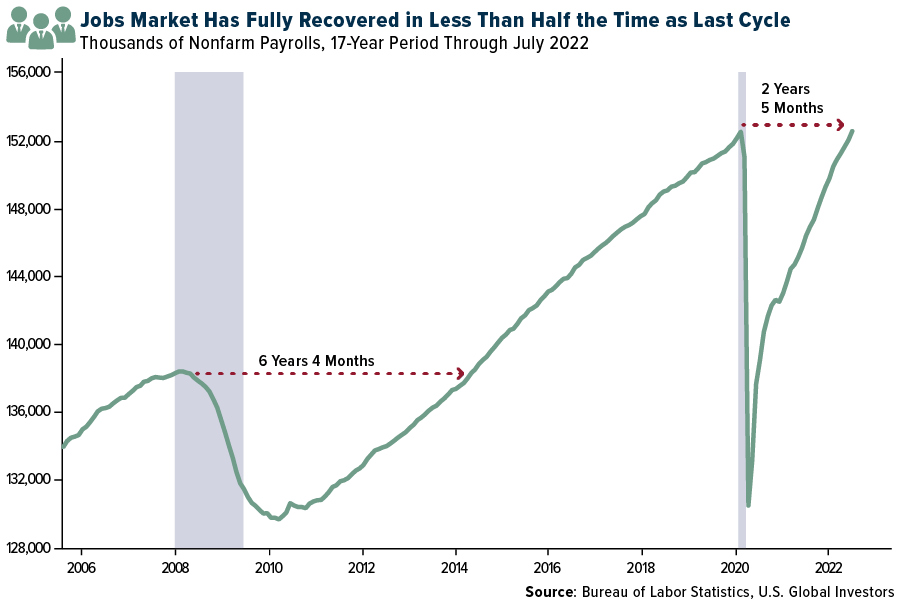

Last month, the U.S. jobs market fully recouped the number of jobs lost due to the pandemic in less than half the time it took following the previous downturn. A stunning 528,000 jobs were added in July, pushing the total number of payrolls above the February 2020 level.

In this case, however, good news may be bad news, as the blockbuster jobs report may prompt the Federal Reserve to tighten more aggressively than planned to cool growth. This could decisively trigger the recession many market-watchers believe we’ve already entered, with the real gross domestic product (GDP) having shrunk for two consecutive quarters, inflation standing at near-historic highs, and a service sector in contraction.

A yield curve inversion has preceded every recession in the past several decades, so we may be in the very late stages of the business cycle. In addition, U.S. yields have inverted at the deepest level since 2000. On Friday, the yield on the two-year government note closed at 3.24%, the 10-year at 2.83%, a difference of 41 basis points.

It will be interesting to see what Jay Powell & Co. decide to do at the next Federal Open Market Committee (FOMC) meeting, scheduled for September 20-21.

Americans Are Cutting Back On Driving, But Lower Fuel Costs Could Be A Game-Changer

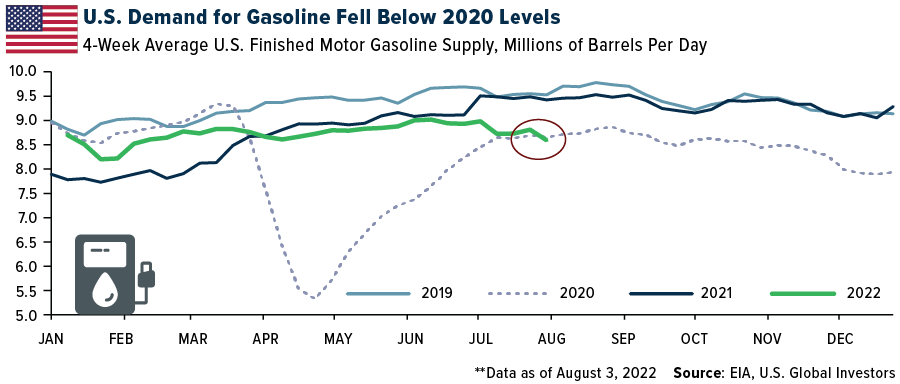

Another sign that parts of the economy may be slowing? Lower fuel demand coupled with falling gas prices. Energy Information Administration (EIA) data shows that this summer, Americans are consuming less gasoline per day than they did in the summer of 2020 when nearly everyone was stuck in their homes bingeing Tiger King on Netflix (NASDAQ:NFLX).

It seems that gas prices above $5 per gallon are a greater deterrent to venturing outside your house than COVID fears and government-mandated lockdowns were.

The decrease in driving activity is in line with the results of a recent survey conducted by the American Automobile Association (AAA). The nonprofit found that a whopping 88% of Americans were driving less due to higher gas prices. Three quarters of respondents said they were combining errands in each trip, while 56% said they were reducing shopping and dining out.

Interestingly, only 13% of people who took the survey said they were driving a more fuel-efficient vehicle in response to soaring gas prices; virtually no one, or 2% of respondents, said they were switching to an electric vehicle (EV).

