This GameStop (NYSE:GME) madness is a clear and present danger to our dividends.

Let’s stop and look at exactly what it means for our income streams, and what we’re going to buy to protect ourselves (and cash in with monthly payouts up to 8%!)

When the Dumb Money Runs, We Need to Be Careful

The whipsawing shares of GameStop, AMC Entertainment Holdings (NYSE:AMC) and others are classic cases of “dumb money” in action: they’re among the many short squeezes breaking out across the market—where short sellers, including hedge funds, betting against a stock lose big as buyers bid the stock up in an effort to “stick it to the suits.”

That buying action forces the “shorts” to rush to cover their massive losses by buying the stock … driving it higher still.

GameStop Soars, “Shorts” Get Crushed

One thing we all know is that when we see behavior like this—including a stock jumping 100% or more in a single day—it’s a telltale sign of a market on the verge of a correction. That goes double when the S&P 500 is bubbling away near all-time highs, as it is now.

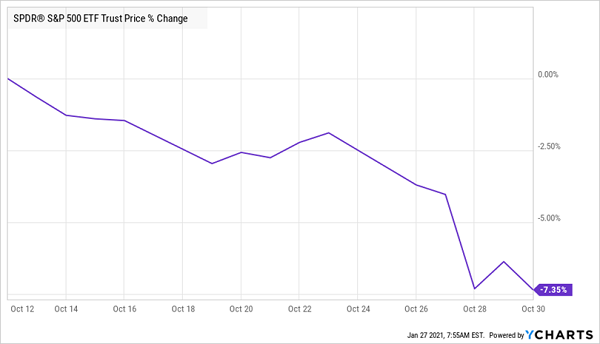

If this all has a familiar ring to you, it’s because ridiculous behavior like this has happened before: in October, the Robinhood crowd was bidding shares of bankrupt companies like Hertz Global Holdings (OTC:HTZGQ) to stratospheric heights for no reason.

What happened after bankruptcy became the new hot trend. Stocks tanked 7%:

Stock Players Lose a Life, Put in Another Token

So what are we rational investors to do at a time like this? Buy the typical S&P 500 stock and hope for gains? Go to cash?

Neither. Doing the former means collecting just a 1.5% dividend—leaving us almost totally reliant on stock-price gains. That, in turn, means we could be forced to sell into a situation like last October (or worse, last March!) to supplement our income. Cash, of course leaves us grinding our teeth while inflation grinds up our nest egg.

This dilemma is why a contrarian approach is my “preferred” strategy. Which leads me to the high-yield plays we’re going to talk about today.

These “VIP” Funds Pay You 3 Ways

The investments I want to bring to your attention are preferred stocks, particularly preferred stocks we purchase through a closed-end fund (CEF).

We’ll get into the specifics in a moment, but off the top, the main thing you need to know is that, unlike low- (or no-) dividend-paying S&P 500 stocks, which can only pay us when their prices move up, preferred-stock CEFs pay us three ways:

- Through their generous dividends (paid monthly): As I write this, the 17 preferred-stock funds tracked by CEF screener CEF Connect yield between 5% and 8%. And all pay monthly.

- Through price gains in the preferred shares and other investments in their portfolios, and …

- Through their vanishing discounts: When a preferred-share CEF trades at a discount to net asset value (NAV, or the value of its underlying portfolio), we’re positioned for “bonus” price-driven upside as these discounts vanish.

How Preferred Stocks Help You Retire on Dividends Alone

Preferreds are different from the “common” stocks of companies like JPMorgan Chase (NYSE:JPM), Visa (NYSE:V) or GameStop (ugh!). The best way to think of preferreds is as bond/stock hybrids. Like a bond, they pay a regular dividend and tend to trade around a fixed price, so, yes, you do trade off some of the upside you might get from common stocks.

But that trade is worth it for us contrarians, because we’re well compensated by preferreds’ much higher yields. And looking further into 2021, we might not be giving up much upside in any event, given the stock market’s high valuation.

And don’t forget about our preferred-stock CEFs’ closing “discount windows,” which give these funds a nice additional upside kicker!

One more note on preferreds’ dividends: these payouts are a lot safer than those of common stocks: if a company runs into trouble and must suspend its payout, it can’t resume dividends to common shareholders before doing so for preferred shareholders. It must also repay us preferred buyers for the payouts we missed during the suspension.

Preferred Stocks: Think CEF, Not ETF (or Heaven Forbid, Buying Direct)

Another reason for going with a CEF instead of an ETF or buying preferreds directly is that the preferred market is tough for us individual investors to research, and it’s not as “democratic” as the stock market.

That tilts the game in favor of actively managed CEFs, because their managers are well-known in the tiny preferred-stock world, and their connections matter: when a company issues new preferreds, these managers’ phones ring before anyone else’s.

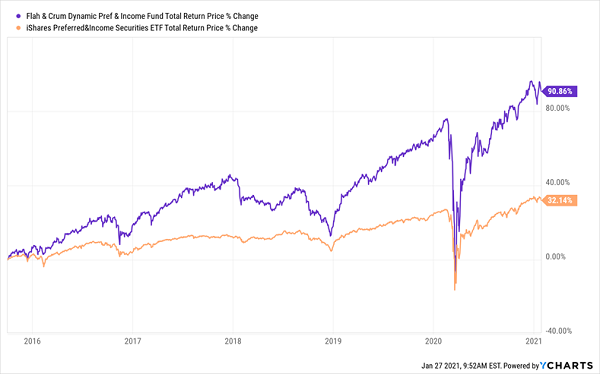

You can see that built-in edge in the performance of the Flaherty & Crumrine Dynamic Preferred & Income Fund (NYSE:DFP), which yields 7% and has nearly doubled our money (with dividends included) since I recommended it in October 2015.

It’s also nearly tripled the return on the preferred-stock benchmark, the iShares Preferred & Income Securities ETF (NASDAQ:PFF).

Preferred-Stock ETF Doesn’t Know What Hit It

Another recommendation, the Nuveen Preferred & Income Fund (NYSE:JPS), payer of a 6.7% dividend today, has also crushed PFF, with a 54% total return since my August 2015 recommendation (more on JPS and DFP in just a moment).

Now you’ll notice in the chart above that DFP did fall sharply in the spring 2020 selloff, so you do have to be prepared for some volatility with these funds. But you can also see that the fund quickly snapped back faster (and higher) than the benchmark, something it’s done in each pullback in the last five years.

That’s why I like to think of these funds as “dividend rubber duckies,” always popping back to the surface when they get pushed down!

The bottom line is, thanks to these funds’ high yields, when a pullback hits, we can simply collect our dividends, hold on and wait for the fund’s discount to work its magic, snapping the price back to, and then above, the performance of the benchmark ETF.

It really is that simple—and it’s why carefully chosen preferred-stock CEFs should be a cornerstone of every income investor’s portfolio.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."