It turned out that the oil bulls haven't had much success yesterday either. And today isn't shaping up to be a much better day for them either. Yet, they have taken black gold higher from its daily lows already - does this mark some kind of a turning point?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

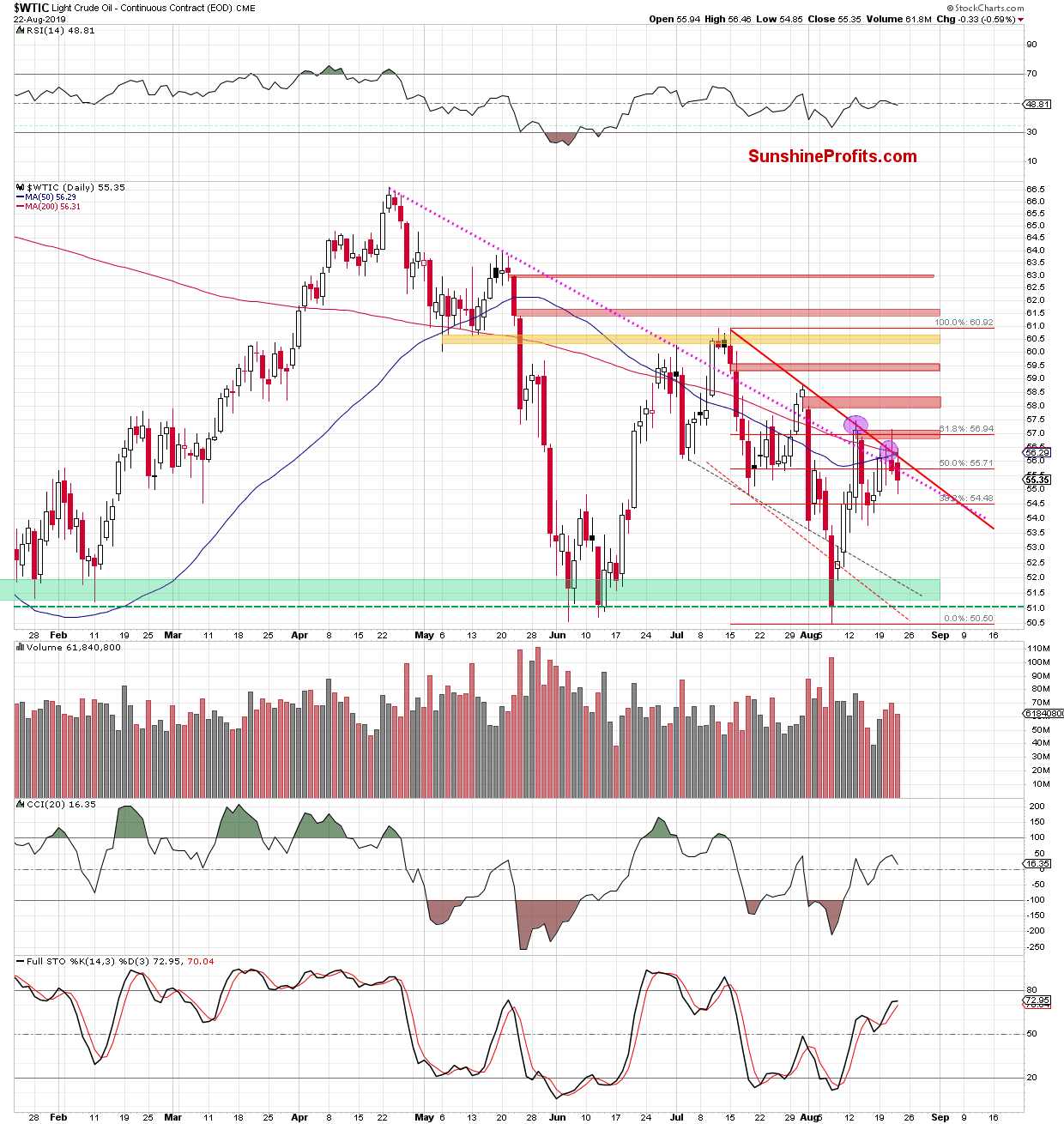

While crude oil moved to the upside right after yesterday's open, the bulls didn't manage to break above the red resistance line for the third time in a row.

The subsequent pullback took the commodity below the pink resistance line, and it closed the day below this resistance. It also marks yet another daily close below the 50- and 200-day moving averages.

The implications of all of these are bearish. But let's check today's price action in the oil futures arena.

