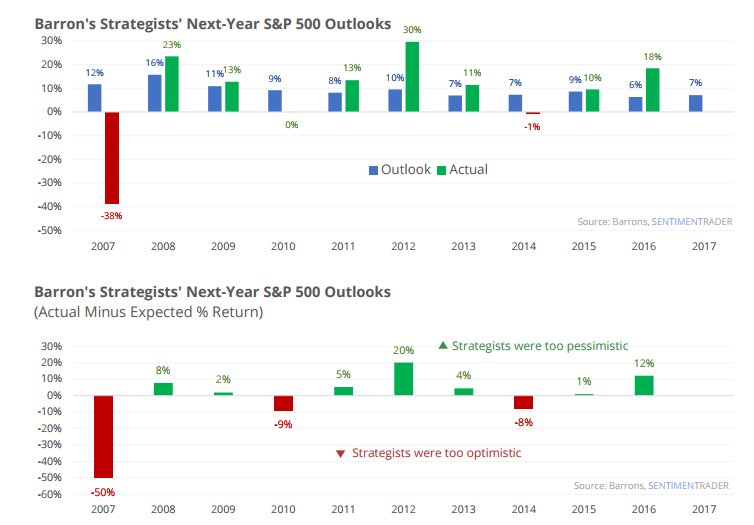

Near the end of each year, Barron’s magazine highlights the outlooks for the next year from 10, or so, Wall Street strategists. As noted recently by Sentiment Trader:

“Strategists are a little more optimistic than the Big Money was, forecasting a gain of around 7% for the S&P 500 in 2018. That’s about how much they thought the S&P would rally in 2017. And 2016. And pretty much every other year. When forecasting, it’s often a good bet just to go with the base rate – the average probability of being positive, or average gain in a random year. For stocks, that’s about a 7% nominal return, with about a 65% probability of showing a gain. Just stick with those, and you’ll have a better record than most. In aggregate, that’s what Wall Street does.”

Of course, 2017, has been a much better than the forecasted year as one of the great triumphs of the Fed’s liquidity-driven policy is that investor’s “animal spirits” finally returned to the investment markets. However, actual results, as Sentiment Trader showed, can vary.

” They overestimated the market’s 2008 return by 50% (!) and underestimated the 2012 return by 20%. Like most outlooks, forecasts, and research pieces, the biggest value isn’t necessarily in the bottom line, but in the thought processes and data used to get there. In those senses, reading through the outlooks can be a great exercise. Using them just for the bottom-line guess at next year’s S&P level is next to worthless as an indicator.”

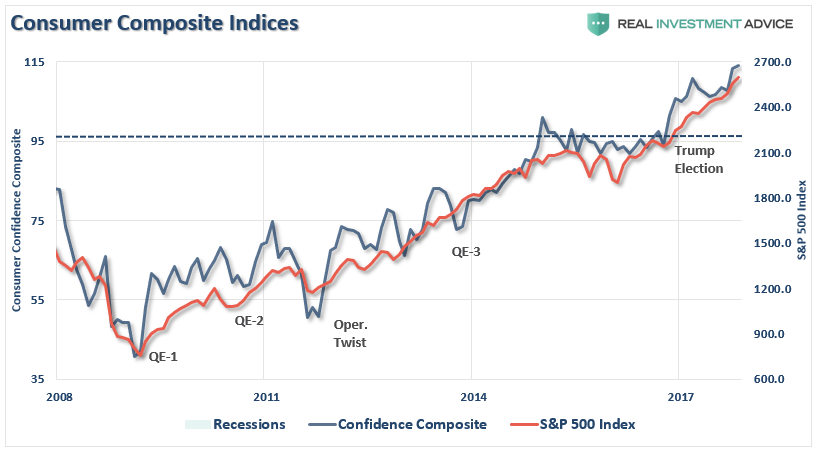

But, with the ongoing massive global Central Bank interventions, as Michael Lebowitz discussed yesterday, it should not be surprising that as markets continue their seemingly unstoppable advance. That advance has ultimately triggered the “greed factor” as shown by surging investor confidence and expectations which have surged to historically high levels. (The chart below is a composite index of both the University of Michigan and Conference Board surveys.)

