As we will discuss, the market is deeply oversold and looking for a “dovish” Fed to spark buying. Traders and investors will be laser-focused on the Fed meeting adjourning at 2 pm ET. Of importance, the decision on taper and their characterization of the economic recovery and inflation. If they do elect to announce a taper schedule, the pace of tapering and any caveats that may delay tapering will be of utmost importance.

Like yesterday markets are opening up a half to one percent higher. Will they hold onto the gains, unlike yesterday? The answer likely lies with the Fed at 2 pm.

What To Watch Today

Economy

- 7:00 a.m. ET: MBA Mortgage Applications, week ended September 17 (0.3% during prior week)

- 10:00 a.m. ET: Existing home sales, month-over-month, August (-1.7% expected, 2.0% in July)

- 2:00 p.m. ET: FOMC policy decision

Earnings

Pre-market

- 7:00 a.m. ET: General Mills (NYSE:GIS) is expected to report adjusted earnings of 89 cents per share on revenue of $4.30 billion

Post-market

- 4:10 p.m. ET: KB Home (NYSE:KBH) is expected to report adjusted earnings of $1.62 per share on revenue of $1.57 billion

- 5:05 p.m. ET: BlackBerry (NYSE:BB) is expected to report adjusted losses of 7 cents per share on revenue of $166.80 million

Politics

- President Biden is back in Washington this morning after his speech to the UN General Assembly. He’s still involved remotely in the proceedings and is hosting a virtual COVID-19 Summit with other world leaders today.

- The Centers for Disease Control and Prevention has meetings today and tomorrow to discuss the need for COVID booster shots. Last week, a Food and Drug Administration (FDA) advisory committee recommended boosters for Americans at high risk of falling seriously ill from the coronavirus.

- The Senate may consider a plan to avoid a government shutdown and to raise the debt ceiling. It passed the House of Representatives last night on a party-line vote with Republicans vowing to block it when it reaches the Senate.

Market Deeply Oversold – Looking For Some 'Dovish' Tones

The rolling correction over the last 3-weeks has pushed the market into deeply oversold conditions on a short-term basis. Such provides plenty of “fuel” for a decent rally over the next month or two given some news to spark buying. Today, the Fed could do the trick with Jerome Powell delivering his post-FOMC press conference with a “dovish” tone. With Congress battling over the debt ceiling, the Treasury running out of money, and the risk of a Government “Shutdown” looming, the Fed has all it needs to provide plenty of “caveats” to its “taper” plans.

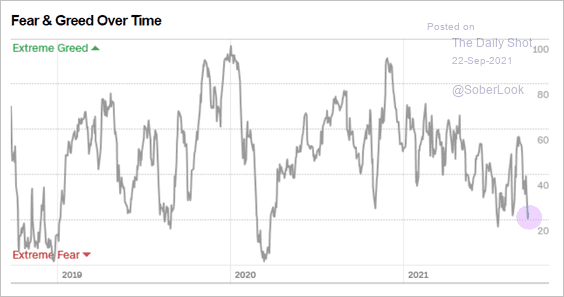

Fear Greed Index Near Lows

Another reason for near-term bullish optimism, is that both the AAII bullish allocation and the “Fear/Greed” index are near their respective lows. Combined with the oversold market conditions, such typically provides a buying catalyst as traders reposition themselves in equity risk.

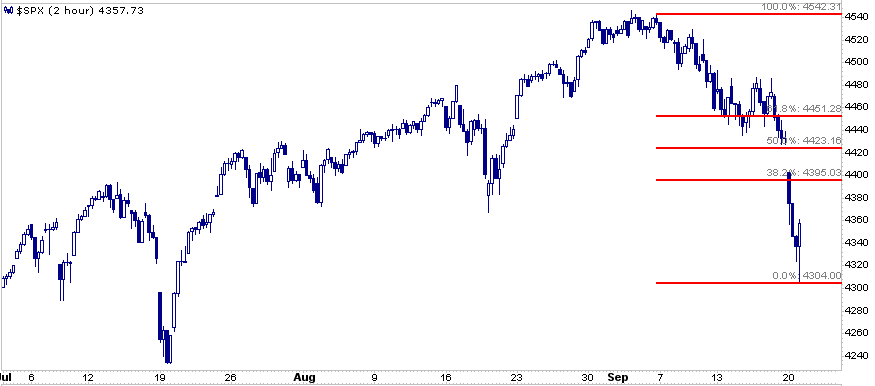

Trading Game Plan for the S&P 500

The markets are trading well. The graph below shows the Fibonacci retracements from the recent high to low. If this rally proves to be a bull trap, it is likely to give up between the 38% retracement (4395) and the 62% retracement (4451). There is also a gap between 4400 and 4430.

It is common for such gaps to fill and then reverse direction. If the market surges higher through the gap and retracement levels, the outlook becomes more bullish. A rally above the 4451 retracement level and well through the 50dma (4436) will likely lead to new highs. Conversely, the 50 dma (4436) may prove to be resistance. The first line of support is yesterday’s lows and the 100dma (4328). A break of the recent low leaves a target of 4106, the 200dma.

