Get ready for it: over the next month or two, the vast majority of stories on inflation—at least, in outlets that are friendly to bullish interests—will remark on the 40-year highs in inflation but append the following phrase:

“But economists expect inflation to moderate in the months ahead.”

This is meant to do two things, if you’re a Ph.D economist or a market observer with a BA in Art History (the difference in prognosticative ability between these two groups is remarkably slim).

First, it is meant to be a soothing reminder that inflation is just a passing fad and nothing to worry about. Pay no attention to the man behind the curtain…Second, it is meant to demonstrate the powerful insights that the speaker commands. Look on my Works, ye Mighty, and despair!

But the contribution of this pronouncement is small. The reason that “inflation will moderate” in the months ahead is simply due to base effects. The table below shows the monthly CPI (seasonally adjusted, headline) prints from 2021, which will be “replaced” in the y/y figures over the next year. The numbers in red all represent inflation which, if annualized, would be 7.7% or higher.

Some of these high prints are driven by energy prices, which are historically mean-reverting, and some are also driven by spikes in “COVID categories” (most famously, used cars). And so most economists’ forecasts project a return to what the economist considers to be the “underlying run rate” of inflation.

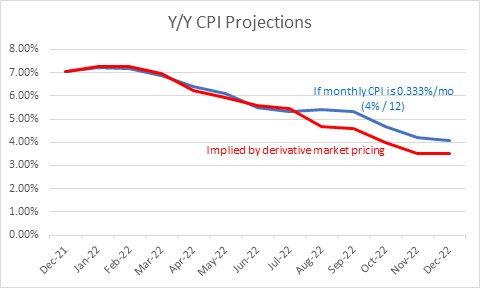

To illustrate this, look at the chart below. There are two lines. One, the blue line, represents what the y/y headline inflation rate would be each month if we simply naïvely replace every year-ago figure that is “dropping off” with 0.333%. Y/Y inflation is roughly flat for a couple of months since 0.33% is roughly what Jan and Feb 2021 saw; then it starts to fall sharply as we drop off 0.62%, 0.77%, 0.64%, and 0.90%. In fact, if we printed 0.333% on headline every month for the next year, Y/Y CPI would decline in every month except for two of the next 12.

The other line in the chart, in red, shows what is currently being priced in the market. You can see that not much more thought goes into market pricing than goes into economists’ forecasts!

Here’s the critical, salient point. Every forecast ends up showing this mean reversion because the usual way of doing projections naturally ignores unknown unknowns. From the top down, we have to choose something to replace last year’s number and the natural assumption is that the “top down” guess hasn’t moved terribly far from the prior guess (in the case of headline inflation, something like 2.0-2.5%; for 2022 maybe they’ll throw in 3.5% or 4% ebbing to 2%-2.5% in 2023).

And from the bottom-up, we know what went up (for example, the spike in used car prices) and we also know that the rate of change of that item will eventually ebb. We’ve known that about used cars for a while. It hasn’t ebbed yet, confounding many, but it will.

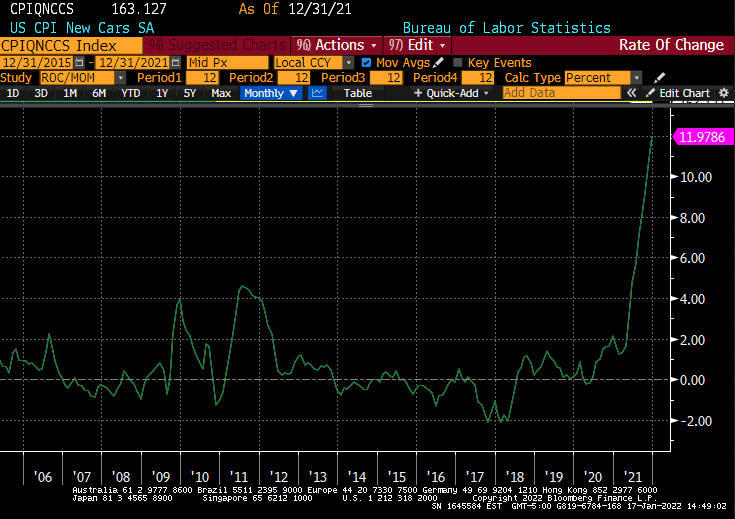

But do you know what else happened, the unknown unknown, that was not forecast back when everyone was thinking headline inflation would decline into the end of 2021? The acceleration in new car price inflation!

