Attention has turned to what extra gems of information might be contained in the release of the FOMC’s January 2019 minutes about the future path of policy. Comments have focused on the Fed’s balance sheet, the consequences of its runoff for financial markets, and what the Fed’s policies might be going forward in terms of balance sheet size and rollover. Financial markets have inferred that the runoff of the Fed’s balance sheet has negatively impacted risk-taking incentives, but that inference is largely mistaken and misses the forest for the trees. Indeed, the minutes state that “Participants noted that the ongoing reduction in the Federal Reserve’s asset holdings had proceeded smoothly for more than a year, with no significant effects on financial markets.”

The early portion of the minutes focused on how to better communicate what the FOMC’s intentions are with regard to the size of its balance sheet. The Committee suggested that it will pursue a multipart process to communicate how it will proceed. The first step was a “Statement Regarding Monetary Policy Implementation” in which it revised previous guidance. The statement made two points. First, it indicated that, going forward, the Committee will continue to operate its floor system (without calling it such) of administered rates, which will require an ample supply of excess reserves. The Committee will not be returning to the pre-crisis process of affecting rates by managing the scarce supply of reserves. What this says is that the Fed will now go forward with a larger balance sheet - a path determined by the amount of currency in circulation, reserve deposits held by governmental and foreign entities, and a larger cushion (as yet unspecified) of bank reserves. That is, the Desk will set interest rates directly rather than indirectly controlling rates by manipulating the outstanding supply of reserves. The second part of the statement indicates that that the Committee stands ready to adjust its path to normalization depending upon economic and financial developments (read: incoming data).

Support for the first point in this policy clarification was actually contained in an earlier segment of the minutes summarizing the Open Market staff briefing on long-run policy frameworks for implementing policy. That briefing argued that the recent experience with what is called the floor system worked out well without the need to manage the amount of outstanding reserves and stated that “The current regime was therefore effective both in providing control of the policy rate and in ensuring transmission of the policy stance to other rates and broader financial markets.” The exact size of this buffer of reserves was not specified, and it was only hinted that the size limit would be reached sometime later this year. Interestingly, there was another piece of information about how the size of the reserve buffer would be managed. That process rests on the often not understood fact that the volume of reserves outstanding does not depend upon bank behavior, including banks’ willingness to hold reserves, but instead is totally under the control of the Fed. To that end, the staff suggested that, over time, as currency demand and other holdings of deposits at the Fed increased with growth in the economy, the constant reserve component would continue to shrink as a proportion of the total size of the Fed’s portfolio.

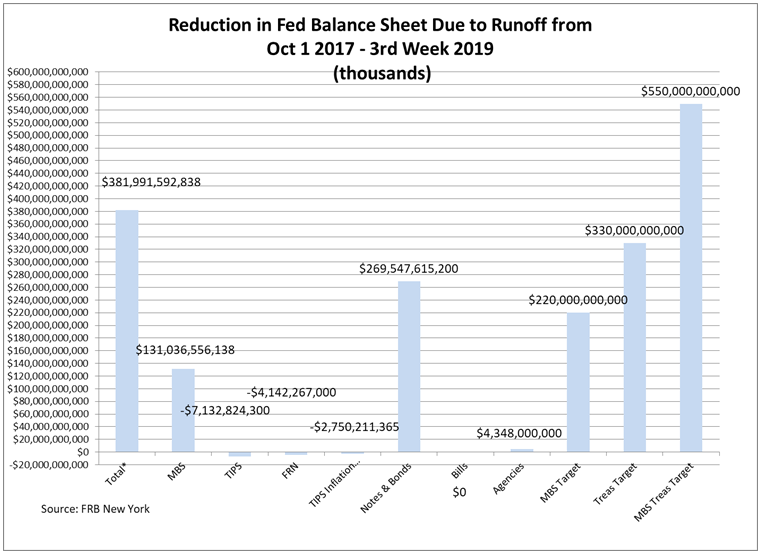

As a last point, it is worth addressing again what the shrinkage of the Fed’s portfolio means to financial markets relative to Treasury debt issuance. The following chart shows the current changes in the size of the balance sheet relative to the Committee’s target of $550 billion, as of the third week in January 2019. Both Treasury and MBS runoff is below target, with the maturing MBS far behind, due in no small part to slower than anticipated pay downs. In total the portfolio has declined by $382 billion, somewhat below the $550 billion target. So, in actuality, the balance sheet shrinkage is below what was planned and announced. Against this evidence is what the Treasury has been doing with regard to debt issuance in response to a growing deficit and outstanding debt of some $22 trillion. Since the Fed started its balance sheet reduction in October 2017, Treasury debt held by the public has increased by a net $1.5 trillion. Moreover, since the Fed’s holdings count as debt held by the public, the Treasury has more than offset the decline in the Fed’s portfolio. In fact, the dominant force affecting financial markets has been the increase in Treasury debt supply (and not the shrinkage in the Fed’s portfolio), combined with recent declines in foreign holdings of US debt.

As for the endgame size of the Fed’s portfolio, we estimate that currency demand would support a balance sheet at about $2.5 trillion by early 2022. To this would be added liabilities reflecting reserves supporting the reserve repo process, US Treasury holdings, and other deposits at the Fed that presently total about $1 trillion, suggesting a balance sheet of about $3.6 trillion, which is not far off from its present size of $4.1 trillion (as of February 6, 2019).