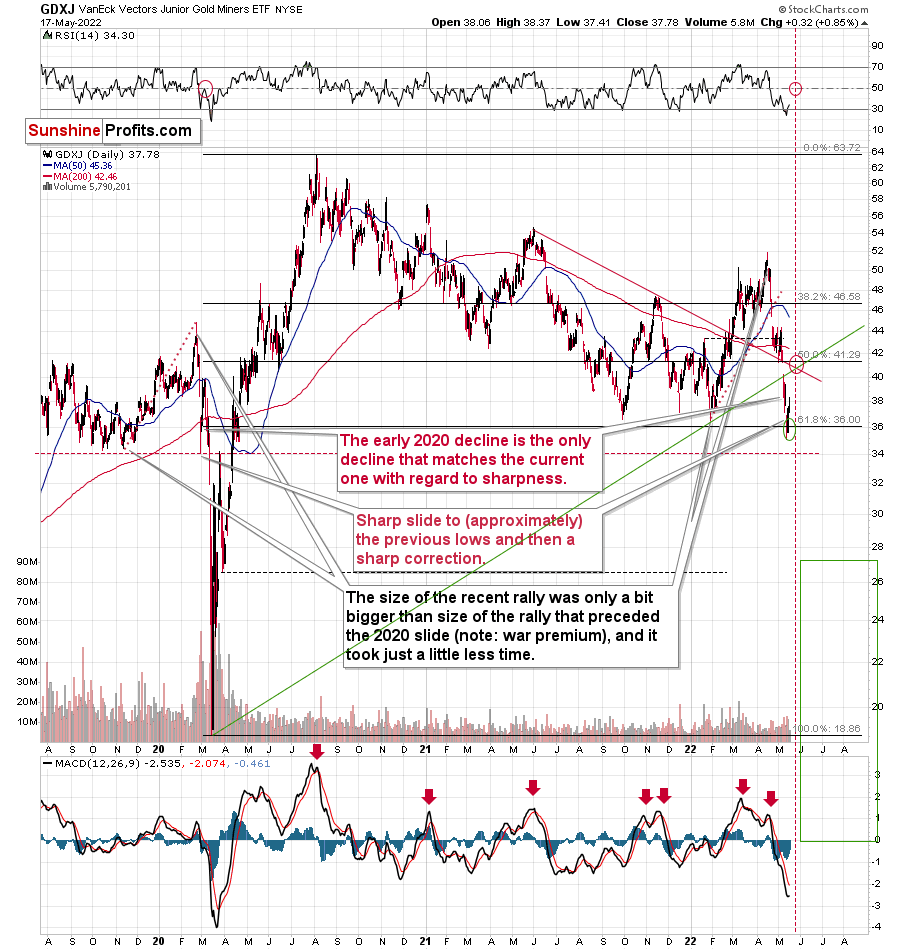

Junior miners are rallying “slowly but surely,” which means that once again practically everything that I wrote on Monday and yesterday either happened in tune with that or it remains up-to-date; and thus, today’s technical part will be rather brief.

