The digital economy, last week, wounded yet another retailer.

Shares of GameStop (NYSE:GME) plunged more than 8% as the video game dealer’s holiday sales disappointed. During the all-important holiday period, sales fell 16.4%, due in part to lower in-store traffic.

But there are other factors at work here.

For a handful of years, I’ve been following an emerging trend that’s touched not only my personal life, but also my life as an investor.

I’m talking about the rise of the 'subscription economy.'

To be clear, I’m not referring to magazine, newspaper or newsletter subscriptions, though the basic idea is the same. The subscription economy revolves around online service providers that follow the same approach.

Right now, the companies embracing this trend are absolutely booming.

Taken Apart Brick By Brick

Today, you can buy a subscription for almost any service or product, including video games, which is part of the reason why GameStop had such a bad start to the year.

Essentially, the subscription economy puts the retailer in direct competition with the companies whose products it sells.

In GameStop’s case, it’s now competing with video game makers like Electronic Arts (NASDAQ:EA), which offers monthly subscriptions. These subscriptions grant consumers around-the-clock access to Electronic Arts’ latest and greatest titles.

Microsoft's (NASDAQ:MSFT) Xbox and Sony's (NYSE:SNE) PlayStation also have digital stores where users can buy games directly. Simply tap a few buttons and within minutes, you’re playing a brand-new video game -- all without leaving the house.

The subscription economy cuts out the middle man. And it’s been a boon for business.

In Electronic Arts’ fiscal year 2017 first quarter, net revenue from subscriptions increased 23%. Meanwhile, revenue from full-game downloads increased 15%.

Since 2013, the company’s digital revenue has increased 67%. This year, it’s expected to represent 59% of total revenue.

The fact of the matter is that thanks to subscriptions and growth in digital revenue, Electronic Arts is fast approaching the point where it could be considered an “e-commerce company.” Like a lot of other companies, its reliance on brick-and-mortar is dwindling.

Now, retailers like GameStop must figure out how to survive or risk being left in the dust.

Faster Revenue Growth Than the S&P

Since 2012, subscription economy companies have crushed it. Their revenues are increasing nine times faster than that of the S&P 500. And sales are increasing four times faster than U.S. retail sales.

Of course, alot of this growth is because younger generations have completely embraced it. In fact, 62% of all 18- to 34-year-olds and 56% of all 35- to 44-year-olds subscribe to three or more services.

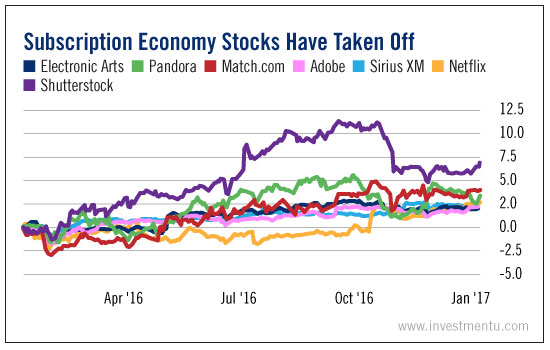

At the forefront are media and entertainment companies like Netflix (NASDAQ:NFLX), Pandora (NYSE:P) and Sirius XM (NASDAQ:SIRI).

And, as I noted last week, there are dating sites like Match.com (NASDAQ:MTCH).

There are professional service companies like Adobe (NASDAQ:ADBE) and Shutterstock (NYSE:SSTK). Adobe switched to a monthly subscription model for its software. Consumers can no longer buy physical copies of popular programs like Photoshop and Illustrator.

After making the change, Adobe’s revenue has increased more than 20%.

As you can see, shares of this small sample of the subscription economy companies performed quite well over the past year.

But the adoption of the subscription economy doesn’t stop there. We’re seeing the shift with enterprise solutions and consumer relationship management companies like Salesforce.com (NYSE:CRM). It’s also happening in cloud cybersecurity companies like Fortinet (NASDAQ:FTNT) and Gigamon (NYSE:GIMO) as well.

The subscription economy is growing quickly. And as younger generations continue to buy into the trend, revenue numbers will continue to grow for companies that caught on early.

Sadly, investors should expect casualties of “old-school” companies to keep piling up.

Good investing.