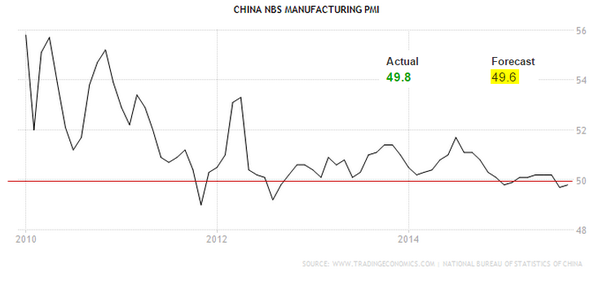

Once again let's start with China where the latest manufacturing report suggests the situation is not as dire as some analysts have been predicting.

China NBS report was slightly better than consensus, sending S&P500 futures higher. It's interesting to see global markets being more reactive to China's fundamentals than China's domestic markets.

| | Source: Investing.com |

|

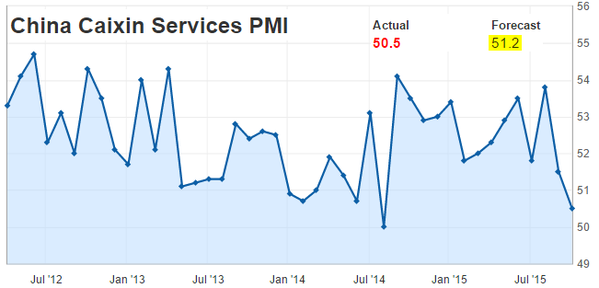

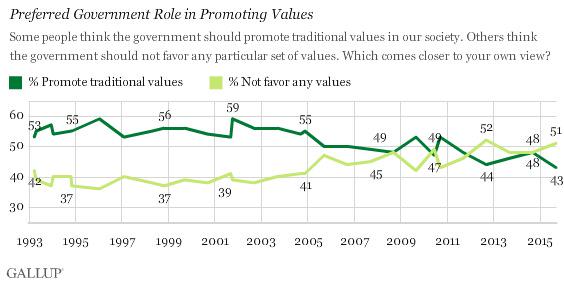

| One should remain cautious on China's economic trajectory however. Several indicators still suggest the risks are to the downside.

The services sector for example was supposed to provide some offset to weaker manufacturing. Will it? The was weaker than consensus. |

|

| | Source: Investing.com |

|

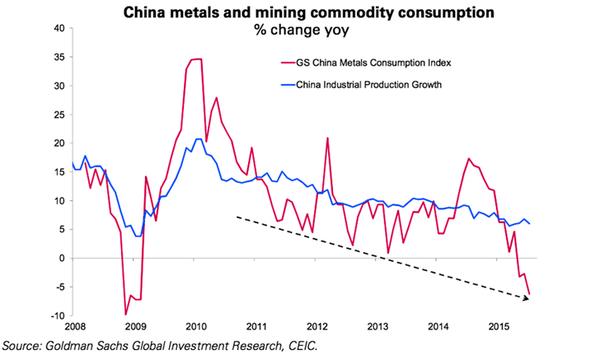

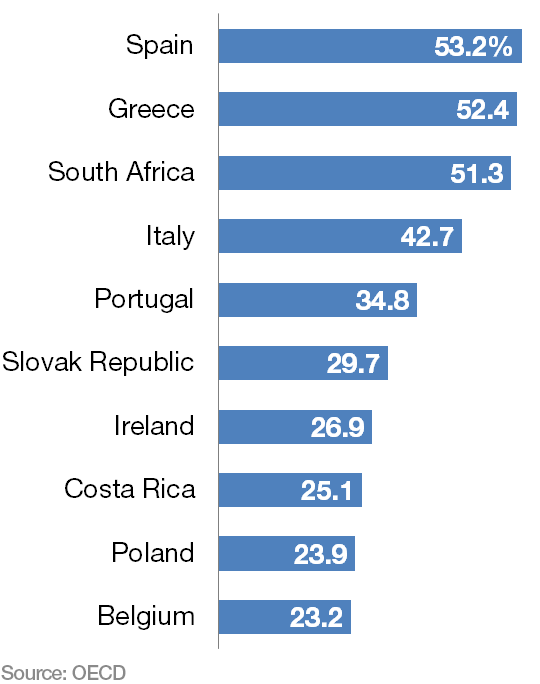

| Moreover the GS Metals Consumption Index (we discussed metals rout in China's markets yesterday) points to a significantly slower growth in industrial production ahead. |

|

| | Source: @vexmark |

|

| Elsewhere in emerging markets we see equity issuance collapse in Southeast Asia. This is not surprising given weakening currencies and large capital outflows. |

