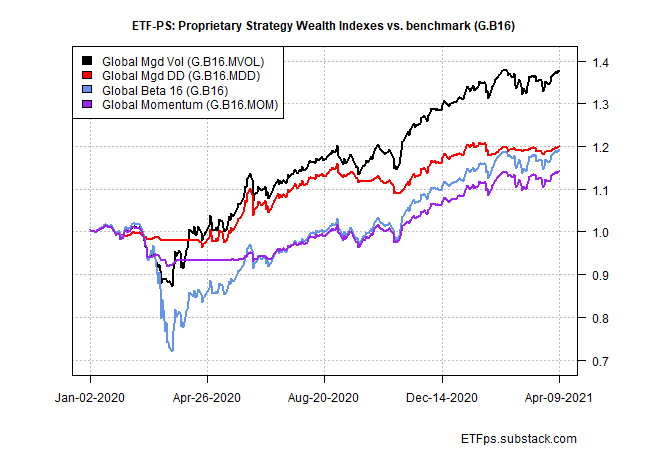

Keeping up with the benchmark remains challenging for our proprietary strategies this year. Beta, in other words, is still red hot at the start of the third quarter.

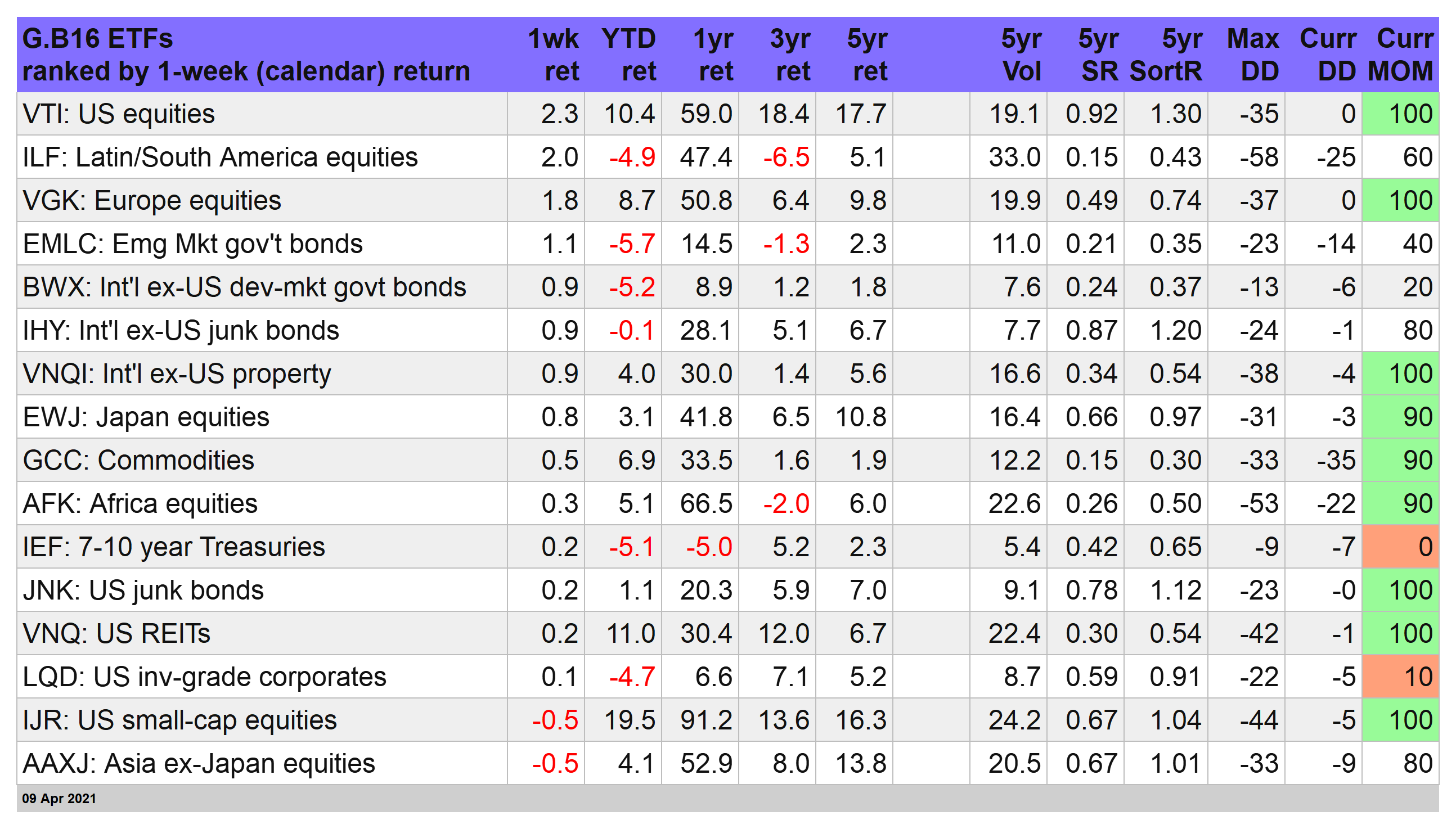

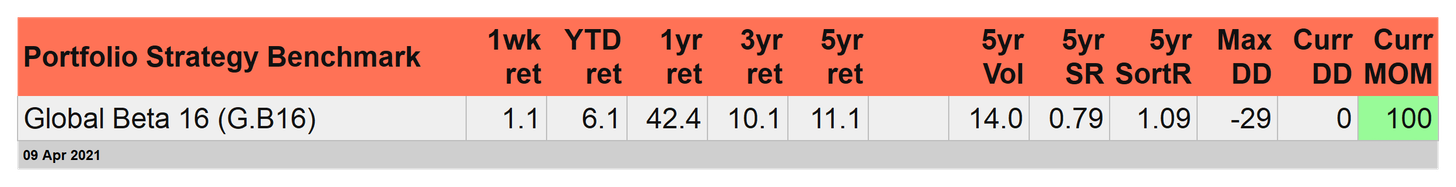

Although there were solid, across-the-board gains last week for the prop portfolio, a passive mix of the 16-fund opportunity set led the field…again: Global Beta 16 (G.B16), rose 1.1% for the five trading days through Apr. 9.

The portfolio benchmark is also the top performer for year-to-date with a 6.1% return. Factoring in risk, however, is another story.

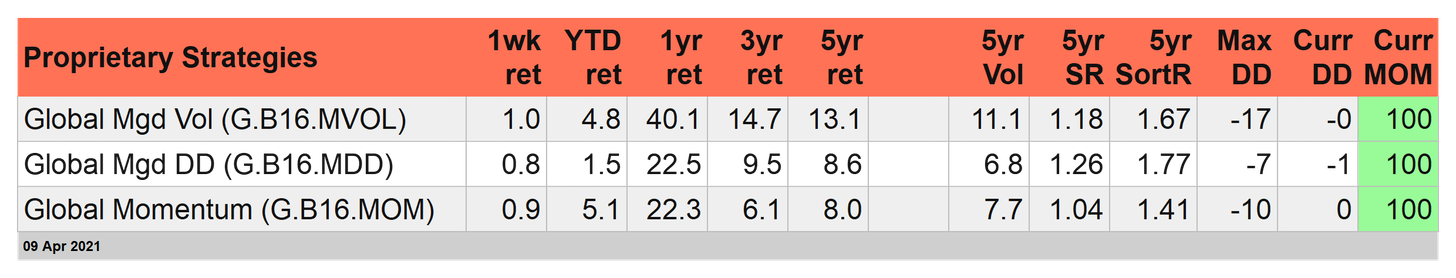

For the trailing five-year period, G.B16 is in last place for Sharpe and Sortino ratios relative to the proprietary strategies. Unless G.B16 is on track to outperform by a significantly wider margin in the months ahead (unlikely), the benchmark’s risk-adjusted results will remain relatively weak.

Global Managed Volatility (G.B16.MVOL) came closest to besting G.B16 last week. The strategy earned 1.0%, fractionally behind G.B16’s 1.1% five-day rally.

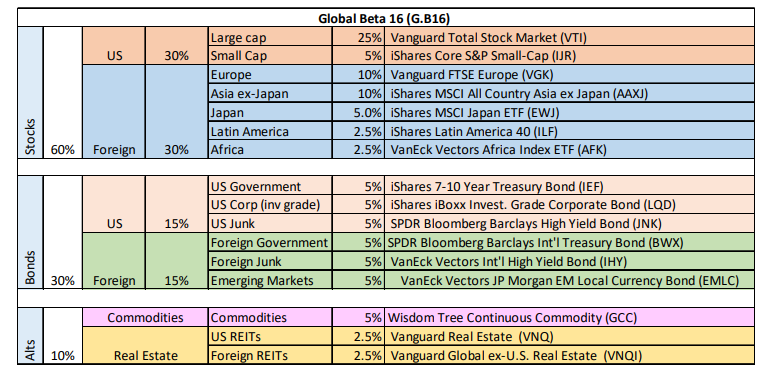

Keep in mind that all three prop strategies use the same 16-fund opportunity set as the G.B16 benchmark—see the allocation table at the end of this article. The difference is how those 16 funds are managed re: risk-on/risk-off. For details on strategy rules and risk metrics in the tables below, please see this summary.

