Today we’re going to dive into a three-fund portfolio that throws off a massive 9.7% dividend yield and that payout is backstopped by stocks everyone knows well.

With a dividend like this, $500k invested gets you more than $4,000 in monthly income!

Big Income From The Big Three

While you might be suspicious of a 9.7% yield (and rightly so!), these three funds are solid. Their combined holdings are built on large caps like Amazon.com (NASDAQ:AMZN), Visa (NYSE:V), and Microsoft (NASDAQ:MSFT).

They then add in fast-growing tech plays like Bill.com Holdings (NYSE:BILL), a maker of back-office software for small and medium-sized companies, which is up 500% over the last five years; and chipmaker Monolithic Power Systems (NASDAQ:MPWR), which has gained 443% over the same period.

These funds then take the returns from fast-growing stocks like these and convert them into big yields for us, thanks to their unique structure as closed-end funds (CEFs).

CEFs, if you’re unfamiliar, are diversified funds that buy a bundle of assets and then, over time, sell some of those assets at a profit and pass on the profits as cash dividends. These payouts are spaced out to give us a reliable income stream. And with one of these funds paying out quarterly and two paying out monthly, you’ll find this “three-buy mini-portfolio” dropping cash into your account at a fast clip. Let’s get into them:

High-Yield CEF Pick No. 1: Liberty All-Star Growth Fund

Liberty All Star Growth Closed Fund (NYSE:ASG) does exactly what its name says: it invests in growth companies. But its definition of growth leans more toward the big guys, with Microsoft, Visa, and Amazon.com as core holdings. The result has been a terrific performance:

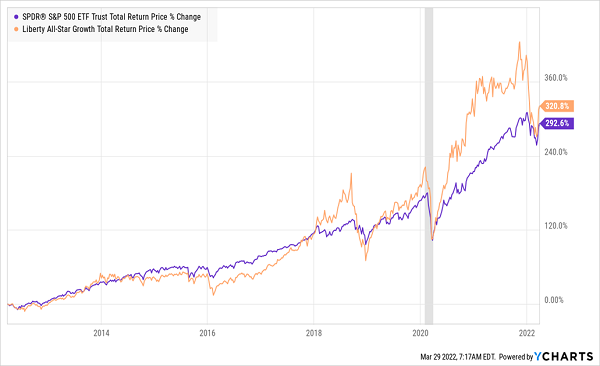

ASG Rolls Past The Market

ASG has a history of solidly beating the broader stock market almost all the time, but as you can see above, the recent selloff has hit it unusually hard. But that’s an opening for us, because the same thing happened during the COVID-19 recession two years ago, and as you can see from the chart above, ASG went on to crush the market in a big way for many months afterward—a setup that looks very similar to the one in front of us now.

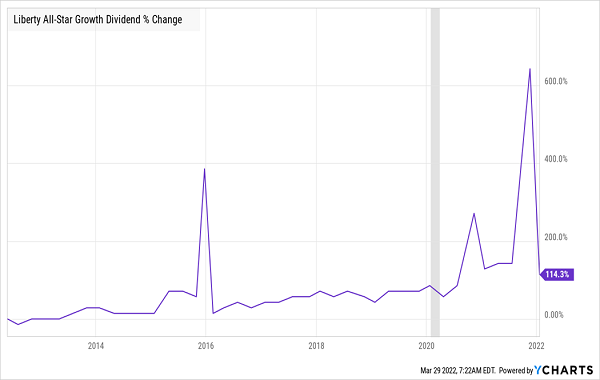

Meantime, ASG yields 8.1%, and the fund has been growing its payouts over the last decade, with some special dividends thrown into the mix (last year’s was particularly large).

Big Yields, Bigger Raises And The Biggest Specials

Now let’s move from the established player to a snappy upstart offering even bigger payouts (that come your way monthly, to boot).

High-Yield CEF Pick No. 2: BlackRock Innovation and Growth Trust

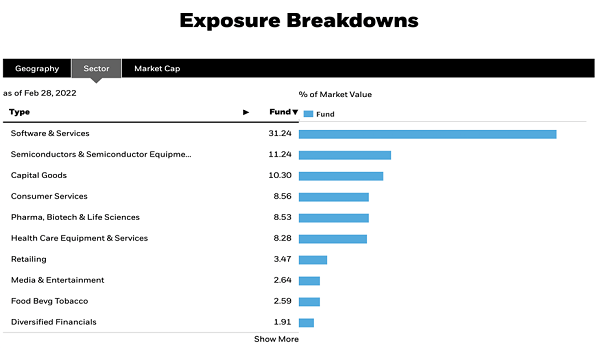

BlackRock Innovation And Growth Trust (NYSE:BIGZ) focuses on up-and-coming tech plays like Bill.com, Monolithic Power Systems and Axon Enterprise (NASDAQ:AXON), maker of software for law enforcement, the military and security services.