|

| | Source: @fastFT |

|

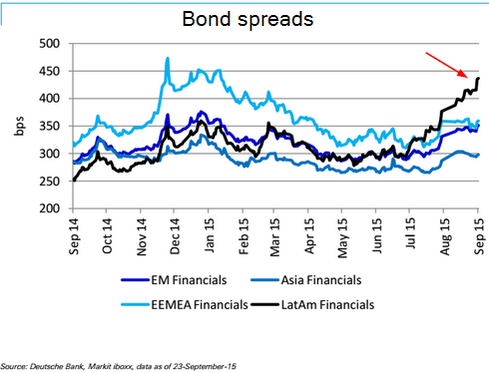

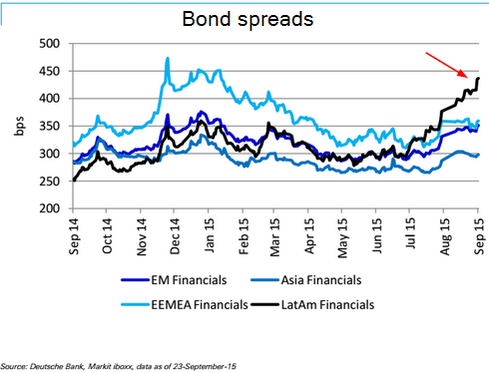

| With the immense currency devaluations and a great deal of dollar-denominated debt, investors have become concerned about Latin American banks. Here are emerging markets' financials bond spreads. |

|

| | Source: Deutsche Bank (XETRA:) |

|

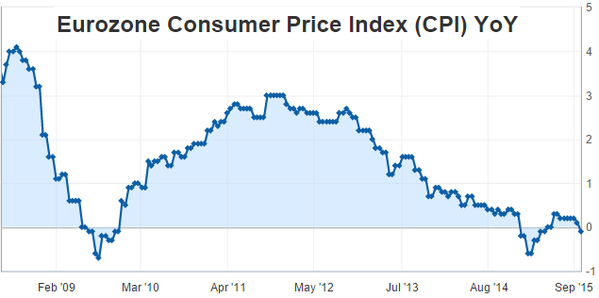

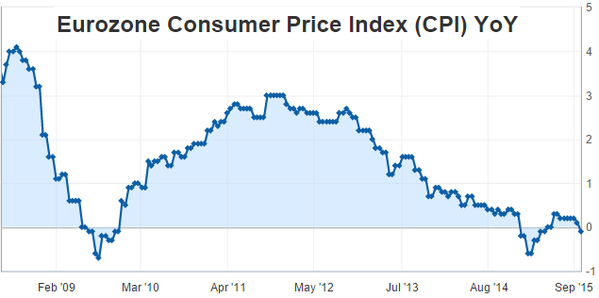

| Switching to the Eurozone, the area's (YoY) turned negative again. |

|

| | Source: Investing.com |

|

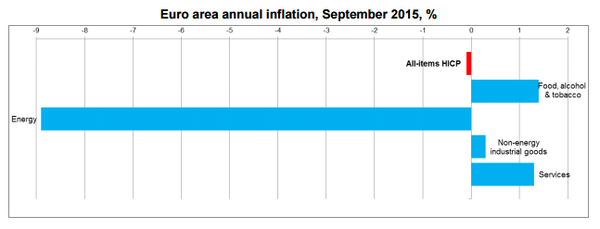

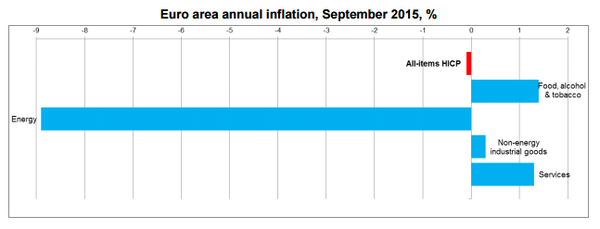

| Of course this decline was entirely driven by energy. |

|

| | Source: @fastFT |

|

| Nevertheless, the ECB is likely to expand the bond buying program soon. |

|

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.