Indeed, one of the reasons that people thought that used car inflation would slow down, and even that used car prices might decline, is that used car prices were in some cases exceeding the prices of new cars, which is an obvious absurdity. But surprise! Due to “a chip shortage,” or the problem getting foam for seat cushions, or any one of a half-dozen other reasons—but perhaps also due to excessive government largesse—new car prices are now rising at 12% y/y.

That was an unforecast “unknown unknown” early last year, and it is one reason that headline inflation ended the year at 7% rather than at 3%. Okay, so there was a “reason” for this surprise. But if you as an economist didn’t see that coming, what makes you think that you will see the next one…or that there won’t be a next one?

Rob Arnott used to make a similar point about corporate earnings. He pointed out that while the “extraordinary items” for any given company, which gets magically discounted when they report their “earnings before bad stuff,” may be a legitimate way to think about the profitability of that company going forward, for the stock market as a whole the amount of “extraordinary items” shouldn’t be discounted since someone is always having a surprise.

It’s a surprise in the micro sense, but not in the macro sense. Surprises happen. Similarly, with inflation: we see economists decay away the surprises that have happened, while ignoring the possibility of other surprises.

If the distribution of those other surprises was random—some of them “inflationary” surprises and some of them “disinflationary” surprises—then this could make sense. The errors would be unbiased and so a forecast that ignores them would be less-volatile than reality, but not necessarily a bad “most-likely” guess.

But in this case, the errors are likely to be on the high side because money growth remains around 12-13% per annum. Guessing that overall inflation is going to head back to 1.5%-2.5% over the next year or two is simply a bad guess. That it will decline from 7% is a high likelihood, but not exactly insightful.

There is a context in which this observation can be a useful contribution: by reminding the listener that when they see inflation decelerate in the months ahead, it doesn’t mean anything we don’t already know, a statement about the likelihood of declining year/year inflation can be helpful. This is the baseline forecast; only deviations from the expected path are worth reacting to.

And for my money, those deviations are more likely to be above the forecast curve than below it.

And Then There’s The Fed

By the way, if the most-recent inflation numbers were basically as-expected…and they were pretty much right on expectations…then why are Fed officials suddenly sounding more hawkish? An as-expected number shouldn’t change your views, unless your expectations were non-consensus. That seems unlikely when it comes to the flock of Econ Ph.Ds who inhabit the Eccles Building.

I think the reason the Fed is sounding more hawkish isn’t because anything has changed recently— it hasn’t—but because they think we need to hear that hawkishness right now. It’s like a parent thinking that the kids “need” a stern talking-to. The kids, somehow, never think so.

As a Fed official, if you talk tough now you create several possible good outcomes. You might “re-anchor” inflation expectations by persuading investors and consumers that the Fed is determined to restrain inflation. It seems unlikely, given how often they talked in 2020 about having the tools to be able to prevent inflation—and then neither using the tools nor preventing inflation—that they’d get much mileage from that tack, but it’s a free option.

Or, you might be able to nudge market expectations in such a way that an actual hawkish turn won’t be as damaging as it historically has been. Or, to be cynical, one might think that a Fed speaker wants to get stern in front of the coming ‘base effects’ ebb, so that it looks to the gawkers in the cheap seats like they moved inflation by merely talking about it. And, in the worst case, you can back off the tough talk before you actually have to do anything.

I think there are a lot of reasons that the Fed is not going to be hawkish in any traditional sense. They’re not going to restrain money supply growth by shrinking the balance sheet and squeezing bank reserves (even if they wanted to, that margin is very far away), and they’re not going to raise interest rates in anything like the aggressiveness of a traditional tightening cycle.

This is partly because they won’t be able to stomach the wealth effect of the market reaction to sharply higher discount rates, partly because sharply higher interest rates would cause big problems with the federal budget deficit going forward, and partly because they have convinced themselves that inflation is currently just ‘paying back’ a long period of being ‘too low’ (whatever that means).

For now, expect them to aggressively and triumphantly forecast that “inflation will moderate in the months ahead.”

But you know the truth.