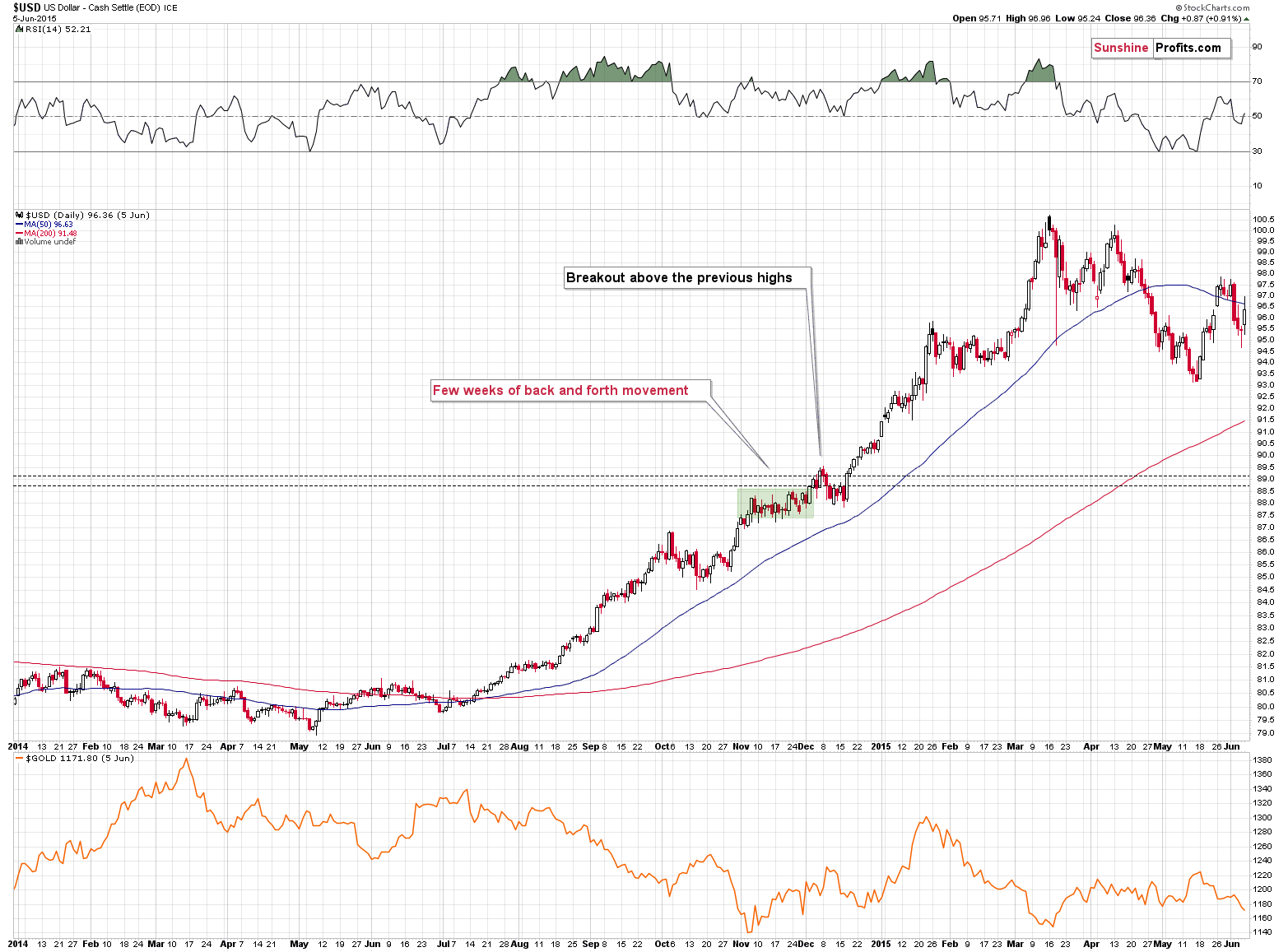

Let’s start with what I ended yesterday’s analysis with—the USD Index.

I previously wrote the following:

The higher of the recent highs is at 103.96 right now, so if the analogy to 2014 is to remain intact, the USD Index could now top at close to 104.5 or even 105.

That’s exactly what happened recently. On Thursday, the USD Index moved to 104.96, and in Friday’s trading it rallied above 105 (to 105.065) and it invalidated the breakout above this level - which is in perfect tune with what I wrote above. Consequently, it seems that we could now see a move to about 103-103.5, after which USD’s rally could continue.

The opposite is likely to take place in the precious metals sector. Gold, silver, and mining stocks are likely to rally in the near term, and then – after topping at higher levels – their decline would continue.

The USD Index futures moved to about 103.7 in today’s [May 17] pre-market trading (so far), so you might be wondering if the bottom is in or about to be, and therefore, will gold stop rallying.