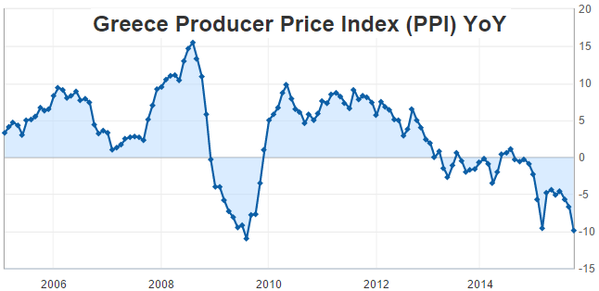

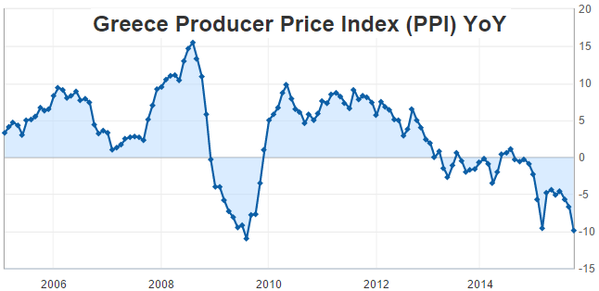

| Speaking of low-flation, here is . Combine falling energy prices with weak demand for everything else and this is what you get. |

|

| | Source: Investing.com |

|

| By the way, Greek bank shares are back near the lows, falling some 40% in a week. Given that nobody knows the outcome of the Greek bank restructuring, volatility has been spectacular. |

|

| The Eurozone labor markets are healing, albeit much too slowly. Italian finally fell below 12% for the first time since 2013. |

|

| | Source: Investing.com |

|

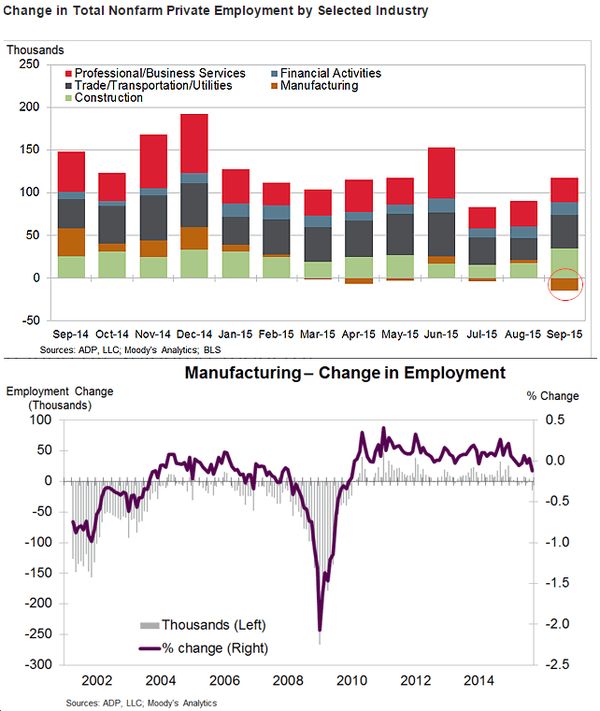

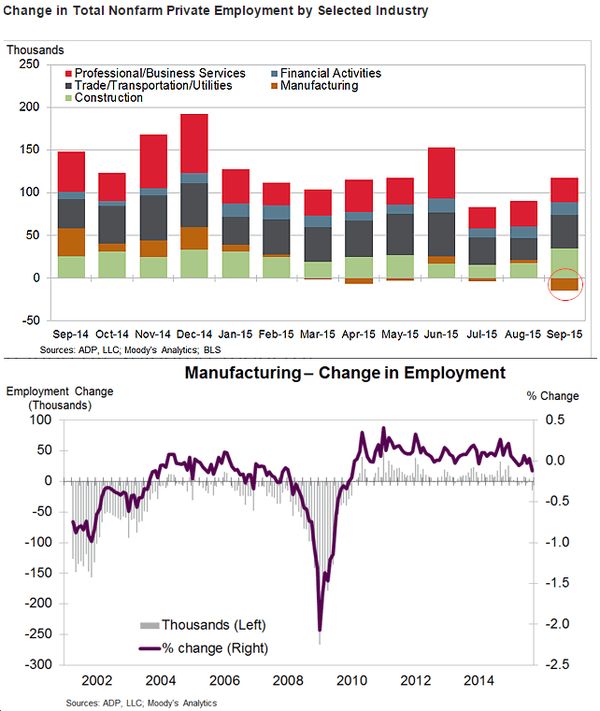

| Back in the United States the report was fairly good, with 200K new jobs created. It did however highlight a big loss in US manufacturing jobs - the largest in 5 years. A strong had something to do with this one. |