Global Managed Drawdown (G.B16.MDD) is the weakest performer in terms of raw performance this year relative to the other two prop strategies and the G.B16 benchmark. With a modest 1.5% gain so far in 2021, G.B16.MDD has a lot of catching up to do.

The strategy may narrow the performance gap after a new rebalancing signal at last week’s close that reflects a more aggressive risk-on profile. More than half of G.B16.MDD’s funds are now risk-on after last week’s trading activity (see table below). As a result, the strategy is positioned with the most aggressive risk posture since mid-February.

Meanwhile, G.B16.MVOL continues to be fully risk-on and G.B16.MOM is moderately biased toward risk-on, as shown below.

All three prop strategies and the G.B16 benchmark edged into record territory last week, suggesting that the bull run still will continue. Supporting the optimism, at least from a US perspective: expectations that the economic rebound will accelerate in the second quarter.

“What we’re seeing now is really an economy that seems to be at an inflection point,” Federal Reserve Chair Jerome Powell said in a “60 Minutes” TV interview that will air Sunday evening. “We feel like we’re at a place where the economy’s about to start growing much more quickly and job creation coming in much more quickly.”

He added that as economic risk fades, the main macro threat is pandemic blowback. “So the principal risk to our economy right now really is that the disease would spread again. It’s going to be smart if people can continue to socially distance and wear masks.”