Follow Up to Monday Market Mayhem

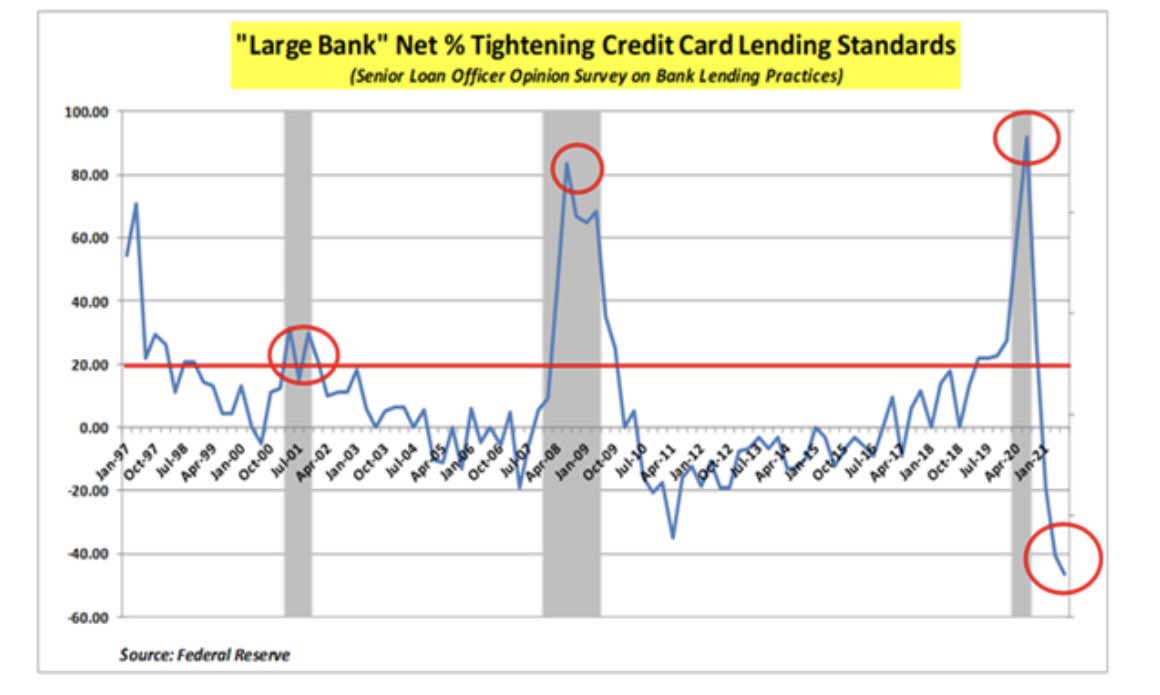

Easy Lending Standards

Employment and inflation tend to get the headlines as far as rationales for the Fed to take action. As we consider what the Fed may do today, we should also consider lending standards. The graph below shows the lending standards for large banks’ credit card customers are as easy as they have been in 20 years. On its own, very easy lending standards, as we have, push the Fed toward a more hawkish stance. Easy borrowing conditions incentivize personal consumption. More consumer activity, especially given current supply line problems, is likely to further agitate inflationary conditions.

Chinas & Evergrande. Will They or Won’t They?

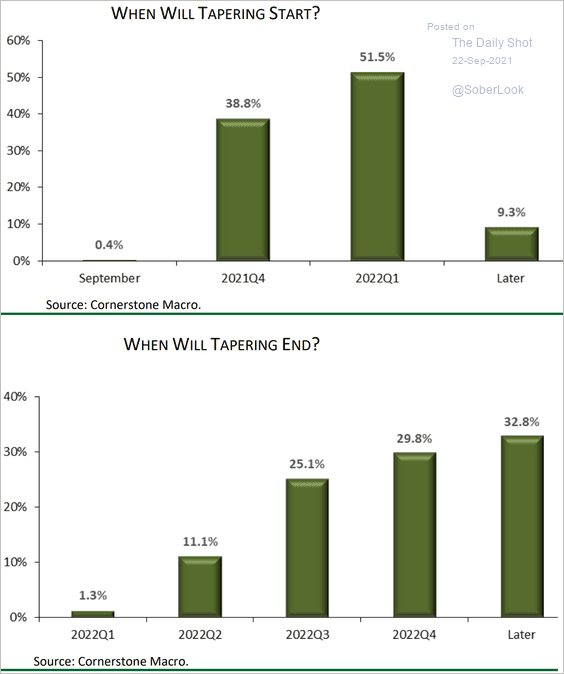

In addition to concerns with China, Evergrande (OTC:EGRNY), and possible contagion, the markets are also grappling with Wednesday’s Fed meeting. In what was likely a purposeful leak last week, the WSJ laid the groundwork for a taper announcement Wednesday and the reduction in asset purchases in November. With the U.S. and foreign markets skidding yesterday some are asking how the Fed might react. In a Bloomberg interview, ex-New York Fed President, Bill Dudley, warns “They’re not going to react to small market moves and defer the tapering on that basis. They have to change their economic forecast,” he said Monday during an interview on Bloomberg Television with Lisa Abramowicz, Tom Keene and Jonathan Ferro (NYSE:FOE) Ferro. “At this point, it’s really premature to reach that conclusion.”