|

| | Source: ADP |

|

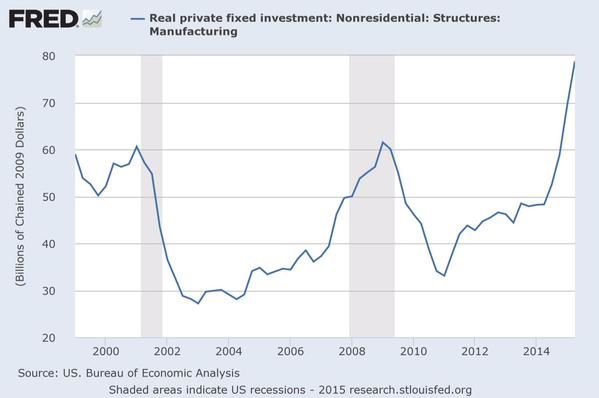

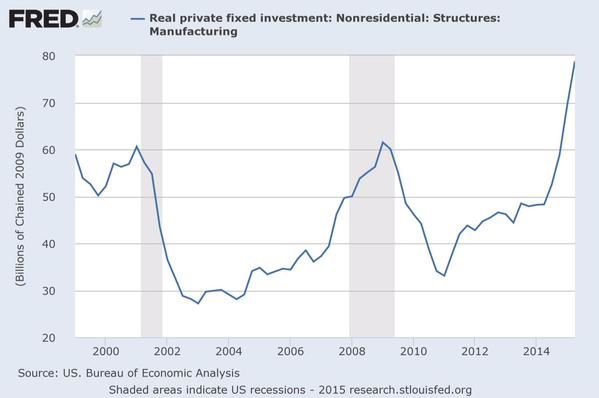

| So what happened to the chemical industry investing in all those plants near O&G hubs? |

|

| | Source: @MattGarrett3 |

|

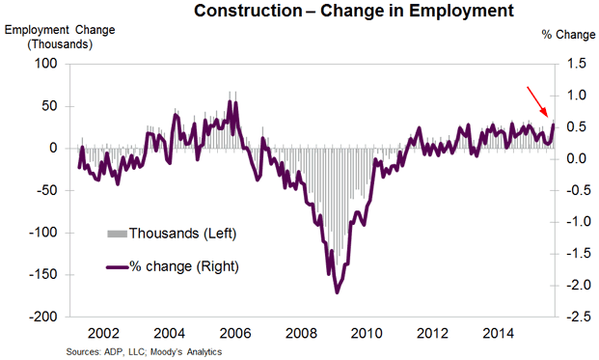

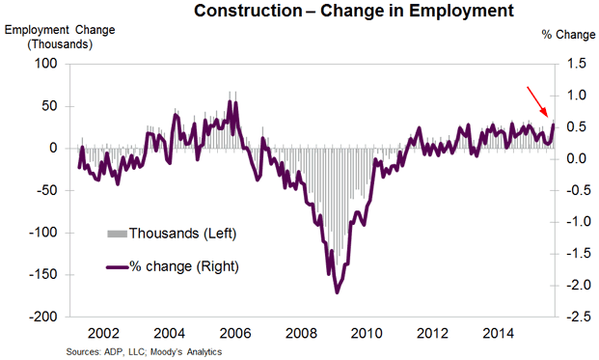

| Some of that showed up in stronger which offset the losses in manufacturing. |

|

| | Source: ADP |

|

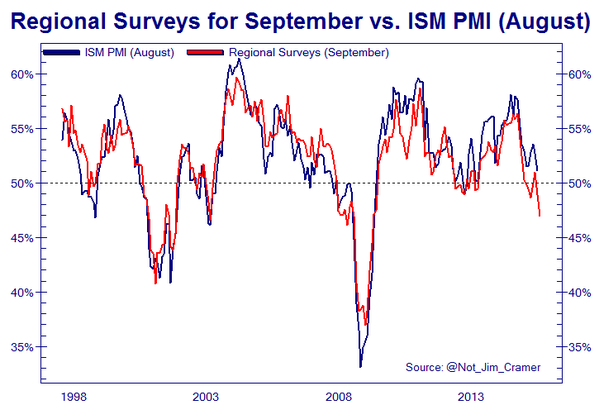

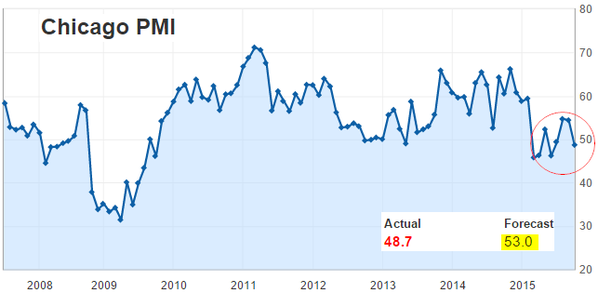

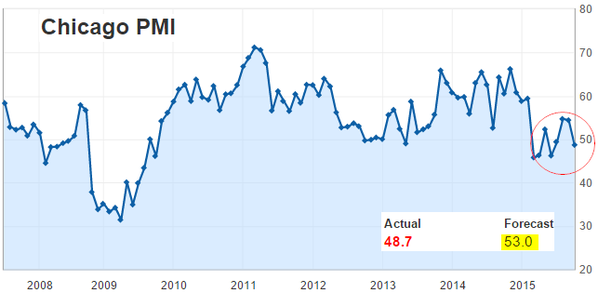

Speaking of manufacturing, the showed the region's manufacturing in contraction - which was not the economists' consensus.