Please note that it’s possible that the USD Index bottoms shortly in the 103-103.5 range but then continues to trade sideways for a few days, while gold continues to rally. In fact, that’s what happened in late 2014. Consequently, what we’ve seen so far today doesn’t imply that gold’s, silver’s, or miners’ rallies are over.

After moving to 103.245, the USD Index futures moved back up, which is in perfect tune with what happened in late 2014, when the USD Index was correcting a breakout above the previous two important highs.

Therefore, it’s quite likely that after a few-day-long pause, the USD Index will rally once again. This means that the precious metals market still has room to rally in the next several days.

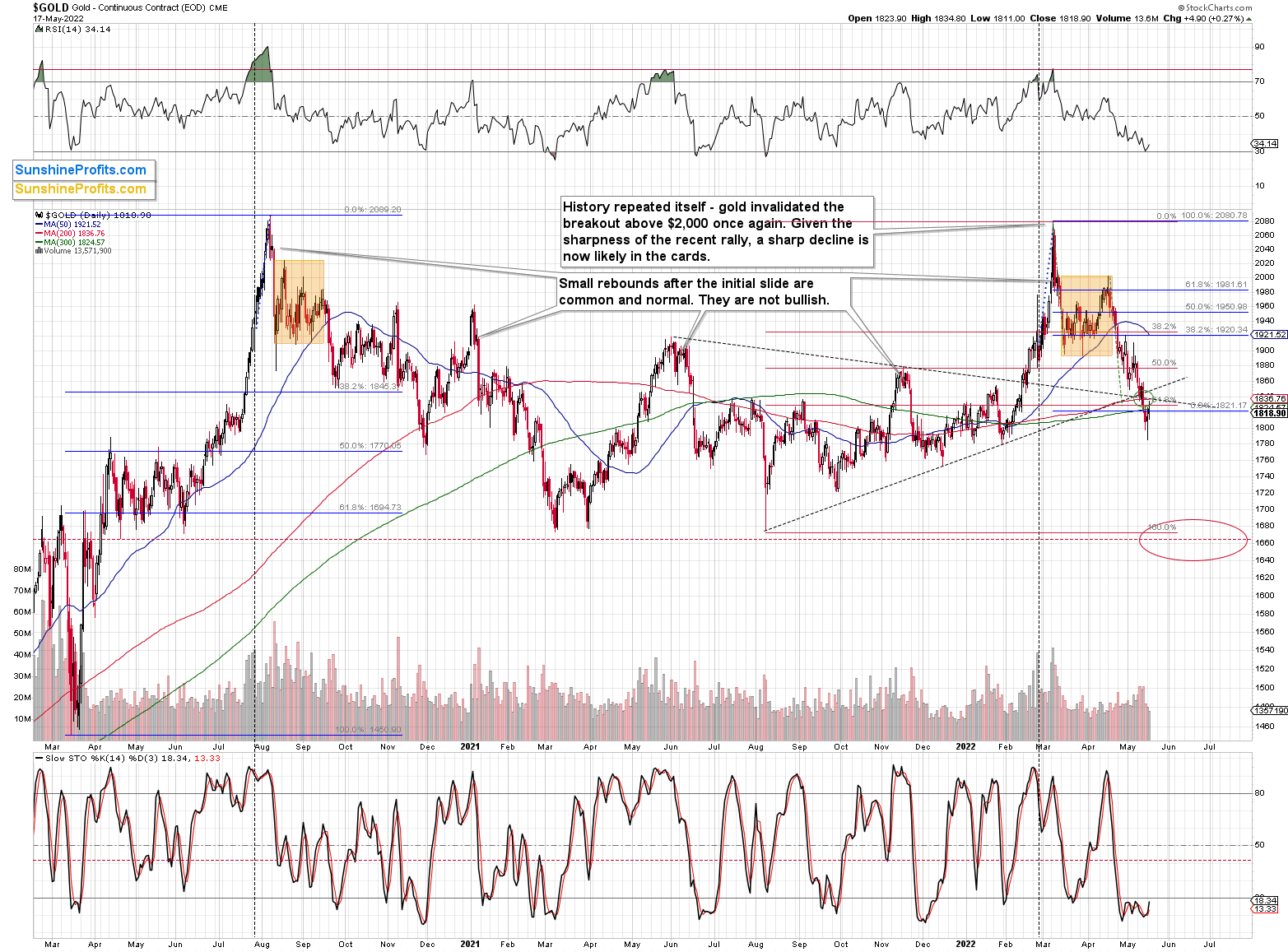

In yesterday’s trading, gold futures were up by less than $5 (0.27%), so it’s nothing special, but it’s a “notable nothing” as gold didn’t return to its previous decline mode.