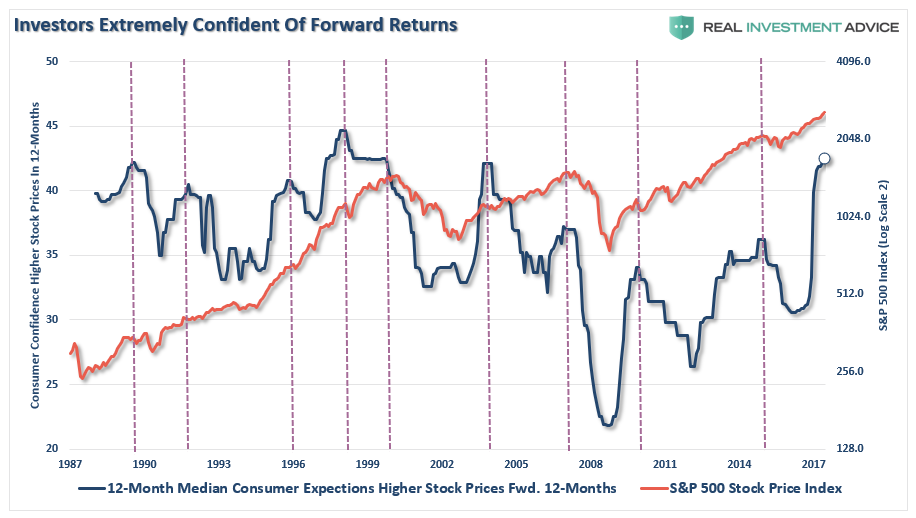

Even the level of individuals believing the financial markets will be higher over the next 12-months has spiked sharply higher in recent months.

However, while Wall Street expects the markets to increase by 7% next year, the long-term historical average, the charts above suggest individuals have bigger aspirations.

How much bigger? A lot!

Schroders Global Investors Study recently surveyed over twenty thousand investors from around the globe to get their expected portfolio returns over the coming 5 years. To wit:

- Investors expect an annual return of 10.2% on their investments over the next five years

- The 2017 survey, which surveyed 22,100 globally who invest, found millennials even more optimistic. Those born between 1982 and 1999 expected their money to make average returns of 11.7% a year between now and 2022.

- Even the Baby Boomer generation is anticipating an above average return of 8.6% a year.

- Breaking it down by generation:

- Millennials (born 1982-1999, aged 18-35): 11.7%

- Generation X (born 1965-1981, aged 36-52): 9.8%

- Baby Boomers (born 1945-1964, aged 53-72): 8.6%

- Silent Generation (born 1923-1944, aged 73+): 8.1%”

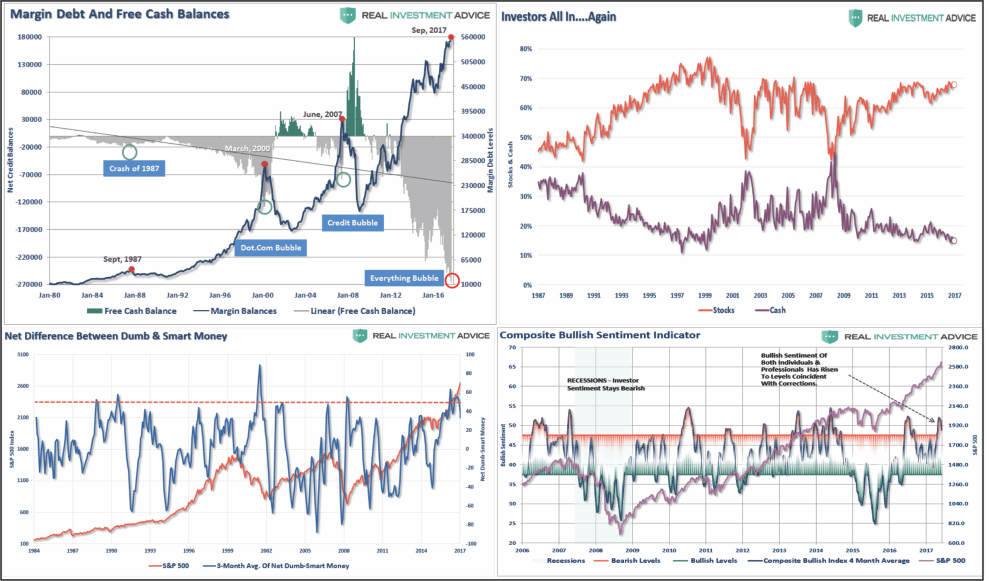

Such levels of optimism may be a bit egregious given the overly optimistic positioning by investors in the market currently as shown.