| | Source: Investing.com |

|

| In fact the regional Fed reports on manufacturing have been terrible, suggesting that the national manufacturing report fromis going to hit new post-recession lows. Once again, welcome to a strong currency regime. Let's help the situation with a rate hike. |

|

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.

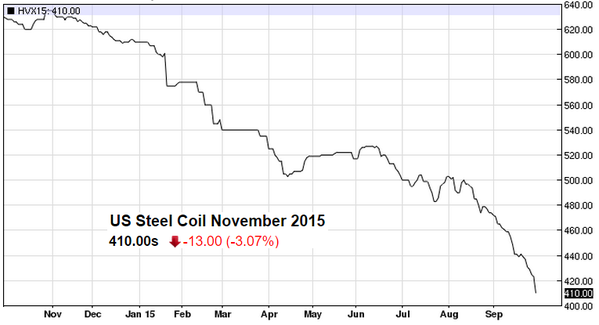

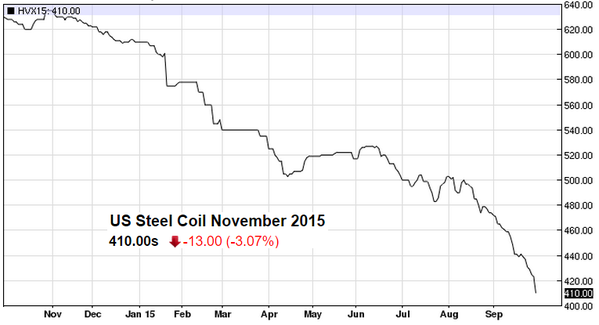

| Now let's take a look at some trends in commodities.

1. US steel price declines have accelerated - following the trend we've seen in Asia and Europe. |

|

| | Source: barchart |

|

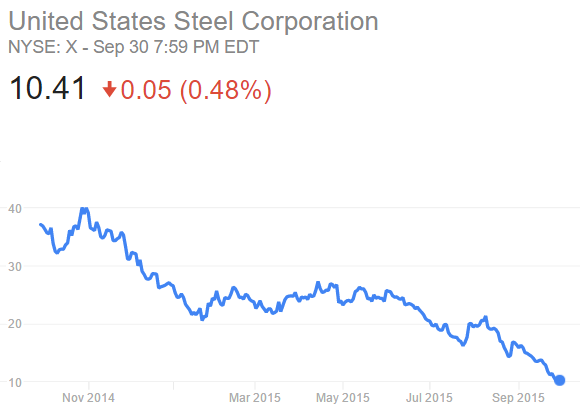

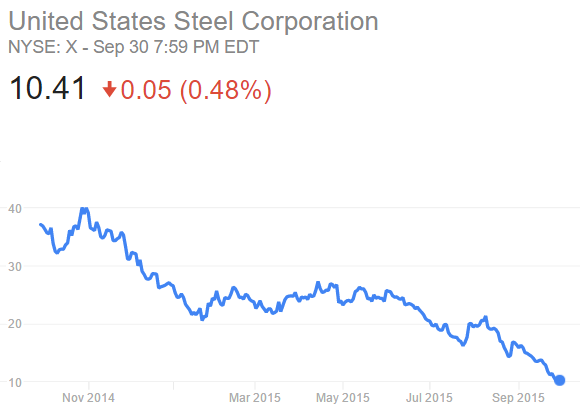

| Not surprisingly, the United States Steel Corporation (NYSE:) shares have followed a similar pattern. |

