“Real protection means teaching children to manage risks on their own, not shielding them from every hazard.” ― Wendy Mogel, The Blessing of a Skinned Knee

In the five weeks from February 19 to March 26, 2020, the S&P 500 fell 33.9%. Because of all the bizarre things we have seen since then, that seems like such a long time ago. Despite serious questions about how quickly the economy will ultimately rebound from the global shutdown, investors are pricing the stock and bond markets for perfection. Many individual stocks sit at new all-time highs, and credit spreads are tighter today than before the COVID-19 outbreak.

Meanwhile, Treasury yields have fallen to levels well below those seen before the pandemic. Mortgage rates for a 30-year term are below 3.00%. Eerily, equity volatility remains quite elevated suggestive of investor anxiety and illiquidity.

As investors, we tend to draw conclusions based on market behavior. When Treasury yields fall, for example, it is not unreasonable to think it portends undetected economic weakness. If credit spreads tighten, it is plausible to believe that the cause is strengthening corporate revenue and earnings.

What if, however, signals are misleading as described above? What if the market’s traffic lights are green and red at the same time? Dare we ask: what happens when good economics become bad?

The Visible Hand

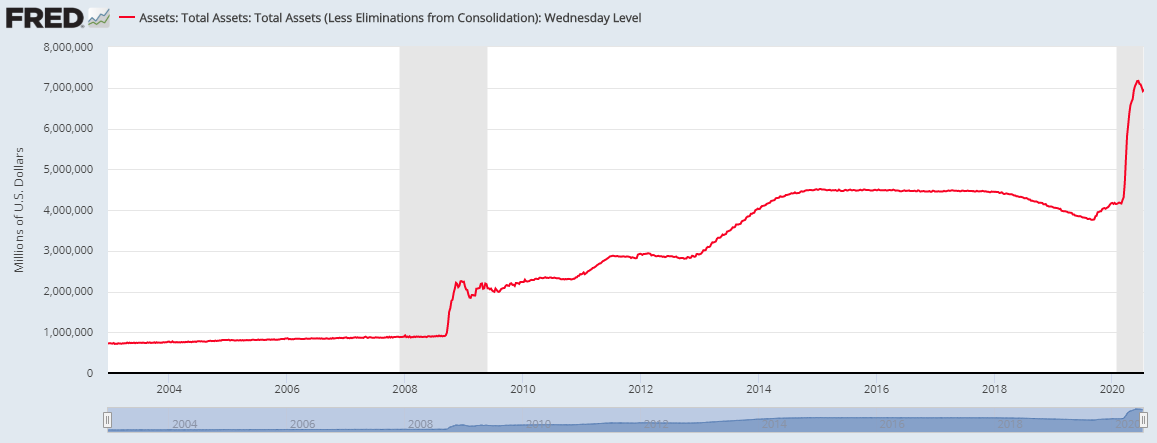

Beginning in February, the Federal Reserve (Fed) initiated several policy programs resulting in a massive surge of their balance sheet. In just 13 weeks, the Fed provided over $3 trillion of liquidity to financial markets. The Fed’s efforts in 2008 pale in comparison.

While such a policy did not forestall a recession, the objective is clearly to mitigate damage in risky asset markets. Actions of this sort are becoming increasingly routine for frightened policymakers. In the name of expedience, they aim to “rescue” financial markets.

On the other hand, in Congressional testimony (those with whom oversight of the Fed resides) and in media appearances, Fed members apply vacuous counter-factual arguments. “Had we not taken forceful action, things would be much worse,” always goes uncontested by elected officials. Uncontested because wealthy individuals and corporations are their primary source of campaign funds. Re-election odds for incumbents correlate well with market direction.

Secondary Consequences

The other issue, the one we write about here, is how that policy response sets the table for other problems. Henry Hazlitt, in his profound book, Economics in One Lesson, describes it this way.

“…a main factor that spawns new economic fallacies everyday…is the persistent tendency of men to see only the immediate effects of a given policy, or its effects only on a special group, and to neglect to inquire what the long-run effects of that policy will be not only on that special group but on all groups. It is the fallacy of overlooking secondary consequences.”

Hazlitt immediately continues-

“In this lies the whole difference between good economics and bad.”

The Federal Reserve’s pragmatism is driven by the influence of wealthy men, corporate executives, and political donors. By insisting that every action be taken with no regard for long-term effects makes certain the influencers’ wealth is protected.

Using the opening quote as an analogy, the Fed has become a notoriously overprotective helicopter parent to the stock market since the financial crisis, shielding it from every hazard. Just as in the case of child-rearing, their actions are responsible for producing an extraordinarily petulant and fragile system.

