With the search for yield, low interest rate environment, and central bank asset purchase programs it’s a question worth asking.

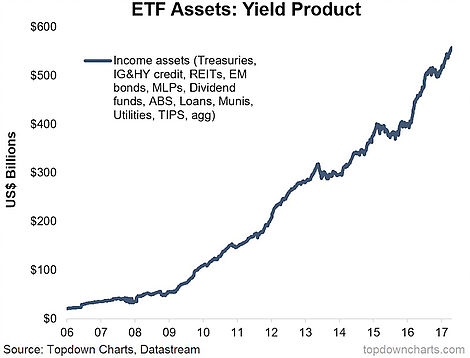

Taking one step to answer this question I turned my attention toward the burgeoning ETF market. The chart below, which appeared in the Weekly Macro Themes report, shows the total amount of assets under management in income related ETFs.

The punchline is that income oriented ETF assets under management (AUM) has ballooned to more than half a trillion dollars. Here’s a look at the growth over the past 10 years… So is a bubble in income assets brewing?

I’ve taken a fairly broad-brush approach in classifying these, and included everything from the traditional government bond ETFs through to high yield credit, EM bonds, loan funds, and even the more equity-like but income-focused REITs, MLPs, and Utilities.

To be fair even though the figure has grown more than 10x in the last 10 years, it is actually quite small given the global bond market is worth in excess of $80trillion, but it is still sizable. Another thing is that you should perhaps expect a structurally higher demand for income assets as baby boomers retire and look to their investments to generate income, but there’s almost certainly a cyclical aspect to it too.

What’s worth noting is the various risks embedded within the diverse range of products I included in the chart – they are all income generating and income-focused to a greater or lesser extent, but they are all quite different. For instance some will be exposed to commodity prices, inflation, equity beta, pre-payment risk, liquidity risk, default risk, property prices, etc. And in a downturn where bonds usually perform well, the return experience could end up quite different from the traditional risk/return profile…

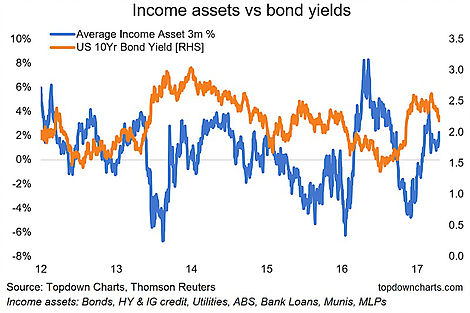

There’s also the matter of plain old duration or interest rate risk.

When we had the global reflation trade running in earnest last year (or the Trump Tantrum as some call it) bond yields spiked and losses mounted across income assets, as the chart above shows.

Whether it’s a bubble or not, the level of risk in this booming group of asset classes is real, diverse and complex to manage. A lot of investors may be surprised when their income generating asset gives them more (or less!) than they bargained for. And with ETF AUM in this group of asset classes going from really nothing during the GFC to a more substantial amount, the next downturn will also present a unique set of challenges to the ETF market itself.