Long-term Treasuries are throwing caution to the wind this week - or more appropriately, seeding caution to the wind, with strong follow-up strength into Friday morning's US jobs report. And as much as anticipating a short-term prospective catalyst is a murky Game of Unknowns endeavor to trade on, we still like the risk profile over the intermediate-term from the short side of long-term Treasuries.

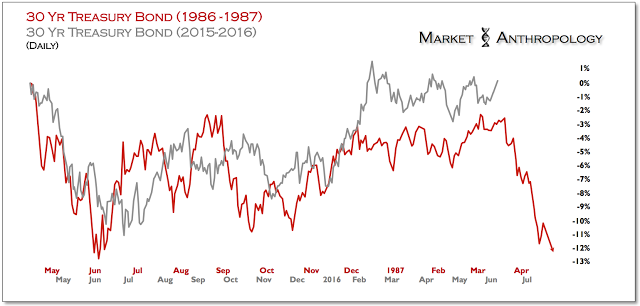

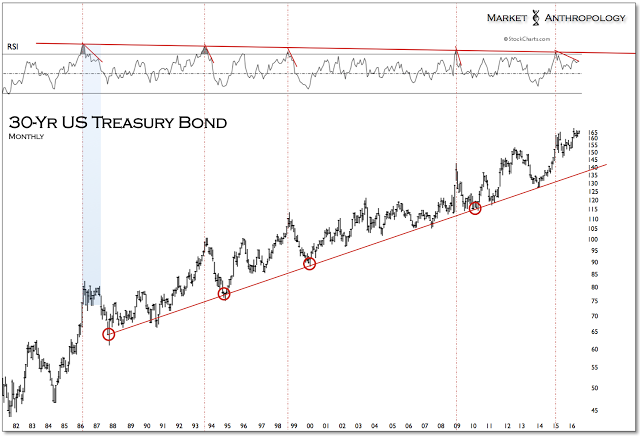

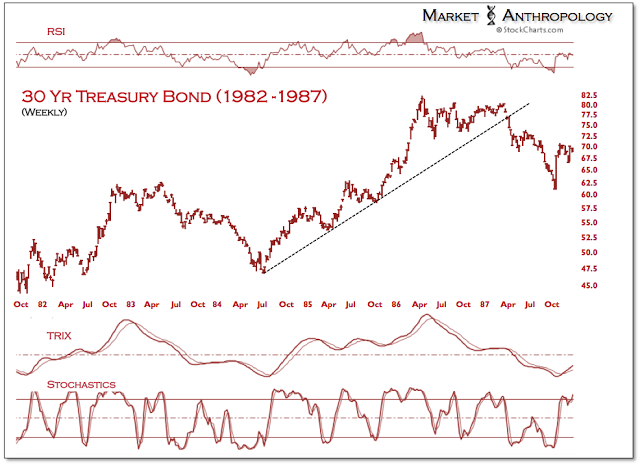

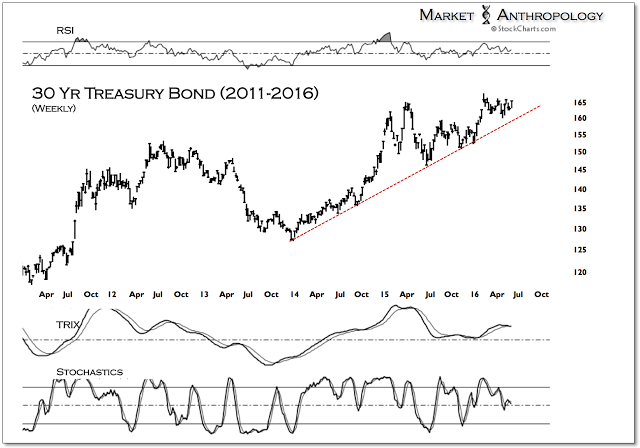

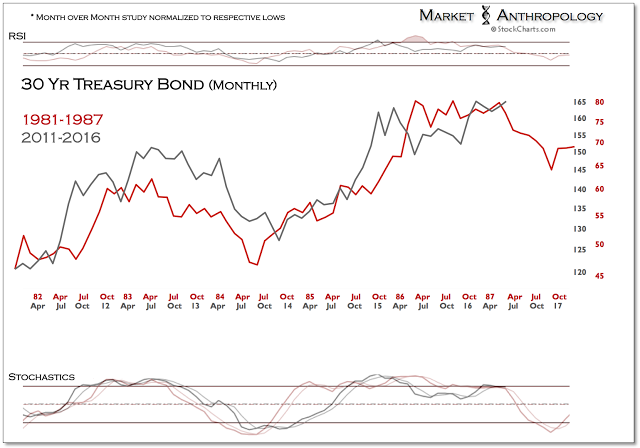

As outlined in a note a few weeks back, long-term Treasuries have been trading in a broad descending range from their February highs that in the past has presaged a subsequent trend shift lower. Coupled with our historical study of how a similar disinflationary market environment exhausted and reversed course, the jobs report appears near a coincident comparative pivot.

From our perspective, a short in long-term Treasuries (30 Year or iShares 20+ Year Treasury Bond (NYSE:TLT)) is asymmetrically defined by the upside risk (<2%) above the previous highs this February and a prospective breakdown below support extending from the lows from late December 2013. While we don't trade futures, we do like the ProShares UltraShort 20+ Year Treasury (NYSE:TBT), that is again revisiting levels around $35.60.