- According to media, UK’s PM Theresa May is facing a new showdown within her Cabinet regarding the trading of goods. Theresa May’s plans could include keeping EU rules regarding the trading of goods and at the same time continue to collect EU customs at UK’s border. The PM currently has one on one meetings and intends to have the plans finalized and agreed, by Friday at a cabinet meeting. On another Brexit front, reports state that UK businesses seem to be reaching a breaking point in the lack of Brexit clarity and as time is running out. Should there be further negative headlines until Friday about Brexit we could see the GBP weakening.

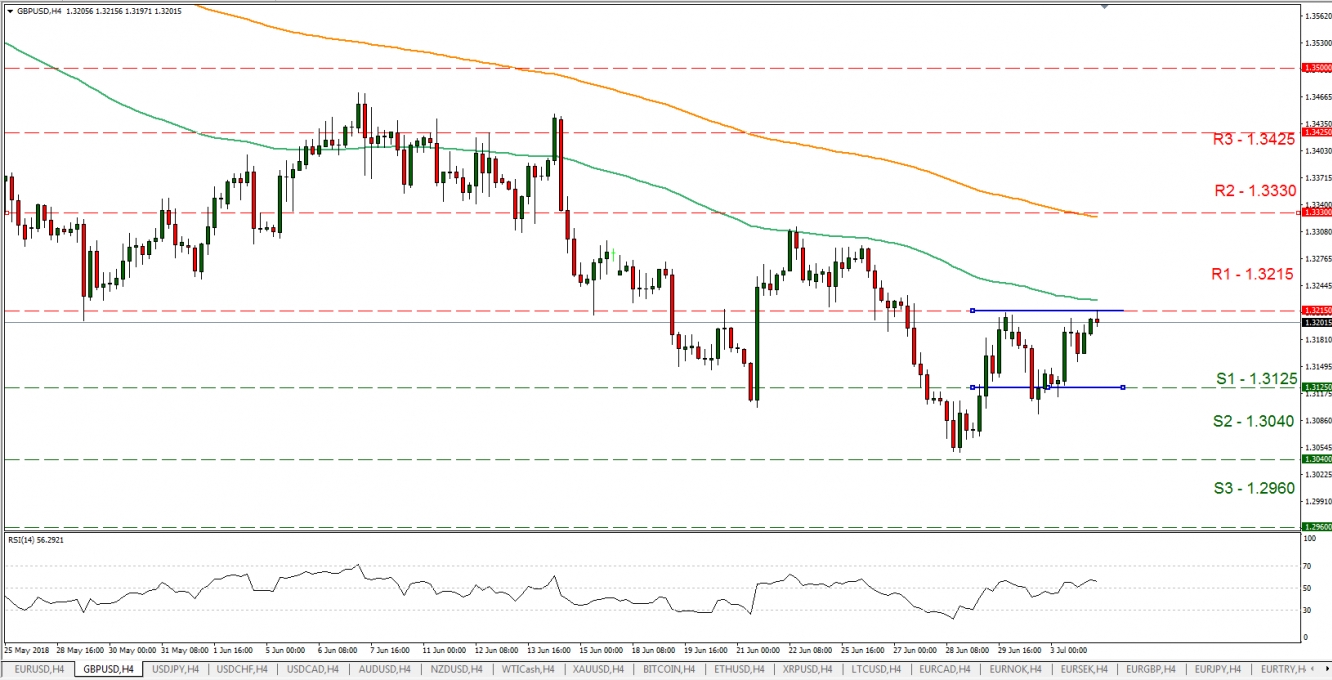

- Cable continued its sideways movement yesterday and during today’s Asian morning tested the 1.3215 (R1) resistance line. We see the case for the pair to continue to trade in a sideways manner however some bullish tendencies could exist if the Services PMI, released today favors the pound. Once again, the pair may prove to be sensitive to any fundamental news regarding Brexit. Should the bulls take over, the pair may break the 1.3215 (R1) resistance line and aim for the 1.3330 (R2) resistance hurdle. Should he bears take the reins we could see the pair breaking the 1.3125 (S1) support line and aim for the 1.3040 (S2) support barrier.

NATO spending disputes rattle allies

- A disagreement between the US and its allies seems to resurface as the military spending issue within NATO starts to prevail once again. A letter was sent by president Trump regarding the issue, to a number of allies, scolding them about low budget spending on security. Canada, Germany, Italy and Netherlands have confirmed the reception of such letters and have answered accordingly pushing back on Trumps scolding. The issue may hit its peak at a NATO summit next week in Brussels according to media. Should there be further negative headlines about the issue we could see increased volatility mainly on USD crosses.

