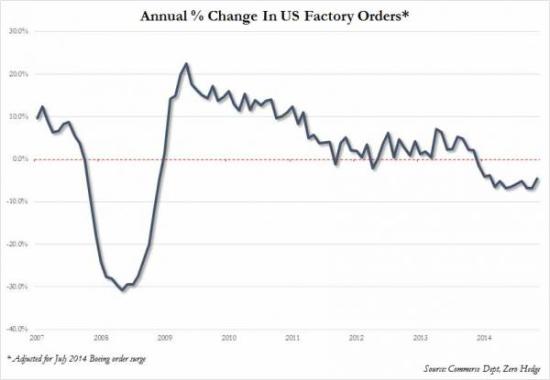

Each month one or two high-profile government reports show the US is growing, adding jobs and generally recovering from the Great Recession. But it’s not clear how that can be, when the part of the economy that makes and moves real things keeps shrinking. Here’s a chart, published recently by Zero Hedge, showing that US manufacturing has been contracting for the past year:

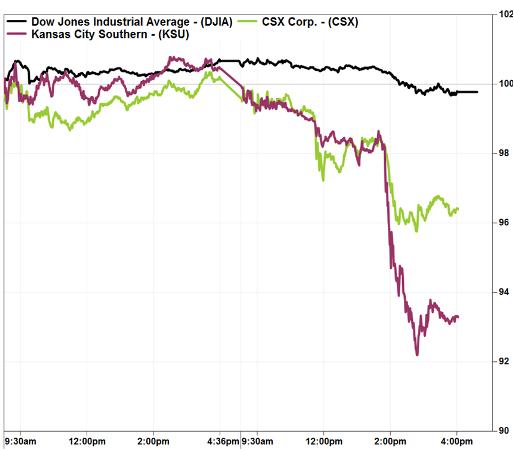

Meanwhile, the companies that move physical things around are falling hard:

Railroad stocks drop after companies give downbeat outlooks

Railroad stocks dropped sharply Wednesday, after both Kansas City Southern (N:KSU) and CSX Corp (N:CSX). provided downbeat outlooks for the current quarter at an analyst conference.The sector’s decline helped pull the Dow Jones Transportation Average, down 2.1%, much more than the 0.9% decline in the Dow Jones Industrial Average. Kansas City Southern’s stock was the biggest loser in the group, tumbling 7.1% on volume that was more than double the full-day average, according to FactSet.

The company’s chief financial officer, Michael Upchurch, said at the Credit Suisse (VX:CSGN) industrials conference in Florida, that fourth-quarter revenue would decline in the “high single-digit” percentage range from year-ago levels, according to a transcript provided by FactSet.

Analysts surveyed by FactSet were expecting, on average, fourth-quarter revenue of $622 million, which implies a 3.3% decline.

CSX slumped 3.7% in active trade, after CFO Frank Lonegro said at the same conference that domestic coal movements have declined “more significantly in the fourth quarter than expected.” As a result, he said earnings-per-share growth is now expected to be about 3%. The company had said in October that it expected full-year EPS growth in the “mid-single digits.”

Among the more-active shares of other railroad companies, Union Pacific Corp (N:UNP) slid 2.8% and Norfolk Southern Corp (N:NSC) shed 2.8%.

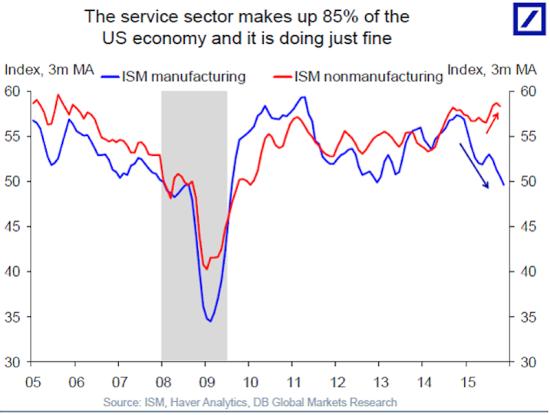

One reason for the discrepancy between overall growth and real stuff is that most of today’s economy is made up of services, and they’re doing okay (chart from Business Insider):

What is the service sector? Mostly software, restaurants, banks, construction companies, retailers, doctors and hospitals.

Can an economy thrive if it doesn’t make or move physical things? Intuitively the answer is no, because most of the services mentioned above either maintain the status quo (like healthcare and restaurants) or (like houses) consume rather than build capital. As for banking, in its current incarnation it’s almost certainly a net negative, draining capital from productive uses and funneling it to trading desks and political action committees.

The US, in short, is engaged in an experiment to see how long an economy can function with services growing and manufacturing contracting. As with so many of today’s monetary and fiscal experiments, no one knows when definitive results will come in. But the data so far aren’t encouraging.