After all the excitement yesterday on confirmation, financial markets do actually have a pulse and that they can actually fall we should see more reserved conditions today.

Whether we are seeing the ‘calm before the storm’ was the question asked yesterday. Remember this is a market that is still so full of complacency, and clearly long equities and short U.S. Treasuries, that the prospect of increased volatility is real, although that proposition still sounds too good to be true, at least for the traders out there. Calmer conditions and leads have been offered for Asia though, and with perhaps the exception of Japan we should see modest upside to the various Asian indices, but there won’t be any real conviction behind the buying.

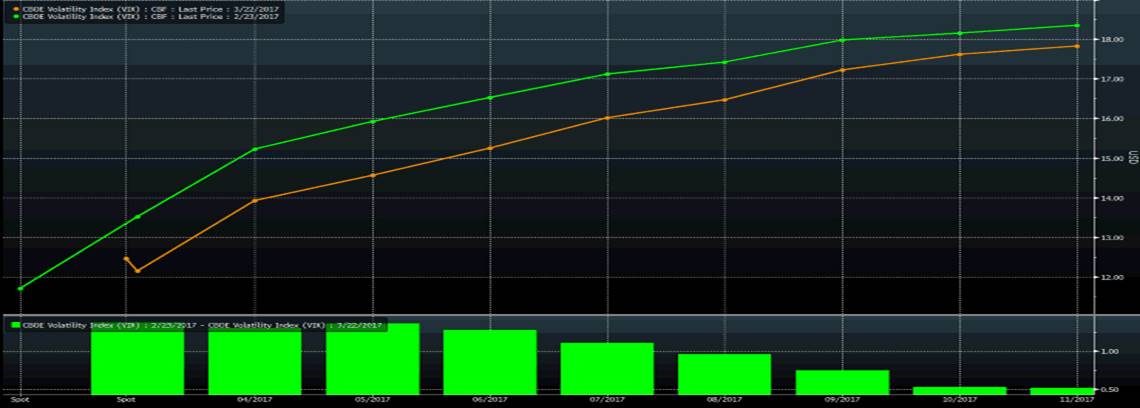

Implied volatility continues to fall out into future months, not rise as some have suggested (current VIX futures curve – orange, VIX futures curve last month – green)

This was thematic yesterday where there so few buyers out there that markets fell under their own weight. Has the overnight session provided any clarity and renewed optimism to wade in? I don’t believe so.

So once again financial strategists become political pundits as we try and assess the probability of House Speaker Paul Ryan’s healthcare plan being passed through the House. We know the Republicans hold 237 of the 430 seats in the House (or 55.1%) and effectively need 216 votes to get the required majority. However, Alyssa Farah, spokesman for the Freedom Caucus, the collective who want Obamacare to be completely torn apart and reworked, has suggested that they have 25 hard ‘no’ votes and Trump and Ryan cannot afford any more than 21. This suggests Trump/Ryan would be four votes shy of the required tally to get the bill over the line, given every Democrat will vote against this bill.

Clearly, the Freedom Caucus want their time in the sun and want to be heard, so this could be the second big loss for President Trump after his immigration order was rejected. This vote then during Asian trade tomorrow will be seen as a proxy for the strength of the mandate that Trump’s has to govern. There is no tax reform without the Ryan healthcare plan voted through, although the likelihood is it will be reworked again and voted on again in the future. So this is a key event risk for tomorrow, and as I mention likely to keep the buyers in Asia at bay.

If we look at other markets to view semantics we can see small buying in U.S. fixed income, with the U.S. 5-Year Treasury falling a couple of basis points to 1.93%, with 5-year ‘real’ yields still just in negative territory. The USD index is largely unchanged but is still holding under the 100 level and while we have seen some buying in the likes of the ZAR and other emerging market currencies the AUD has certainly not fared as well, although is now eyeing a move back into the trading session highs of $0.7691. Small buying has also been seen in high yield credit, with the HYG (NYSE:HYG) gaining 0.3%.

It all suggests calmer conditions from the prior session, but as I mention it’s all about tomorrow and it would be interesting if we actually saw the bill being passed, followed by a strong (February) durables goods data (consensus 1.3%).New York Fed president Bill Dudley speaks at 01:00 AEDT on Saturday morning and if he talks up the prospect of a June Fed hike, given financial conditions are still so accommodative, then things get very interesting. Obviously a lot of hypotheticals, but do we start saying the reflation trade is back on if this scenario plays out? These are fickle markets.

Turning the Asian open, it’s interesting that SPI futures have pushed up 19 points, largely as a function that S&P 500 futures are 8 points, or 0.4% higher from the ASX 200 close. So a number of traders who had positioned for another night of fairly heavy selling have likely closed out of SPI futures shorts.

As far as sector leads go in the S&P 500 the buying really centred on tech, so this won’t really help the ASX 200 too greatly. U.S. Financials and materials are largely unchanged, but BHP’s ADR (American Depository Receipt) is up 0.8%. CBA’s ADR is 0.5%.

Commodity leads are mixed, with spot iron ore falling 3% to $84.99 and the days of calling $100 spot prices seem a distant memory. Iron ore and steel futures (traded on the Dalian exchange) has pulled back 1% and 0.2% respectively. Gold is modestly high, as is U.S. crude, which is actually around 20c higher from the ASX 200 close, despite a 4.95 million barrel increase in the weekly (official) inventory data. The offset being a sizeable draw in gasoline inventories of 2.81 million.