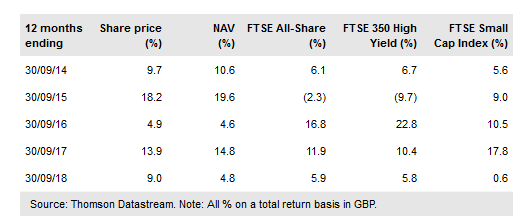

Diverse Income Trust PLC (LON:DIVI) aims to generate a good and increasing level of income, as well as capital gains over the long term. It primarily invests in UK equities, across the market capitalisation spectrum, seeking companies that are underappreciated by the market and able to generate productivity gains, which in turn underpin future dividends growth. The trust has around two-thirds of its holdings in companies outside of the FTSE 350 index, and is relatively lowly correlated with mainstream UK indices. DIVI has a solid medium- and long-term performance track record with a total return of c 14% pa when both the NAV and dividend income are included, over the period since inception in April 2011 to end-September 2018. UK equities remain out of favour ahead of Brexit and volatility has increased. This combination is presenting greater opportunity to add value, according to the managers Gervais Williams and Martin Turner.

Investment strategy: Disciplined and risk-aware

DIVI is not constrained by benchmarks and has a wide investment opportunity set from which to select stocks. It has a bottom-up approach and a disciplined investment process to build a diversified portfolio of around 150 stocks. The managers are sensitive to the preservation of shareholders’ capital. A FTSE 100 put option covering around 40% of the portfolio should help protect against a sharp fall in mainstream UK equities and, in that event, allow DIVI the agility to take advantage of investment opportunities.

To read the entire report Please click on the pdf File Below.