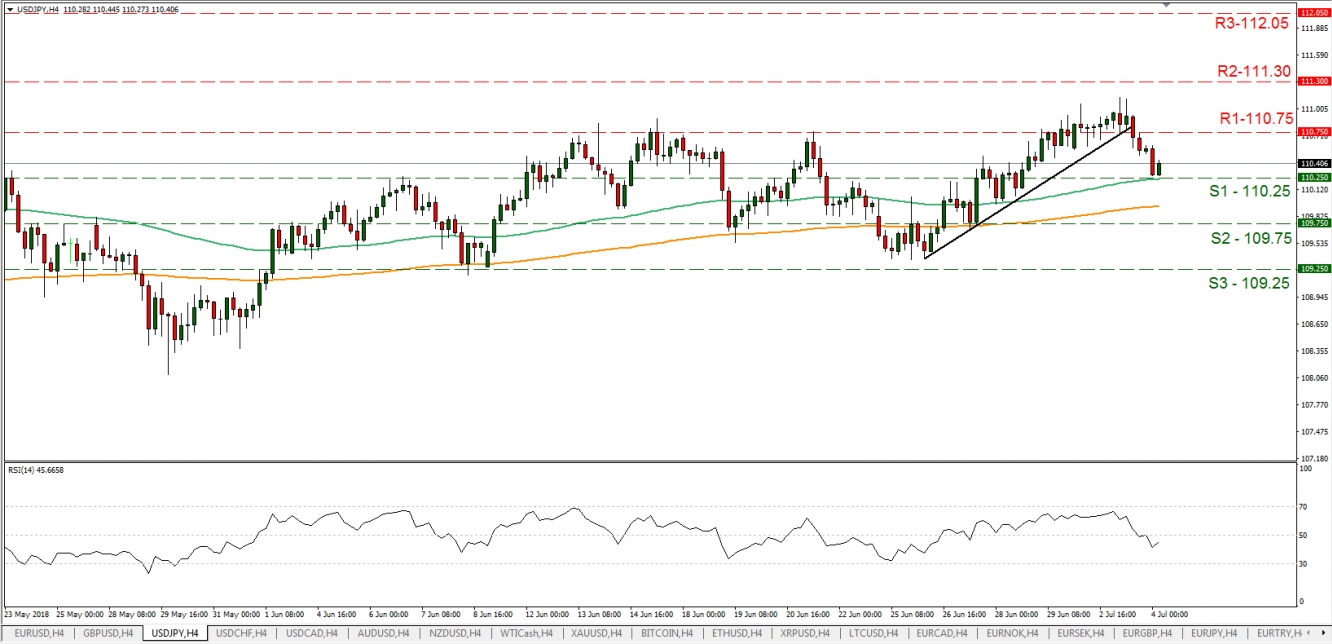

- USD/JPY dropped yesterday breaking the 110.75 (R1) support line now turned to resistance. Technically it should be noted that the pair broke the upward trend-line incepted since while the RSI indicator in the four hour chart could imply a rather indecisive market. The pair could continue to trade in a sideways manner today as the 110.25 (S1) support level remained intact against the pairs testing, in today’s Asian session. Also it should be noted that as today is a US holiday volatility could be reduced somewhat. Should the pair find extensive buying orders along its path we could see it breaking the 110.75 (R1) resistance line while if it comes under selling interest it may break the 110.25 (S1) support line and aim for the 109.75 (S2) support level.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

In today’s other economic highlights:

- In today’s European session, we get Eurozone’s Markit Final Composite PMI for June and UK’s Services PMI also for June. As for speakers BoE’s Sam Woods and Victoria Saporta speak.

- On the commodities front crude oil prices dropped in the American session due to confirmation of supply increase from Saudi Arabia, after a request was made previously from President Trump. However, the commodity rebounded as the API weekly crude oil inventories released a drawdown of -4.5 million barrels and regained most of the loss.

·Support: 1.3125(S1), 1.3040(S2), 1.2960(S3)

·Resistance: 1.3215(R1),1.3330(R2),1.3425(R3)

USD/JPY

·Support: 110.25(S1), 109.75(S2), 109.25(S3)

·Resistance: 110.75(R1), 111.30(R2), 112.05(R3)