In other words, my previous comments on gold remain up-to-date:

In short, gold reversed yesterday’s decline after almost touching its previous 2022 lows, and at the same time, it practically erased the entire war-tension-based rally—just like it was supposed to.

Gold ended the day only $5.80 higher, but the important thing is that it reversed at all. Gold’s RSI also bounced off the 30 level, which can be viewed as a buy signal on its own.

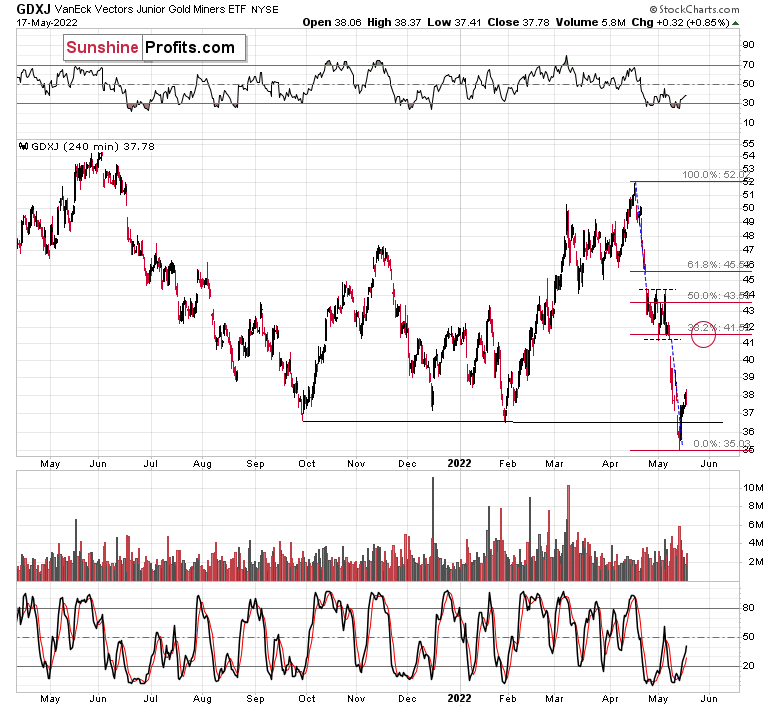

While gold was up by 0.27% yesterday, GDX was up by 0.19%, and GDXJ was up by 0.85%. It seems that we’re using the right proxy for making money on the rebound as it’s moving up most visibly. No wonder—it’s been the most oversold.

Of course, there will be some back-and-forth movement on an intraday basis, but it doesn’t change anything. Junior miners are likely to rally this week, nonetheless. And perhaps not longer than that, as the next triangle-vertex-based reversal is just around the corner—on Friday/Monday.

