If you want to diversify, get a strong—and growing—dividend and dodge risky speculation, the SPDR S&P Dividend ETF (NYSE:SDY) may seem like a no-brainer.

But buying this fund would be a huge mistake!

Today I’m going to show you why, and help you avoid a couple other seemingly obvious moves that could steer you into big trouble. Further on, I’ll reveal a terrific fund paying an outsized monthly dividend (yielding 7.9%) to buy now and tuck away for two decades or more.

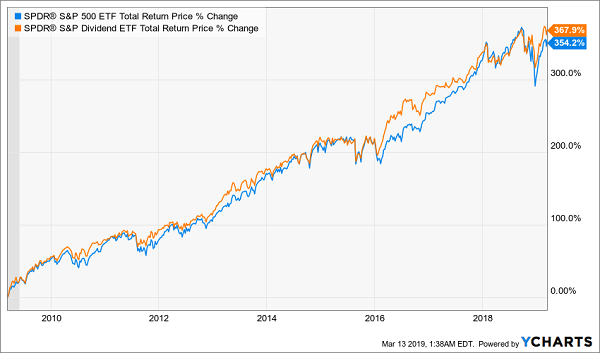

First, back to SDY, which has beaten the S&P 500 over the past decade:

SDY Throws Us the Bait …

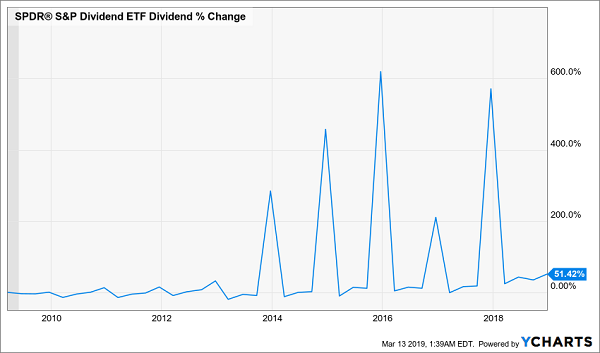

At the same time, the fund has shown solid dividend growth, as well as some massive special dividends that have helped its payouts grow substantially over the years:

And Sets the Hook

So why not just buy this fund and call it a day?

I’ll give you three reasons.

First, the dividend is too low. We can easily beat SDY’s 2.5% yield by being a little more selective.

Second, SDY, which tracks the S&P 500 High-Yield Dividend Aristocrats Index (comprised of S&P 500 stocks that have raised dividends for 25 years or more), actually exposes us to many underperforming companies.

Finally, the fund includes some stocks with strained payout ratios (or the percentage of earnings paid out as dividends).

For many people, it’s difficult to believe that a firm that has paid growing dividends for more than two decades could suddenly cut its payout, but it happened to Bank of America (NYSE:BAC) and General Electric (NYSE:GE).

Before 2008, you’d have been laughed out of the room for suggesting instability in a stock like GE—and then they cut in 2008 and again a decade later, in 2018.

And if it happened to a one-time blue chip like GE, it can happen to any company, especially now that many of the Dividend Aristocrats in both the energy and consumer-staples sectors are facing falling revenue and/or earnings.

Buying Aristocrats “Direct” Disappoints, Too

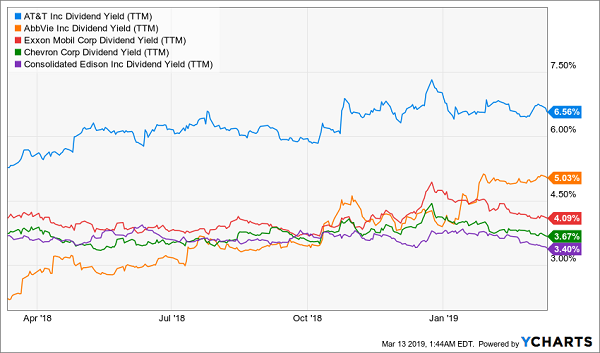

Instead of blindly buying all the Aristocrats through SDY, we could limit ourselves to just the top five highest-yielding stocks in this group.

This would give us a higher average yield (4.5%) than you’d get from SDY, but it would result in an energy-heavy portfolio that should immediately make you worried. These companies are AT&T (NYSE:T), AbbVie (NYSE:ABBV), ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX) and Consolidated Edison (NYSE:ED).

High Payouts, Little Safety

There’s another problem: these stocks haven’t been doing so well. Over the last five years, only two of them, Consolidated Edison and AbbVie, have outperformed the S&P 500—and three of them have been duds:

Decent Yield, Meager Gains

On average, these stocks have returned 18.9% over the last four years, or 3.5% annually. Compared to the S&P 500’s 8.3% average annual return, that’s simply a disaster.

So choosing the highest-yielding Dividend Aristocrats clearly doesn’t work. What can we do instead?

This Fund “Squeezes” A 7.9% Payout From Stocks You Know Well

How about picking the Eaton (NYSE:ETN) Vance Tax Advantaged Dividend Fund (EVT)? This closed-end fund (CEF) has outperformed the S&P 500 on a total-return basis over the last decade by a huge margin:

Beating The Market

Its portfolio includes high-quality dividend payers like JPMorgan Chase & Co. (NYSE:JPM), Johnson & Johnson (NYSE:JNJ), Verizon Communications (NYSE:VZ) and Merck (NYSE:MRK). The fund’s dividend yield is a staggering 7.9%, and its dividend has gone up 34.9% in the last 10 years.

How does EVT manage to get such performance (and income) out of big-cap S&P 500 names?

Simple: it boasts a team of managers who have proven their value by conservatively employing leverage and constantly rotating the portfolio based on the payout quality of the companies EVT holds. That’s the power of going with a team of investment pros instead of a “dumb” index fund like SDY.

Here’s the kicker: EVT’s management fee of 1.08% is a bargain when you look at the fund’s performance (and note here that all the returns I just showed you are net of fees).

A final benefit: the fund’s tax-advantaged structure should also cut the tax burden on your profits.

4 More “Pullback-Proof” 7.5%+ Dividends For 2019

When you buy 4 other massive CEF dividends I’m pounding the table on now, you get an unbeatable dividend “triple play”:

- A 7.5% average payout—and that’s just the average! One of these dividend dynamos throws off an incredible 8.4% cash stream.

- Crash protection: Each of these 4 funds trades at an incredible discount to NAV, setting them up for massive outperformance on the next market rise—and cushioning the blow when the market throws its next tantrum.

- Dividend growth! The payouts on each of these 7.5%+ payers are growing like weeds. That’s right: management is practically begging us to take cash off their hands!

In fact, they’re forcing us to, through their sky-yields and regular dividend growth.

I’m one of a handful of analysts in the world devoted 100% to high-yield CEFs. I’ve spent hours sifting and analyzing to come up with these 4 “best of breed” funds, and I can tell you this:

These are precisely the kind of investments you need to own in today’s economy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.