Add the overly optimistic outlook and positioning to a market that is the most overvalued, overbought, and extended, in the last 20-years and the risk to future returns becomes much more evident.

The reality, of course, is once again investors are setting themselves up for disappointment. The expectations of “compounding returns” of 6, 8 or 10% is a myth that needs to go away. As Richard Rosso wrote recently:

“When it comes to compounding, investors should never suffer torturous time to breakeven. Compound interest works if the rate of interest is consistent, not variable. You wouldn’t know it from stocks, especially this year, but from what I know, stocks are indeed a variable, and occasionally, volatile asset class.

So sorry, Suze. This bit of knowledge? Strike out. Not everything compounds.

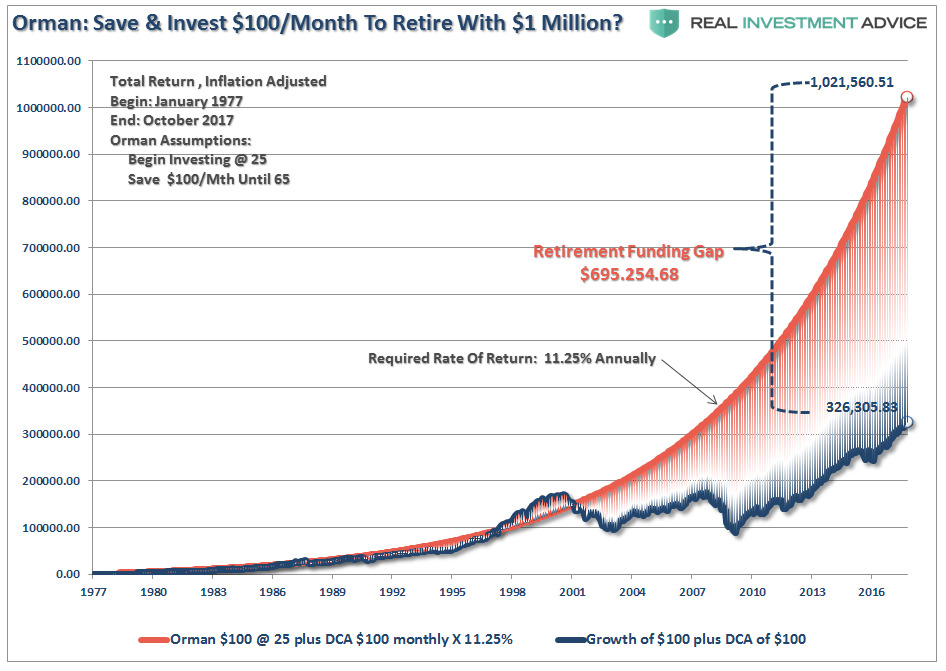

‘Orman explained that if a 25-year-old puts $100 into a Roth IRA each month, they could have $1 million by retirement.’“

“As outlined in the chart above, on an inflation-adjusted basis, achieving a million-buck balance in 40 years by dollar-cost averaging $100 a month, requires a surreal 11.25% annual return. In the real world (not the superstar pundit realm), a blind follower of Suze’s advice would experience a whopping retirement funding gap of $695,254.68.

I don’t know about you, to me, this is a Grand Canyon expectation vs. reality-sized unwelcomed surprise.”

But yet, Millennials are currently hoping for “Orman” type returns.