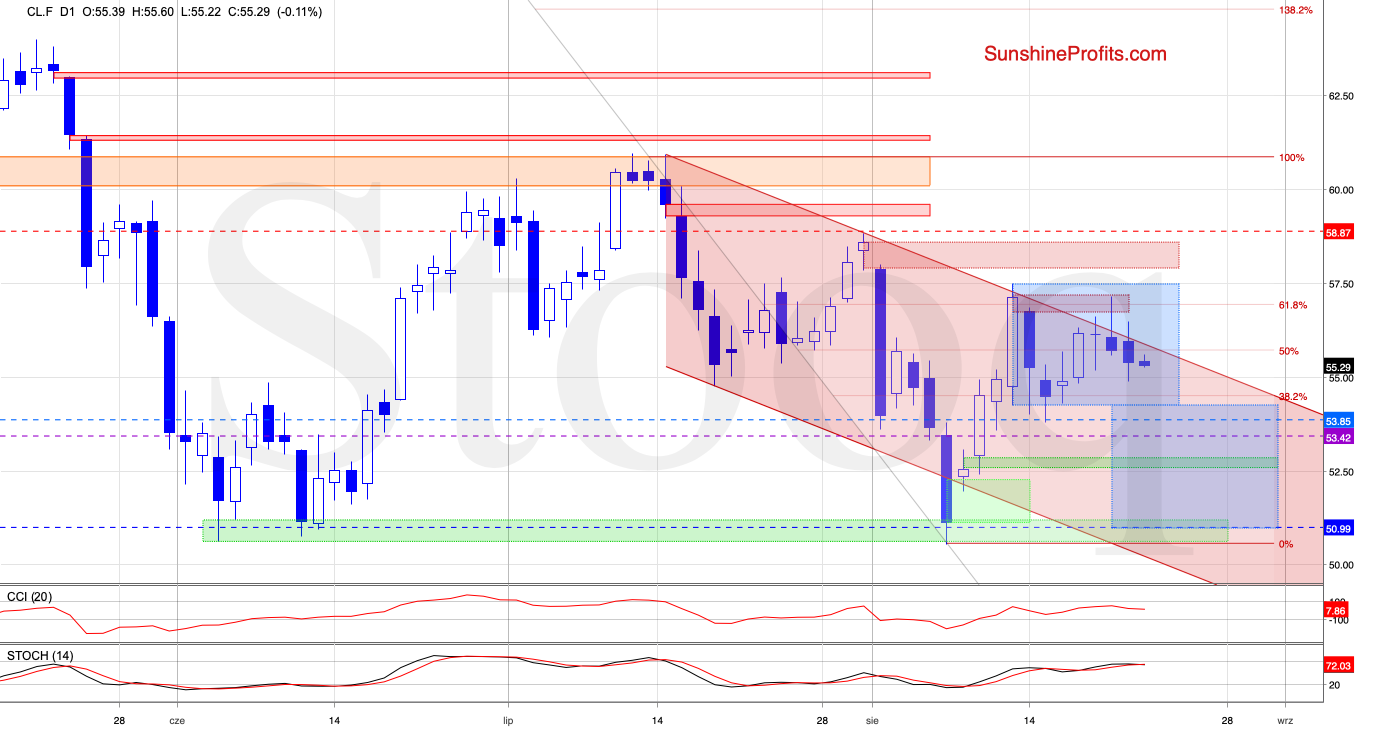

Earlier today, crude oil futures opened below the upper border of the red declining trend channel and then moved slightly lower. Since then, they've decline further and currently trade at around $54.60.

The Stochastic Oscillator has issued its sell signal, which together suggests a drop to at least the lower border of the blue consolidation in the very near future. And indeed, black gold has almost touched the $53.40 handle earlier today.

If the lower border of the blue consolidation is broken, it would open not only the way to our initial downside target abut also to around $51 - there, the size of the downward move would correspond to the height of the consolidation.

Let's take a look at the 4-hour chart for more clues.

Immediately noticeable is the very short-term declining purple trend channel, which suggests a test of the lower border of the formation in the very near future. If this is the case, we'll not only a drop to our initial downside target, but also likely a test of the potential lower border of the formation, which is currently at around $53.42.

And indeed, that's exactly what has happened earlier today.

Summing up, the oil downswing has continued yesterday despite the bulls' best efforts. The buyers' intraday breakout attempts above several important resistances have been invalidated. The continued combined technical factors of multiple resistances, the Stochastic Oscillator's sell signal and the 4-hour chart daily indicators' sell signals indicate that a continuation of yesterday's oil downswing is very likely, and our profitable short position remains justified.