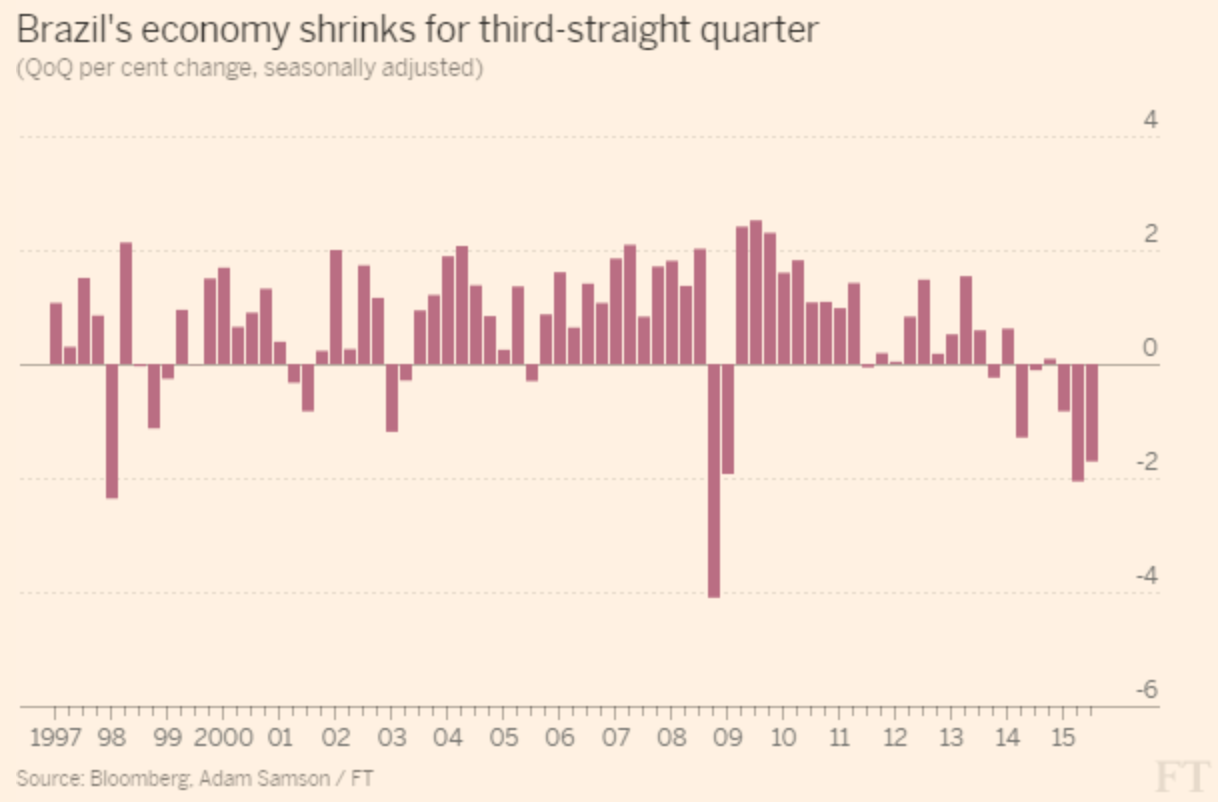

Brazil’s gross domestic product fell by a record 4.5% year-on-year in the third quarter, confirming expectations that Latin America’s largest economy is in for its worst recession since the 1930s.

Source: Financial Times

Brazil’s left-leaning president, Dilma Rousseff, presided over an economy where unemployment rose to 7.9% in September, up from just 4.7% in October of last year, inflation is running at more than 10% for the first time since 2002 and Brazil’s government budget deficit is now at 9.5% of GDP according to the Financial Times.

What Happened to Brazil’s Economy?

Brazil has a rising middle class and, for a resource-rich emerging economy, it also has a substantial domestic consumer market but household consumption fell 1.5% in the third quarter, while services dropped 1%. Weak harvests for coffee, sugarcane, oranges, cotton, wheat, forestry and cattle husbandry contributed to an agriculture sector contracting by 2.4% compared with the previous three months and both industry down 1.3% and investment down 4%.

The trade balance made a positive contribution to growth, the FT said, but this was mostly due to a crash in imports down 20% quarter-on-quarter rather than a large increase in exports, which grew only 1.1%, helped by the weaker real.

Source: Financial Times

Keepin’ It Real

Not surprisingly, the Brazilian real has fallen more than 30% in a year, partly due to the deteriorating economy and partly due to the fall in commodity prices that has undermined all resource exporters.

The fall, though, is worrisome because interest rates are at 15% — usually an incentive for foreigners to buy the currency but with inflation at 9% the net rate is more like 6, still a fall of 30% while interest rates are at 15% — that doesn’t say much for investor confidence in Brazil.

Problems at the Top

Dilma Rousseff’s government seems paralyzed, on the one hand unable to bring themselves to enact the austerity measures needed to help balance the books, and on the other swept up in the country’s biggest corruption scandal in which the state-owned energy company Petrobras (N:PBR) admitted to 6 billion real ($1.6 billion) in losses… so far.

Neither the economy nor the currency is expected to recover anytime soon. Q4 of this year and much of next year could be little better than Q3. Rousseff could be ousted, or resign, making way for a more fiscally sound government to take charge but she could equally cling on to the next election in 2018 although her rating is said to be at an all time low of just 8%.

The only silver lining according to Lee Alston, Ostrom professor at Indiana University and a research associate at the National Bureau of Economic Research, writing in the FT, is that compared to previous crises, particularly corruption scandals, this time those in charge are holding the government to account, especially the judiciary, public attorneys, the TCU and the federal police.

They have investigated, prosecuted and even imprisoned previously untouchable business leaders and politicians involved in corruption. While these changes are not likely to improve the economic situation in the short term, they do hold out hope for the future and will instill confidence in foreign investors that the country is coming of age.