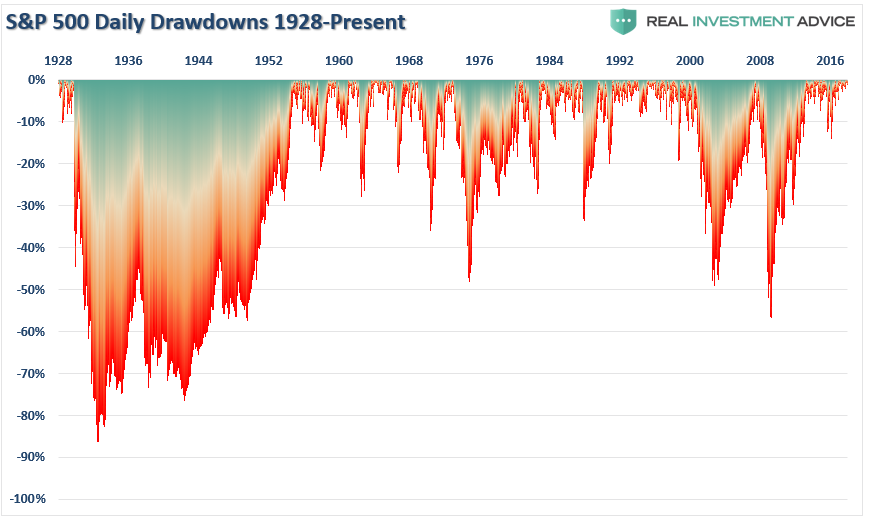

Reality is likely to be extremely disappointing as drawdowns of 10% or more have occurred throughout history with regularity.

Irrational Exuberance

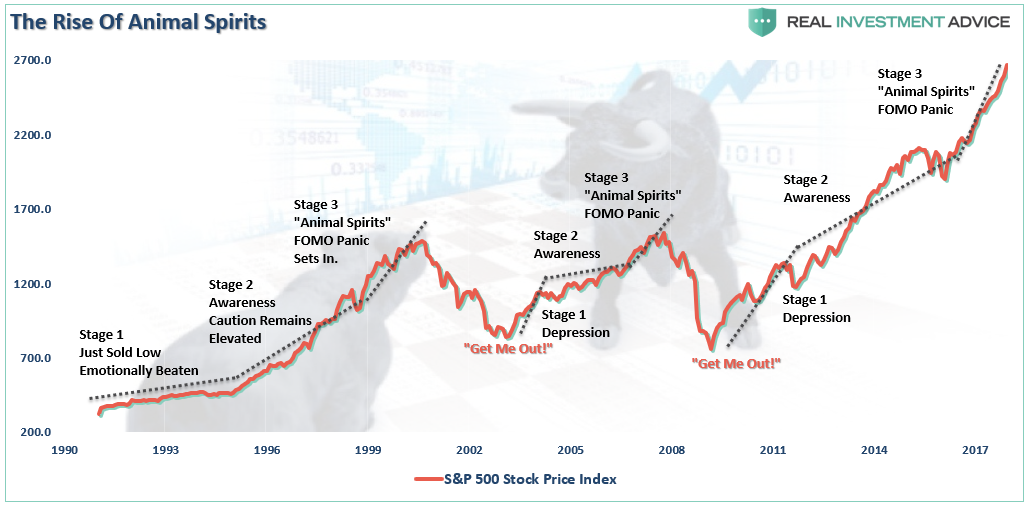

Here’s a little secret, “Animal Spirits” is simply another name for “Irrational Exuberance,” as it is the manifestation of the capitulation of individuals who are suffering from an extreme case of the “FOMO’s” (Fear Of Missing Out). The chart below shows the stages of the previous bull markets and the inflection points of the appearance of “Animal Spirits.”

At the peak of previous bull market advances, the markets have entered into an accelerated phase of price advances.