|

| | Source: Google (NASDAQ:) |

|

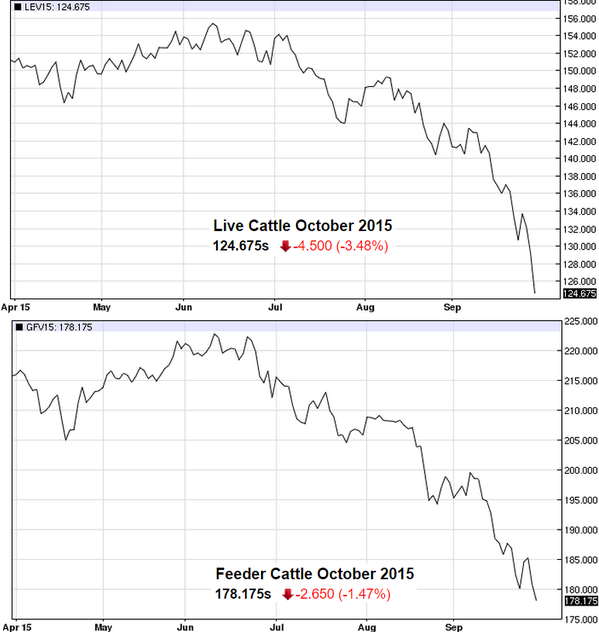

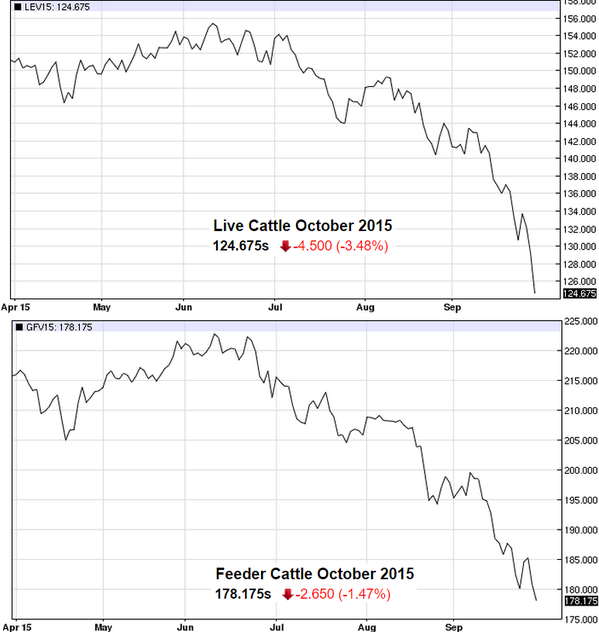

| 2. The CME cattle futures hit a 2-year low (another limit down). There are a number of reasons for this including unwillingness to take deliveries by futures traders (increasing contango). Cheap steaks for the holidays? |

|

| Reuters: - The glut of heavyweight cattle afforded some packers enough inventory for at least the next two to three weeks, feedlot sources and analysts said.

Reuters: - ... They said competitively-priced pork and extra tonnage from record-heavy cattle exacerbated the already tepid seasonal demand for beef. In a trading strategy known as bear spreading, some traders sold October futures and simultaneously bought deferred months to avoid the potential delivery of against that contract on Monday. "No one wants to take deliveries in the first place. But, catching some (deliveries) and not being able to get them slaughtered is a double nightmare," said Cassandra Fish, author of industry blog The Beef. |

|

|

| | Source: barchart |

|

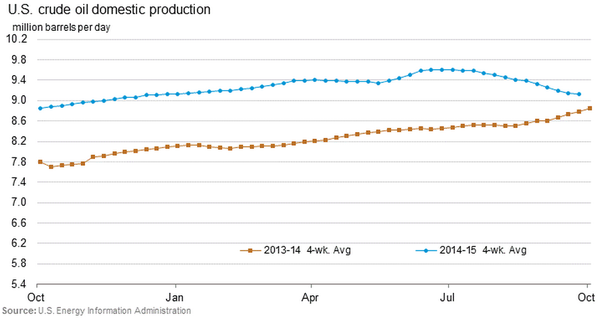

| 3. US production is still declining, gradually converging with last year's level. |

|

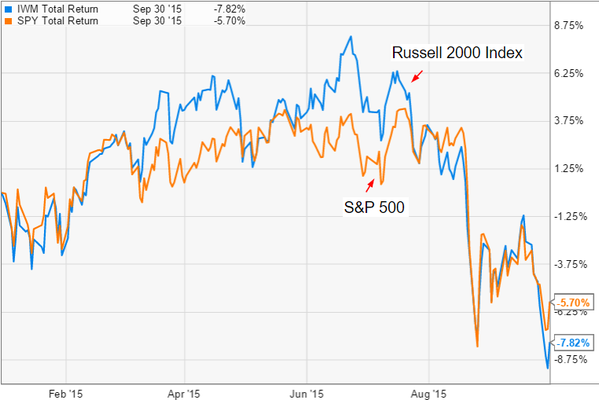

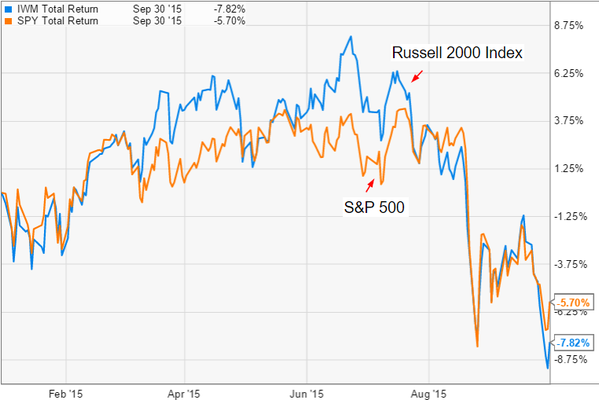

| In equity markets, US small caps are now underperforming on a year-to-date basis. |

|

| | Source: Ycharts |

|

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.

