Will the U.S. government’s stalemate over budget negotiations trigger a recession? In “normal” times this question would be dismissed as absurd. But the times they are a changing.

The good news is that the latest numbers still indicate that the U.S. macro trend remains positive. The Capital Spectator reported yesterday, for example, a set of nowcasts point to a moderate growth rate for the fourth-quarter GDP report that’s scheduled for release at the end of this month. But as new estimates of the partial government shutdown’s economic costs remind, the potential for trouble is rising.

The White House Council of Economic Advisers, for example, yesterday raised its estimate of economic damage from the shutdown. The New York Times reports that the Council’s chairman, Kevin Hassett, advised that

the administration now calculates that the shutdown reduces quarterly economic growth by 0.13 percentage points for every week that it lasts — the cumulative effect of lost work from contractors and furloughed federal employees who are not getting paid and who are investing and spending less as a result. That means that the economy has already lost nearly half a percentage point of growth from the four-week shutdown. (Last year, economic growth for the first quarter totaled 2.2 percent.)

It doesn’t take a Ph.D. in economics to realize that the constant chipping away at growth will eventually lead to economic contraction since there’s a finite amount of positive output that can be shaved before GDP change turns negative. Thus the crucial question: When will the shutdown end? At the moment, it’s a guessing game, although the latest headlines imply that the end game isn’t near.

It doesn’t help that going into the shutdown U.S economic growth was already slowing. Most estimates for the Q4 GDP report that’s due on Jan. 30 expect a second straight quarter of deceleration. The Wall Street Journal reports an average 2.6% projection via its survey of economists this month – down from 3.5% in Q3 and the red-hot 4.2% rise in Q2.

It’s a safe bet that the blowback from the shutdown will continue to trim the Q4 estimate, slowly but steadily. Exactly how much, however, is open for debate.

“We have no way of estimating the impact on government contractors, or the second round effects when those businesses fail, or have to delay paying their employees, subcontractors, suppliers, and creditors, but it will not be trivial,” advised Ian Shepherdson, chief economist at Pantheon Macroeconomics Shepherdson in a research note yesterday. “Accordingly, if the shutdown were to last through the whole quarter, we would look for an outright decline in first quarter GDP.”

Compounding the uncertainty is the missing economic reports as key government offices remain shuttered. Although the Bureau of Labor Statistics remains open, the Census Bureau is no longer publishing new data and so last week’s scheduled updates on factory orders, international trade and wholesale trade remain on hiatus. Today’s report on retail sales and tomorrow’s update on housing starts are also expected to be delayed until some future date. The Bureau of Economic Analysis is closed, too, and so it’s unclear if the Q4 GDP report due later this month will see the light of day.

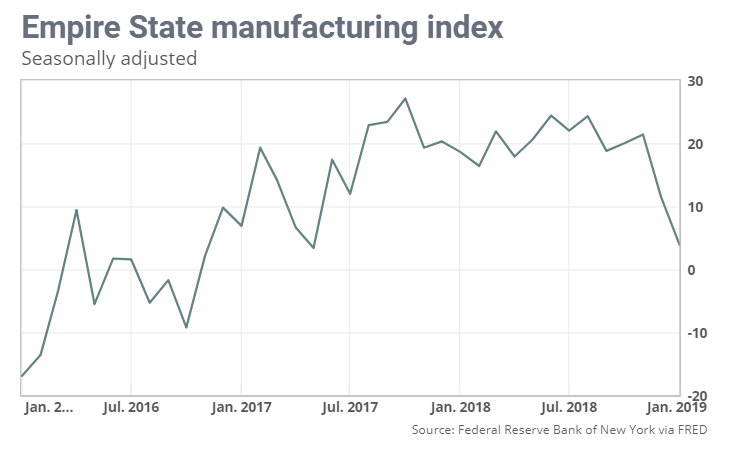

As hard data goes missing, survey estimates of economic activity will become increasingly valuable. On that note, yesterday’s preview for January manufacturing output reflected a sharp slowdown in growth. The New York Empire State Manufacturing Index slumped this month to its lowest point in over a year.

Meanwhile, Redfin reports that the housing market continued to cool in December. According to the real estate brokerage, home sales tumbled by nearly 11% in 2018’s final month, the biggest monthly decline in two years.

It’s premature to read too much into these numbers, but it’s also short-sighted to dismiss the possibility that economic growth is slowing in the new year, for organic as well as political reasons.

Optimists point out that the pinch was slight from the 2013 shut down – a mere 0.3 of a percentage point from GDP. But the shutdown that year lasted only 17 days. The current shuttering is now 25 days and counting and the political signs suggest there’s no end in sight. A second effort in the Senate to reopen the government, for example, was blocked by Republicans on Tuesday. Meanwhile, House Democrats yesterday rejected President Trump’s invitation for negotiations.

“If this self-inflicted wound ends by the end of this month, then we estimate the loss to growth to be about 0.5% in the first quarter. Thus real GDP will increase by 2.0%, rather than 2.5%,” writes Bernard Baumohl at The Economic Outlook Group.

But as the U.S. economy moves deeper into uncharted territory, the uncertainty will rise for even the most carefully crafted estimates for factoring in the impact from Washington’s impasse. As Baumohl reminds, “You can’t model for stupidity.”