profits, the very thing that should be making them feel bullish.

But as I told CEF Insider subscribers in a private webinar a few weeks ago, a trade war wasn’t going to happen, and investors need to look past the headlines to what’s really going on in the economy. When they do, there is a lot to feel good about.

3 Dividends Up to 11.7% to Buy Now

So how should we buy into this market?

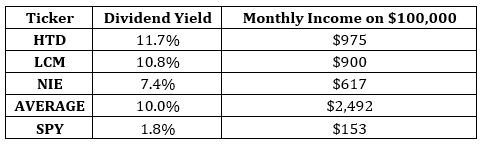

You wouldn’t make a mistake if you just bought SPY and held for the market to recover—but you can do better, with a higher income stream and bigger total returns, with 3 funds full of S&P 500 companies: the AllianzGI Equity & Convertible Income Closed Fund (NYSE:NIE), the John Hancock Tax Advantaged Dividend Income Closed Fund (NYSE:HTD) and the Advent/Claymore Enhanced Growth & Income Closed Fund (NYSE:LCM).

Each of these funds focuses on large cap S&P 500 firms—familiar names like Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Helmerich & Payne (NYSE:HP) and Visa Inc (NYSE:V), and each has an income focus that investors should pay particular attention to—because these funds provide a passive income stream that is many times that of the S&P 500.

While SPY is paying less than 2% in dividends right now, these funds pay an average of nearly 10%, which means a $100,000 portfolio of all three will get you $2,492 in monthly income, versus a paltry $153 per month from that same amount in SPY:

For an income stream 16 times greater than the index, these funds are worth considering on their own.

Which brings me to the second part of that double discount I mentioned before.

Discount No. 2 (or How to Buy Stocks for 90 Cents on the Dollar)

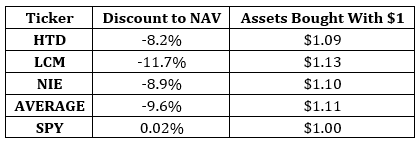

What I mean is that the market price for these funds is lower than the net asset value (NAV) of the stocks each fund holds. That’s because these are closed-end funds (CEFs), which often trade for less than their NAV—unlike ETFs, which almost never do. And the discounts are massive for each of these funds.

Buy SPY and a buck gets you a buck worth of stocks. Buy these funds and a buck gets you $1.11 worth of stocks.

Why is this a double discount?

Because stocks are already discounted thanks to the recent selloff—and thanks to the big discount to NAV in these funds, you get those discounted stocks at another discount. That points to some nice compounded gains when other investors see huge earnings gains and get greedy.

The 8.2%+ Dividends Wall Street Keeps Hidden

Funny thing is, you won’t hear a thing about CEFs like these from Wall Street or your financial advisor.

Why?

Because most of these folks would rather peddle what’s popular, or maybe steer you into an ETF like SPY. It’s a lot easier for them—they don’t have to do a smidgen of research and they still get paid.

Nice work if you can get it!

I don’t know about you, but I’m tired of the average Joe getting the scraps while a small inner circle of wealthy investors pockets the serious money.

That’s why I started investing in CEFs in the first place—with their unbeatable discounts and huge dividends, they’re the perfect antidote to today’s headline-driven market.

That’s because their markdowns give you downside protection while their massive income streams deliver more of your profits in CASH, not fly-by-night paper gains.

My 5 Top CEFs to Buy Now

HDI, LIM and CIE are a great start, but you can set yourself up for even bigger gains as investors come to their senses with my 5 top CEFs to buy now.

Each one throws off safe, and massive, dividend payouts—I’m talking an average 8.2% in CASH, with one of these beauties even handing you an outsized 10%.

Best of all, each and every one of these 5 CEFs trades not only at a massive discount to NAV but a completely unusual one—so it’s only a matter of time before these markdowns return to normal.

The bottom line? We’re looking at easy 28%+ upside in the next 12 months.

But as I told you off the top of this piece, we need to make our move soon.

Don’t miss out on the biggest gains (and income) on offer here. Click here now to get the names, ticker symbols, buy-under prices and my complete research on the top 5 high-yield CEFs to buy now.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."