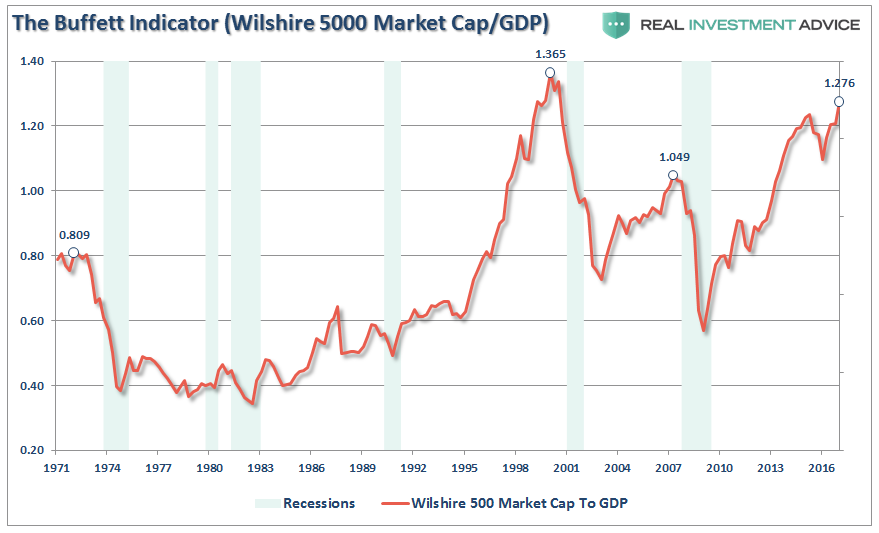

Since “the price you pay day is the value you receive tomorrow,” as famously noted by Warren Buffet, it should not come as a surprise that “value investing” is lagging the “momentum chase” in the market currently. But again, this is something that has historically, and repeatedly occurred, during very late stage bull market advances as the “rationalization” for a “never-ending bull market” is promulgated.

Given the length of the economic expansion, the risk to the “bull market” thesis is an economic slowdown, or contraction, that derails the lofty expectations of continued earnings growth.

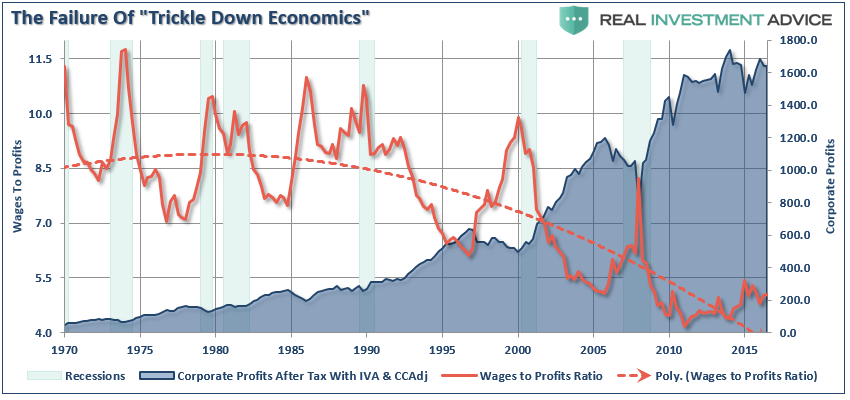

While tax reform legislation may provide a bump to earnings growth in the near-term, it is the longer-term growth rates of the economy that matters. Furthermore, while providing a tax cut to corporations will certainly boost their bottom line, there is little evidence, historically speaking, “trickle-down economics” actually occurs. If it did, wages as a share of corporate profits wouldn’t look like this.

With an economy that is 70% driven by the 90% of the population who don’t benefit from corporate tax cuts, the long-term effects of a deficit and debt busting tax bill should be worrying investors.

But, for now, that is not the case as the rise in “animal spirits” is simply the reflection of the rising delusion of investors who frantically cling to data points which somehow support the notion “this time is different,” a point recently made by Sentiment Trader:

“We’ve discussed a multitude of momentum studies in the past month or two, with an almost universal suggestion that the types of readings we’ve seen this year are rare and hard to bust. This unrelenting bid has been one of, if not THE, most compelling bullish argument, and it shows little sign of stopping.”

But importantly, they always do.

We have seen this before.

There was no catalyst that we know of that burst the dot-com bubble in 2000. There was no catalyst that started the slide in the markets in 2008 until it triggered the Lehman bankruptcy and “all hell broke loose.”

Today, we once again have exuberance present and there is a widespread belief that nothing will stop this runaway train.

But eventually, for whatever reason, the market will top. It is impossible to predict when, or how it will happen. It just most assuredly will, and will do so just as everything seems to be its brightest.

It will be the rudest of awakenings for the slumbering bulls.