The EIA will report last week’s fuel consumption numbers on Wednesday, and I expect to see that demand has jumped back above 2020 levels now that gas prices have fallen for more than 50 straight days after peaking at an all-time national average high of $5.02 on June 14.

For Many Americans, Vacations Will Happen “No Matter What”

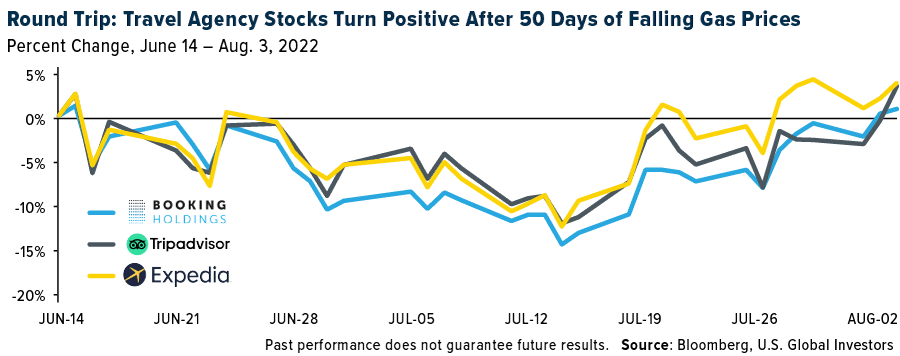

Another recent survey, conducted by McKinsey & Co., shows that many Americans are still planning a vacation this summer “no matter what,” even as inflation remains a top concern. Nearly 70% of respondents said they were taking a trip regardless of rising prices, COVID, a potential economic slowdown, or other worries.

This positive sentiment was echoed by Booking Holdings (NASDAQ:BKNG) CEO Glenn Fogel, who told CNBC this week that Americans are “going to keep on traveling, and they are going to travel more and more over the long run.”

Fogel joined the network to discuss Booking’s incredible second-quarter financial report. The online travel agency, which owns well-known brands such as Priceline, Kayak, and OpenTable, recorded more room night bookings in the three months ended June 20 than in any quarter in 2019 before the pandemic. Total revenues were $4.3 billion, nearly double what they were in the previous quarter, while net income was $857 million, compared to a net loss in the same quarter last year.

Looking ahead, Fogel expects record revenue in the third quarter, and bookings for the final quarter of the year are currently about 15% ahead of the same period in 2019.

We’re bullish on not just Booking but also rivals TripAdvisor Inc (NASDAQ:TRIP) and Expedia (NASDAQ:EXPE), shares of which have recovered their losses, and then some, as gas prices have retreated from all-time highs on June 14.

Shipping Giant Maersk Posts Record Results

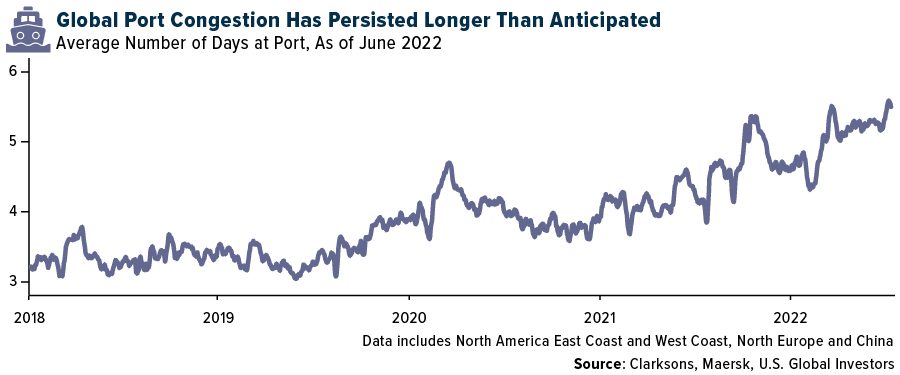

Besides consumers, lower gas costs are beneficial to industries that consume great amounts of petroleum liquid fuels. Those include airlines and shipping container companies, the latter of which is still seeing worsening congestion at ports in North America, Europe and China.

The world’s second-largest shipping company, Moeller-Maersk (OTC:AMKBY), is often seen as a barometer of the global shipping industry, and if that’s the case, Maersk’s second-quarter results should put investors’ minds at ease. The Copenhagen-based company reported a record revenue of $21.7 billion in the June quarter and a net profit of $8.6 billion, also a new quarterly record.

Based on these impressive results, Maersk is raising its guidance for the full year, from $30 billion EBITDA (earnings before interest, taxes, depreciation, and amortization) to $37 billion. It’s also raised its free cash flow (FCF) estimate from $19 billion to “above” $24 billion. Maersk’s Board of Directors is also increasing the company’s share buyback program to $3 billion for the years 2022-2025, up from $2.5 billion earlier.

Some financial news outlets have drawn attention to the fact that Maersk moved 7.4% fewer containers in the second quarter compared to the same quarter last year, but as the company itself points out, this is due to the increasing port congestion, not a meaningful slowdown in demand. According to the Census Bureau, new orders for manufactured durable goods rose to $272.6 billion in June, a 2% increase from May. Shipments of manufactured goods have also been up 13 of the last 14 months as of June.

Disclaimer: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate for every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.