| Also take a look at The Carlyle Group LP (NASDAQ:) share price. Is the firm too exposed to the buyout PE business? Or are some poorly-timed energy investments spooking investors? Claren Road problems? |

|

| | Source: barchart |

|

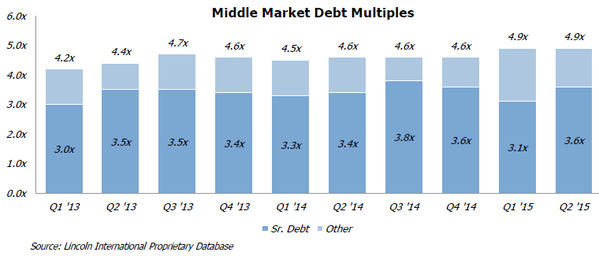

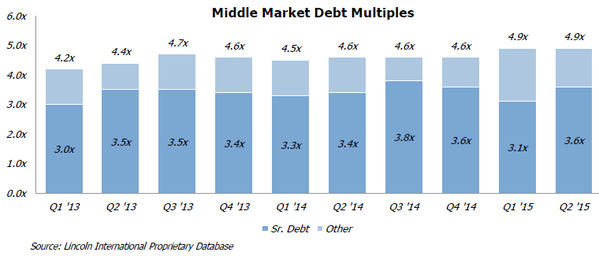

| In private credit we see middle market loan leverage remaining elevated. |

|

| | Source: Lincoln International |

|

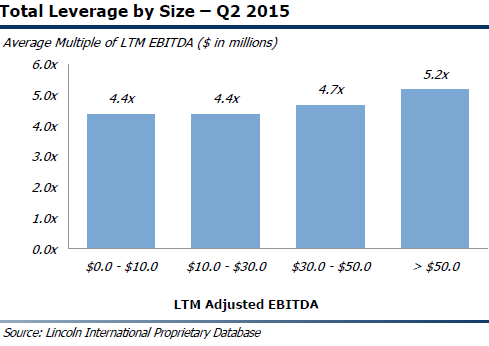

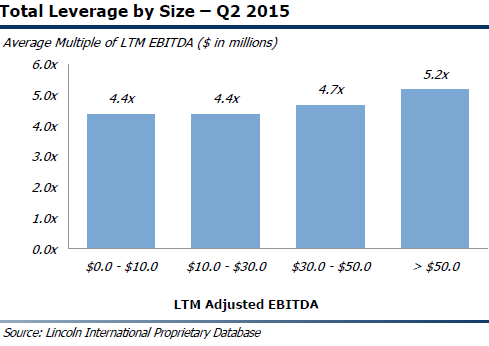

| Also here is the middle market leverage by company size (the "size premium"). We've seen the smaller firms' leverage move up a bit in recent quarters. |

