Another hand went up. I pointed for the next question.

When you consider dividend investments, Brett, what is more important in your opinion:

- The current yield and value of the stock itself, or

- The “engine” that is driving the business and the profits?

“Great question,” I replied. “The business engine. Always consider where the cash flow is coming from, first.”

In other words, if the business is humming, the dividends will be there. And as the payout keeps chugging along, so will the stock price. A dividend will protect the stock from downside and, with growth, provide a sweet kicker of upside.

Our astute questioner at the AAII (American Association of Individual Investors) event was ahead of the curve. Many “first-level” dividend investors get tied up with stated yields. But a payout is nothing more than a promise.

Sure, a 10% sounds awesome. As I write, about 52 US-based stocks offer double-digit yields.

We own exactly zero of them in our Contrarian Income Report portfolio, where we focus on secure, high yields. Not one of the 52 passes our CIR security clearance.

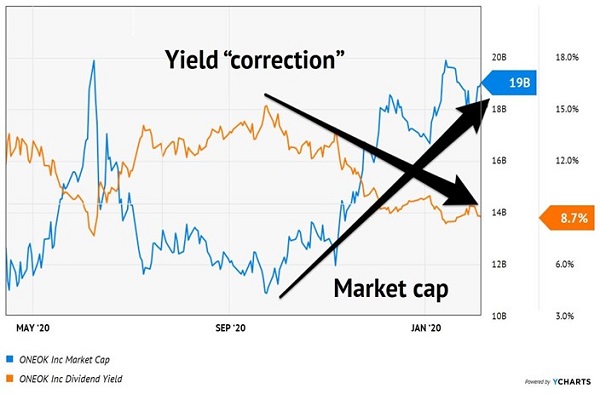

Now, I’m not saying a 10% yield is always trouble. It depends on the engine. Let’s take ONEOK (NYSE:OKE), a stock we’ve been discussing in these pages since last April. OKE has yielded as much as 15% as recently as September!

Usually, that’s a “red flag” level dividend. But it was due to a short-term hiccup—energy prices being depressed due to the virus. (And hey, who wasn’t depressed at some point in 2020?)

Long-term, OKE’s profit engine (powered by its existing energy pipelines) has the potential to produce yearly earnings of more than $3 billion. At its summer nadir, the stock had a market cap of less than $11 billion (less than 4-times future profits!). Mr. and Ms. Market have begun to correct this mistake, and whittled OKE’s yield down to a still huge 8.7%:

Profit Engine Fine, So Yield “Corrects” and Price Rallies

Now OKE is fortunate in that its product is still relevant as we head into 2021. The same cannot be said, however, for companies that ended up on the wrong side of The Great American Reset.

The past 12 months have seen 6 to 12 years’ worth of economic development in many sectors.

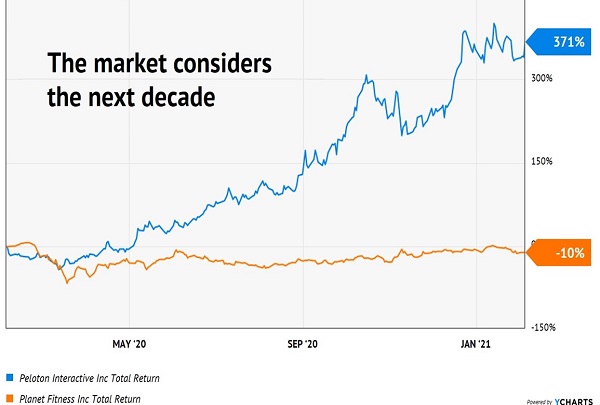

Planet Fitness (NYSE:PLNT) operates more than 2,000 fitness clubs. Peloton (NASDAQ:PTON) is the bike in my basement (and app on my phone). Same industry, but their stocks trade on different planets:

Peloton Pumps, Planet Fitness Slumps

Traditionally, these are the types of moves that we’d see play out over many years or an entire decade. But Mr. and Ms. Market didn’t waste any time—they discounted the next decade quickly, rewarding Peloton shareholders.

Next let’s consider Simon Property Group (NYSE:SPG), a high-end retail REIT (real estate investment trust) with an ownership stake in more than 200 properties. Its “digital foil” is Shopify (NYSE:SHOP), an online platform that helps businesses sell online.

Each new “Shopify store” takes a bit of juice out of the pressure to be Simon’s next tenant. After all, why deal with a physical presence when you can hire a smart developer, build a nice-looking website, reduce your “rent” and sell as much product as you’d like?

Back in the day, this trend would have taken years to play out. But again, since the Reset button was hit, the market has not been playing around. Shopify has soared 160% while Simon has shed 26%:

Digital Mall Over Physical Mall

As a guy who has built and launched two Shopify “apps”—software products geared to help Shopify users—I can personally attest to the company’s amazing growth as well as the quality of its customers. The trend has been in motion since I began working with Shopify in 2014, and it has accelerated over the past 12 months.

I’m sure you see The Great American Reset taking hold all around you. The stores and restaurants you drive by today are hurting. How many will actually open on the flip side of Covid?

Meanwhile, the stock prices of “Reset plays” like Peloton and Shopify continue to rise into the stratosphere. Which brings us to our big quandary:

The Great American Reset is indeed a “thing.” But how do we safely invest in it?

Neither of these darling stocks pays a dividend. Peloton is still losing money (my household’s subscription notwithstanding), while Shopify trades for a white hot 800-times earnings.

Many investors are buying shares and hoping they continue higher. No thanks.

There’s a better way to stay on the right side of the Reset. We’ll look for the stocks—dividend payers of course—that are providing the “picks and shovels” powering the Reset.

During the gold rush of the 1840s, hordes flocked to California to get rich mining for gold. But the guys who made the real money didn’t actually mine anything. They were the entrepreneurs who sold the “pick and shovels” as well as booze, entertainment options and lodging to the hapless speculators.

We’re seeing the same phenomenon unfold in 2021. We’ll let the first-level types gamble with their dividend-less Pelotons and Shopifys, while we calculated contrarians identify the pick and shovel payouts that:

- Represent dividends likely to follow similar “moonshot” patterns as the digital darlings we discussed above, and

- Sport stock prices that will, in turn, chase their rising payouts higher.

And by the way, the valuations of the Reset-winner stocks we’re considering haven’t yet entered the stratosphere, either. In fact, many of them haven’t moved much relative to tech, because they aren’t headline technology plays.

That’s too bad for the mainstream financial types who overlook them, but just right for us.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."