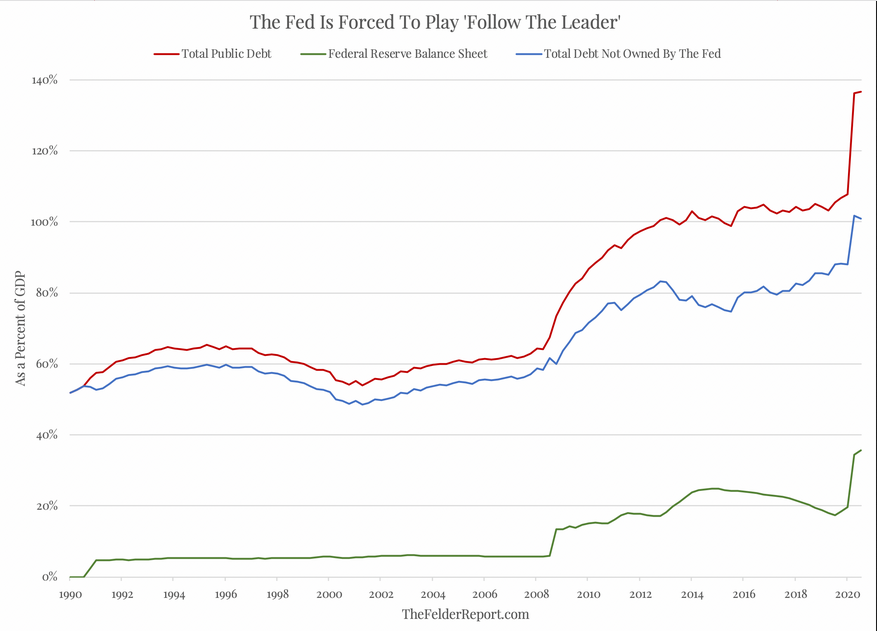

Back in October, I published a post titled, “This Is What Monetization of the Debt Looks Like,” arguing that the Fed’s intervention in the repo market at the time was not a return to “quantitative easing,” as many critics suggested at the time, but simply the central bank acting as lender of last resort to the Federal Government. It was, in its purest form, a commitment to monetize that amount of debt that could not be absorbed by the market.

Now, nearly 10 months later, it appears that this commitment has only grown stronger. What it really amounts to is “fiscal dominance,” a scenario in which a country’s debt grows so large that the central bank is forced to abandon whatever ostensible mandate it has been given for a new, unspoken one: print as much money as is required to fund the government and prevent a debt spiral.

It only takes a glance at the chart below to understand that the Fed is now being forced to play “follow the leader.” As former chief economist for the BIS William White put it:

“At some point, people realise that the government can’t support the debt burden without going back to the central bank to print more money. This is a tipping point.”

We have now reached that tipping point.

Investors should understand that this is a marked change from the monetary policy of the past in which the Fed could pursue its dual mandate without being hindered by fiscal policy. Fiscal policy is now officially taking the wheel and the dual mandate is taking a back seat. And if inflation does, indeed, make a comeback then the central bank’s ability to manage it could be severely hobbled by this new mandate to monetize the debt to whatever extent is necessary.

Perhaps this is why Jerome Powell keeps telling us he is committed to creating inflation: so when it does arise he can say (in his best Pee Wee Herman voice), “I meant do that.” Because the perception that the Fed has explicitly engineered inflation may prove to be its only hope at preventing hyperinflation.

At some point, though, it will become obvious to all that the Fed abandoned its mandate of stable prices, not because it believed it was the right thing for the economy but because the federal government rewrote the mandate for them, even if it wasn’t done explicitly.