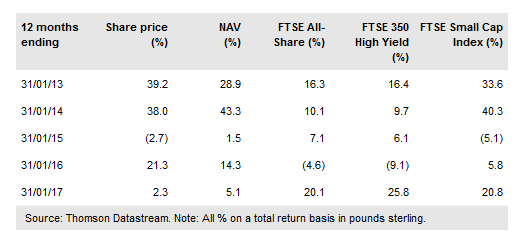

Diverse Inc (LON:DIVI) invests in UK stocks from across the market cap spectrum that have strong prospects for sustainable dividend growth. This all-cap income generating strategy was developed by Gervais Williams and Martin Turner of Miton Asset Management. The c 145 stock portfolio provides a broad spread of investments and has a strong bias towards dividend-growing smaller companies. In terms of NAV total return, the trust has generated +125% over five years, ranking it second in its 23-strong peer group (the Association of Investment Companies’ UK Equity Income sector). Since launch, DIVI’s annual dividend has grown from 2.0p in FY12 to 2.8p in FY16 and it has built a substantial revenue reserve.

Investment strategy: To unearth hidden value

DIVI’s managers hold a diverse portfolio of stocks) that exhibit strong potential for sustainable dividend growth. The aim is to purchase such stocks when overlooked by the rest of the market. Currently these opportunities are seen to be most prevalent among small companies, not simply due to there being many more companies from which to choose (c 1,250), but also because of the lack of sell-side analyst coverage, which makes the market less efficient and presents opportunities for those with the expertise to do their own research. Whereas most UK equity funds invest primarily in the UK’s largest 350 companies by market cap, DIVI’s investments include a significant allocation to small caps and AIM stocks.

To read the entire report Please click on the pdf File Below