The cable is still trading close to 1.4030, as the optimism about the Brexit transition negotiations could contain the market sentiment in the beginning of this new week, after closing last week close to 1.3940.

Barnier who is the EU chief negotiator said today that the 2 sides have reached an agreement about the financial settlement and citizens rights.

The markets participants focused on that negotiations progress sending the Sterling higher across the broad shrugging off the Irish border issue which is still looking to remain for a while or may be to the end of the negations which are expected to lead to a complete split at the end of 2020.

From another side, BoE said that the UK’s banking system has the ability to withstand the consequences of a disorderly Brexit and also the Chancellor of the Exchequer Philip Anthony Hammond's spring statement could restore the market confidence in the UK economy.

The markets will be waiting ahead tomorrow for the release of Feb UK CPI which is expected to show rising yearly by 2.8%, after increasing in January by 3%, While BOE inflation yearly target is 2%.

There will be also tomorrow the release of Feb inflation figures over the producing level, before The MPC members meeting next Thursday which is widely expected to come with no interest rate change.

BOE’s MPC 9 members have voted unanimously in their last meeting on last Feb. 8 to leave the interest rate unchanged for second meeting in row at 0.5%, after raising it by 0.25% on last Nov. 2 from 0.25%.

The members have been more optimistic last meeting and have indicated that the markets are underestimating the interest rate outlook showing lower tolerance of watching the inflation scale above BOE's 2% yearly inflation target.

The MPC meeting will be a day after the first FOMC interest rate decision under the Fed new Chairman Jerome Powell.

Powell boosted demand for the greenback following his recent reference ot he probability of raising the interest rate 4 times by 0.25% this year.

So, the Fed's interest rate outlook dots plot will be closely watched and also the Fed's language concerning the inflation outlook will take the market attention.

As The FOMC members can shock the markets by any reference in their economic assessment to weakness or a slowdown of the US economic activity, after the optimism they have highlighted it is released economic assessment following last January meeting.

When the committee members were confident in the US economy and its ability to reach the Fed's 2% inflation yearly goal. last Jan FOMC statement came with no reference to the inflation lower than expected figures considering that adopting $1.5 trillion in tax cuts is to boost the economic activity further this year.

The markets are looking to see also whether or not the FOMC is to change its language after taking this expected hiking decision.

Is it to name AGAIN the new level "1.75% Fed fund rate" a relatively low level would help to support continued job growth ?

Is it to maintain in its economic assessment that "The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2% inflation"?

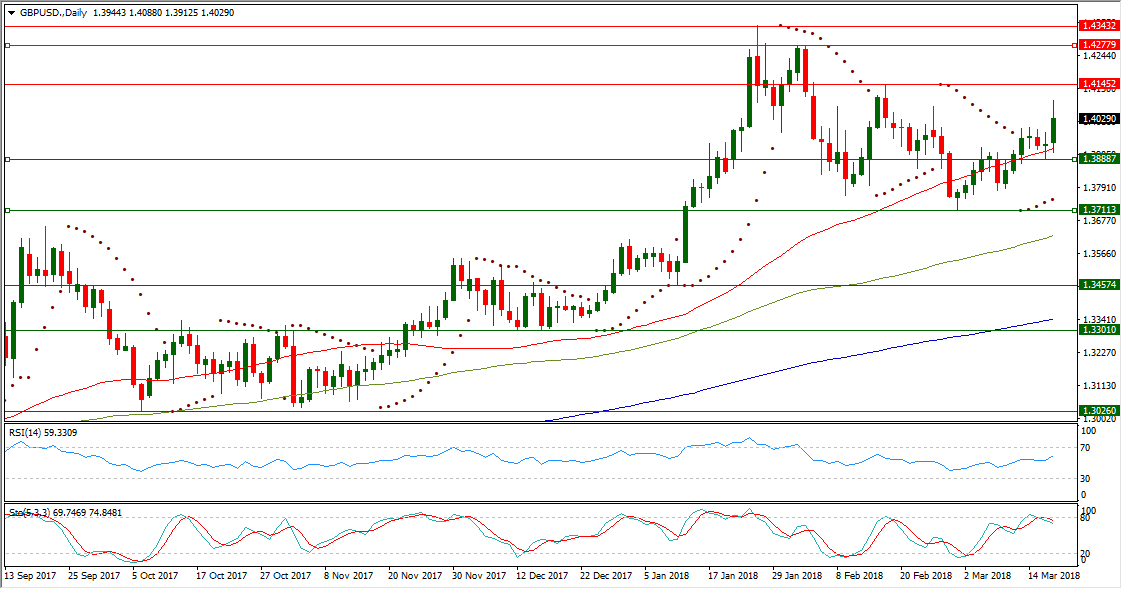

GBP/USD could gather momentum to be now in a higher place above its daily SMA50, after bouncing up below this average at 1.3888 last Friday.

While the pair remains underpinned over longer range by continued being above its daily SMA100 and also its daily SMA200.

GBP/USD is now on its fifth day of consecutive being above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.3749.

GBP/USD could overcome last Feb. 26 high of 1.4069 by reaching today 1.4088, but is still below its formed resistance on last Feb. 16 at 1.4145 which drove the pair down to have a lower low at 1.3711 on Mar. 1.

GBP/USD daily RSI-14 is now referring to higher existence inside the neutral region reading 59.330.

GBP/USD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral area at 69.746 leading to the downside its signal line which is in the same area reading 74.848.

Important levels: Daily SMA50 at 1.3924, Daily SMA100 at 1.3626 and Daily SMA200 at 1.3341

S&R:

S1: 1.3888

S2: 1.3711

S3: 1.3457

R1: 1.4145

R2: 1.4277

R3: 1.4343