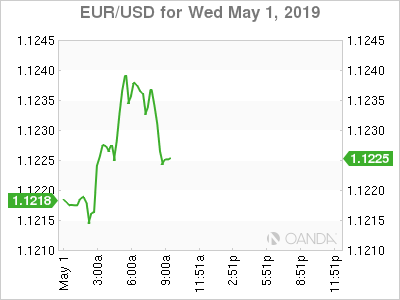

Early trade is seeing light flows as most of Asia and European equity markets are closed in observance of the May 1 holiday. After yesterday’s close, stocks got a boost after better than expected results out of Apple (NASDAQ:AAPL). Yes, they posted their second consecutive decline in earnings and revenue, but it was much better than what was feared. Apple basically erases the weakness that we saw the day before from Alphabet's (NASDAQ:GOOGL) sour results. The dollar did get a small boost on the better than expected results from the ADP report. The private sector is showing hiring remains strong as April showed 275,000 jobs created, much higher than the 180,000 forecast. The report highlighted that the economic soft patch at the start of the year has not materially impacted hiring. The dollar has modest losses to the euro and British pound and slight gains to the commodity currencies.

- FOMC – How patient on inflation will they be?

- Trump – Wants 1% cut and more QE

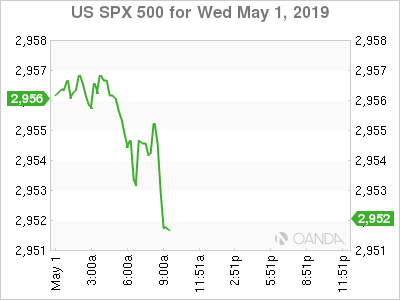

- Stocks – Mixed earnings could put a temporary cap on this rally

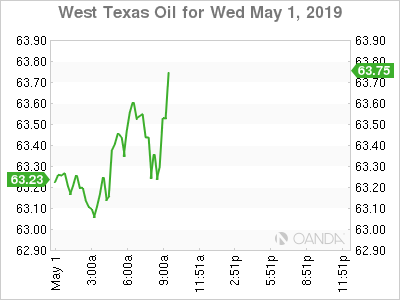

- Oil – Lower on stockpiles surge and Maduro still controls military

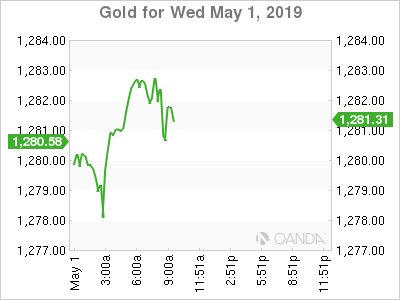

- Gold – Dovish induced Fed rally may stall

Fed

The FOMC is widely expected to hold policy unchanged and affirm their patient pledge. They may acknowledge the inventory affect to the recent GDP surprise, but should emphasize they will need to see more data points. The markets will heavily focus on their concern with soft inflation. It is possible the Fed could decide to hint at the possibility of easing if inflation worsens. The Fed will also need to reiterate their independence from the President. Trump’s recent calls for 1% cut on interest rates and more QE will likely be ignored by the Fed.

Trump

President Trump is determined to keep on telling the Fed how to keep supporting the economy. Hardly anyone is taking some of the suggestions seriously, but it appears Trump will gladly blame the Fed for any softness with the economy over the next year or more importantly around the election.

His twitter account has been busier than ever. Yesterday’s tweets include “China is adding great stimulus to its economy while at the same time keeping interest rates low. Our Federal Reserve has incessantly lifted interest rates, even though inflation is very low, and instituted a very big dose of quantitative tightening. We have the potential to go up like a rocket if we did some lowering of rates, like one point, and some quantitative easing. Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records &, at the same time, make our National Debt start to look small!

Trump is asking for the Fed to cut interest rates by 100 basis points and to deliver more QE. This is more political posturing, but in the end, he may be right about calling for a rate cut.

Stocks

Mixed earnings results will unlikely be a catalyst for the next push higher with stock prices. While the Fed is on hold, a trade deal is coming, and Treasury yields have stabilized, we could see U.S. stocks run temporary run out of momentum here. Earnings results continue to come in mixed. Early in the morning, CVS (NYSE:CVS) and Hilton Worldwide Holdings Inc (NYSE:HLT) surged after raising their respective forecasts, while Yum! Brands Inc (NYSE:YUM) sold off after delivering roughly in-line results.

Oil

Crude prices sold off after both a strong inventory gain and after Venezuelan President Maduro seemed to maintain a strong grasp over his military support.

The weekly API oil inventory report showed a build of 6.8 million barrels, up from the draw of 3.1 million barrels we saw last week.

Venezuela, which holds the world’s biggest cruder reserves is likely to see continued protests that are led by opposition leader Juan Guaido, but the markets may wait to see if he can muster up a significant amount of military support before pricing in heightened tension that could drive up oil prices. It appears for now, Maduro has a strong hold of the military. It is unclear if the political situation will change anytime soon.

Gold

The precious metal remains steady ahead of key FOMC rate decision and press conference. Easy monetary policy could provide a boost for the yellow metal, but it may not be substantial as expectations remain high for a final trade deal to take place within the next month.