|

| | Source: Lincoln International |

|

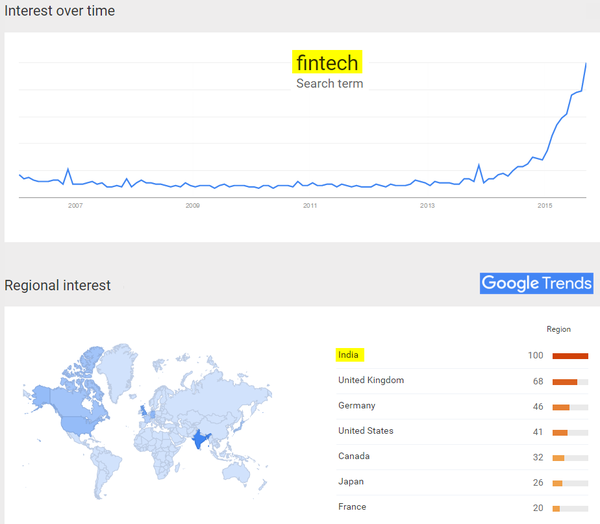

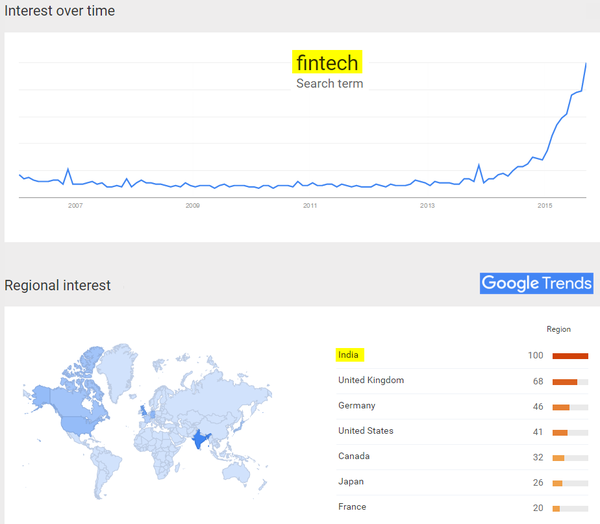

| Finally, interest in "fintech" spiked recently with a great deal of interest coming from India. Yes, supposedly there is a tech "revolution" taking place in financial services. Nevertheless, this feels a bit frothy. |

|

| | Source: Google Trends |

|

Turning to Food for Thought, we have 2 items this morning:

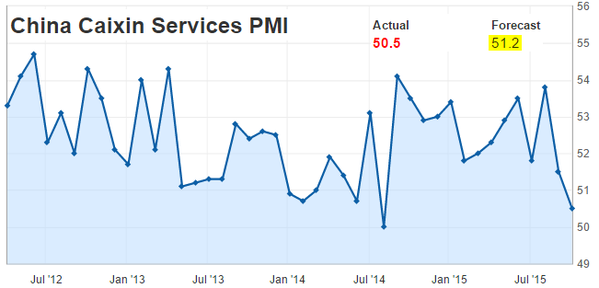

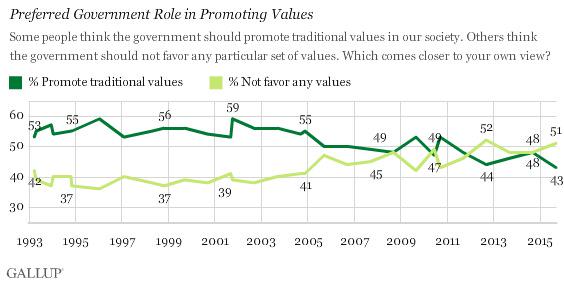

1. Americans no longer seem to want the government to promote "traditional values".

| | Source: @GallupNews |

|

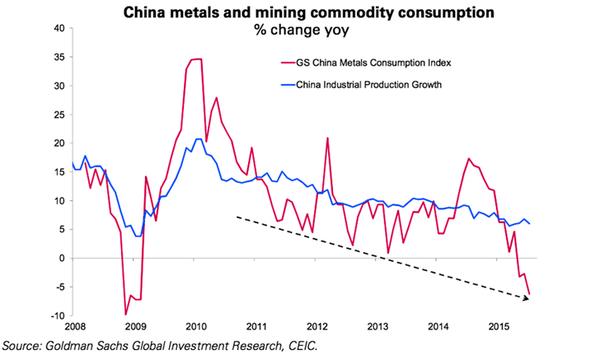

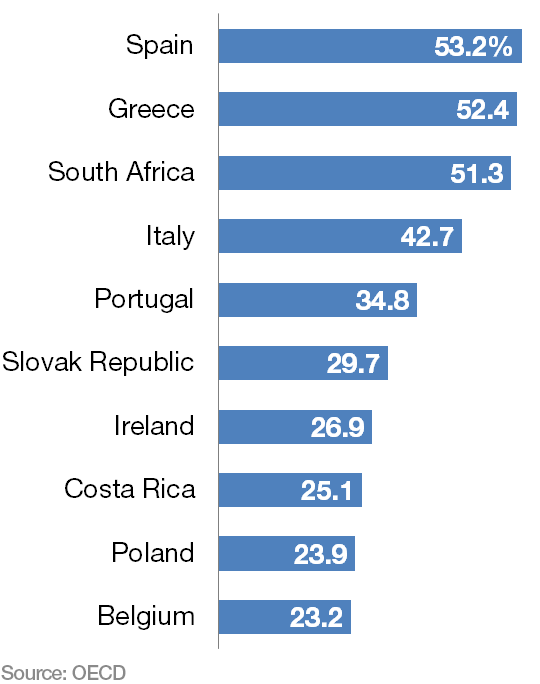

| 2. This chart is a bit dated but it's a good ranking of nations with the highest youth unemployment. |

|

| | Source: @wef |

|

Disclosure: Originally published at Saxo Bank TradingFloor.com