Drawing again from Wendy Mogel –

“If a child is distressed and sees Mom react with panic, he knows he should wail; if she’s compassionate but calm, he tends to recover quickly.”

This long-term “parental” panic pattern results in a variety of adverse consequences. The worst of them may be the extreme surge in passive investing. As we wrote in a Passive Fingerprints are all over This Crazy Market, the influence of passive investing on the current market is extreme.

Other Factors

In 2014 Steve Bregman at Horizon Analytics, enlightened us to what he calls the ETF (exchange-traded fund) divide. His argument highlights the passive, indiscriminate nature of ETF investors. The monumental shift away from discretionary (active) value-oriented strategies was well underway but not yet diagnosed in a way that Bregman astutely observed.

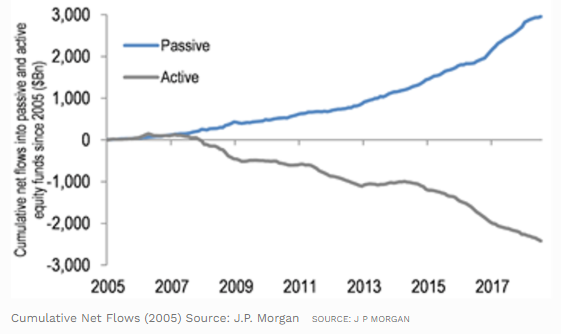

Since then, the wave of passive investing has become a tsunami. Passive, or index strategies, attract massive capital at the expense of discretionary or active mutual fund managers.

That re-allocation means two things:

- Money is leaving active managers who regularly hold 5% cash on average and is going into passive ETFs which hold less than 0.10% cash

- Active managers have historically been the cops on the beat patrolling overvalued stocks and selling them when those conditions are clear. Those cops are being systematically “defunded,” and there is no consideration of “value” in the passive index world.

Seismic Shift

Why are these issues so important?

First, when $3 or 4 trillion dollars move from funds managed with 5% cash to funds with near-zero cash, $150 to $200 billion of “new money” leads to an explosive upside effect on individual stocks targeted in passive funds.

Second, when money is removed from discretionary hands and reallocated to index funds, there is no consideration for price, ever. When a passive S&P 500 or NASDAQ 100 fund receives one dollar to invest, it immediately invests in all of the underlying stocks. It does so at whatever price is available. The top decile, ranked by market cap, perpetually benefits the most as the inflows occur. The bottom decile also benefits via overvaluation but to a lesser extent.

Stocks that do not benefit are those not in passive ETF/indexes. Those are stocks that enjoy none of the indiscriminate flows of capital and frequently become undervalued.

Blame Game

The Fed is responsible for market inefficiencies in the same way a parent is responsible for the demeanor of an entitled child. If policymakers repeatedly rush to the care of markets anytime difficulties arise, then investors never see problems. Prudence and risk management are put aside and neglected. The buy-the-dip mentality goes beyond a humorous meme, it becomes a doctrine.

Over time and with plenty of Fed parenting, passive investors outperform the prudence and diligence of discretionary value managers. When the pattern repeats for a decade, then the chart above of net flows is the result. The concentration of passive investing becomes acute, and its effects on valuations extreme.

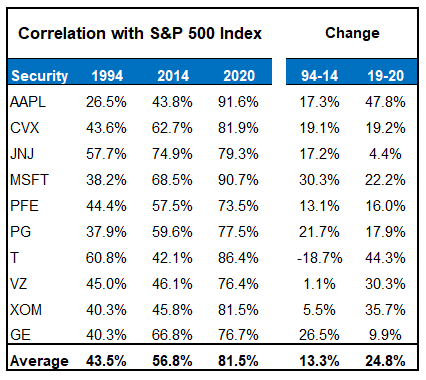

As Bregman pointed out in 2014, a proliferation of the ETF divide had, even then, begun to reveal itself in unhealthy ways. Those circumstances persist. The strong correlation of large S&P 500 components to the S&P 500 is now stark. The table below adds recent data from 2020 to Bregman’s original table.

The dramatic rise in correlation means there is less benefit to diversification than historically has been the case. Owning a variety of stocks and being well-diversified makes sense unless the benefits of that strategy no longer exist. Based on current data, diversification using index funds is futile.

Summary

Central bankers are prone to applying a convenient narrative to justify their actions. Their dialogue is usually laced with contempt for those who cast doubt. That is not a sign of confidence; it is a sign of deep insecurity. A sign of confidence would be humility, a characteristic one never sees out of Fed leadership.

Markets are more fragile today because of a hovering Fed parent, shielding investors from every hazard. The second and third-order effects continue to evolve, but the volatility in the first quarter offered a glimpse of disturbing possibilities.