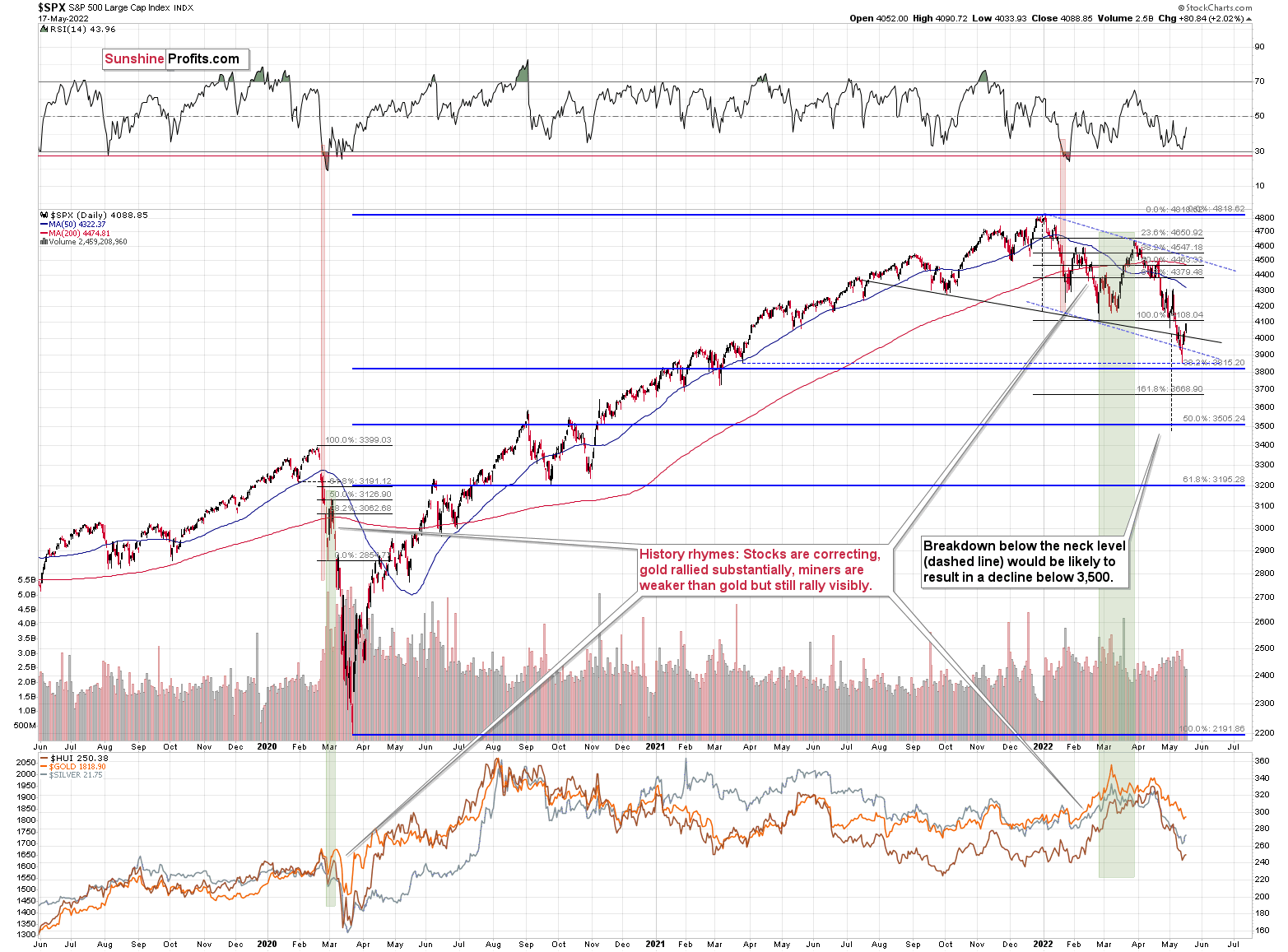

Meanwhile, the S&P 500 Index has clearly invalidated its head-and-shoulders pattern in terms of the daily closing prices, which is a buy signal on its own.

This means that the odds of a short-term rally in the following days have greatly increased. This makes the current long position in junior mining stocks even more justified and it is likely that profits on it will increase shortly.