Part of this fund’s appeal is that its manager, BlackRock, is the largest asset manager in the world, with $10 trillion dollars in its care. That kind of heft gives it unparalleled insights into the stocks it holds. And it attracts the top portfolio managers, too.

Source: BlackRock

Here’s the kicker: because BIGZ is a new fund, having launched in the middle of 2021, it’s trading at a 12.7% discount to net asset value (NAV, or the value of the stocks in its portfolio), making it one of the cheapest funds on the market, despite BlackRock’s edge.

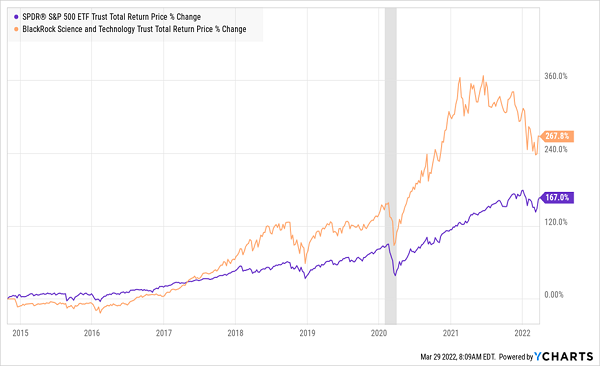

This is partly because BIGZ is too new to really have any track record to talk about. That said, if we compare it to its sister fund, the older and more established BlackRock Science and Technology Trust (NYSE:BST), we can understand why BIGZ is a great opportunity now.

A Proven Track Record

BST has proven that BlackRock can crush the market with a tech-focused portfolio, and that has resulted in BST trading at a big premium several times in recent years (it’s now trading at just a 3.3% discount). That’s a good indicator that when investors realize their mistake and snap up BST’s younger sibling, BIGZ, its big discount should disappear, giving you big cash payouts on top of its steady cash flow.

High-Yield CEF Pick No. 3: The PIMCO Strategic Income Fund

Now let’s round out our portfolio with PIMCO Strategic Income Fund (NYSE:RCS), which focuses on bonds and is managed by PIMCO, one of the biggest and most successful bond investors in the world. PIMCO is so big that the US government approached it about buying many of its bonds during the subprime-mortgage crisis of 2008–’09.

That uniquely special market access and deep understanding of macroeconomic factors has made RCS a monster of a fund, but a monster that is temporarily downtrodden.

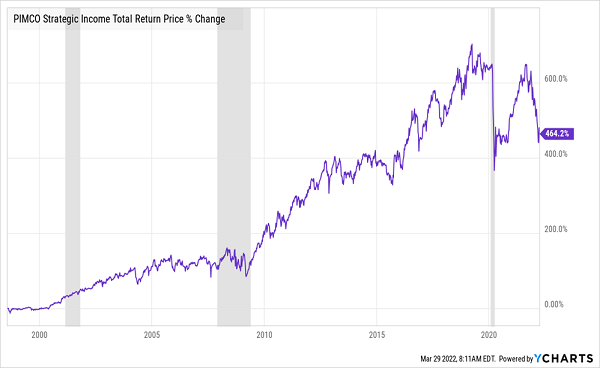

A Fascinating Track Record

With over 600% gains leading to the pandemic, RCS proved itself to be a darling for an investor who wanted income (RCS’s 10.7% yield is nothing to sneeze at, after all) and the best of the best when it came to managing a diversified portfolio of government, corporate and foreign bonds.

Notice RCS’s slide during the COVID-19 pandemic and again in 2022. In both cases, investors panicked thanks to seemingly once-in-a-lifetime disruptions (first a global pandemic, then Russia’s aggression in Ukraine). When the COVID-19 selloff hit, they quickly realized their mistake, resulting in a recovery back to its pre-pandemic trend, as you can see above.

The same pattern is just starting now.

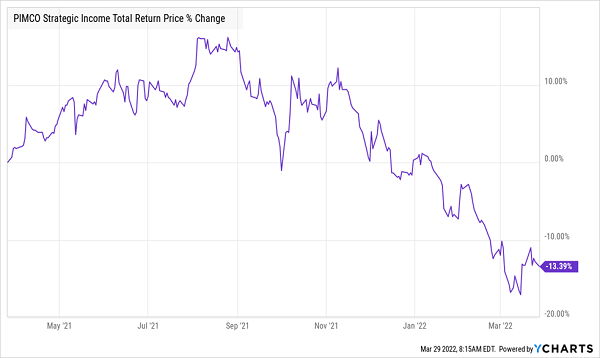

A Recovery Begins

With RCS seeing a bottom in March, it’s begun to show signs of recovery as we head into April, giving us a great entry point for capital gains (in addition to that huge 10.7% yield) as it rebounds.

Three funds, with temporarily depressed assets that are starting to recover, combine to pay you that 9.7% income stream, in addition to massive capital gains potential, as the market continues to reverse course. These types of opportunities don’t come around often, which makes this one all the more exciting.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."