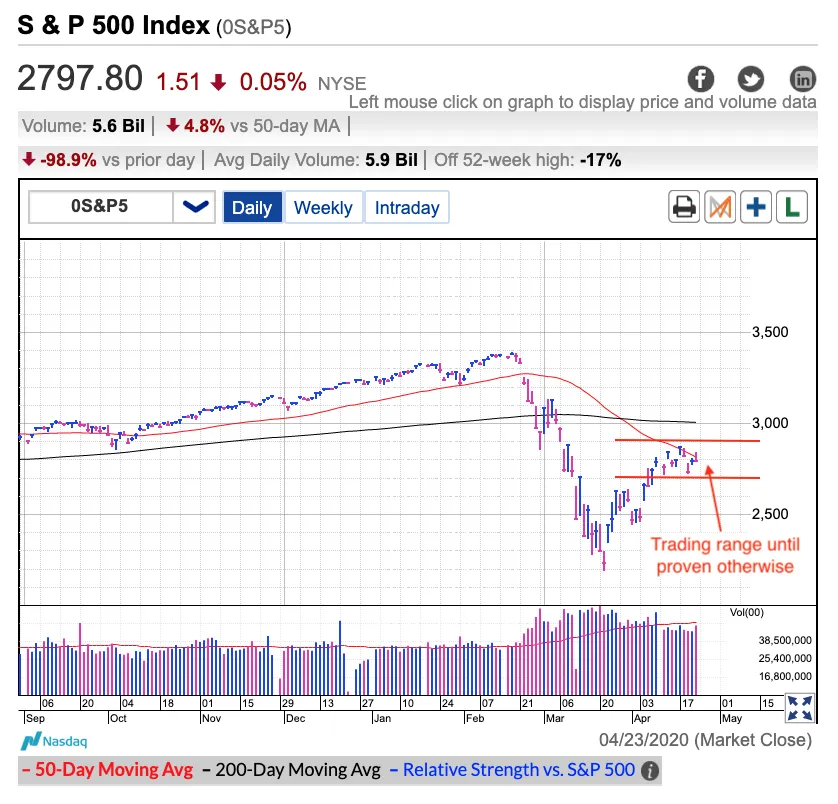

The S&P 500 continues consolidating inside the 2,700 and 2,900 range. We’ve been stuck in this region for two weeks following the mammoth rebound from the March lows. Thus far, the market refused multiple opportunities to breakout/breakdown and no matter what the bulls and bears claim, it continues chugging sideways.

It’s been a fantastic run and obviously the market deserves a break following a historic 20% surge. There are two ways markets rest and reset. The first is a more conventional pullback to support. The proverbial, two steps forward, one step back. That’s what a lot of people, myself included, were expecting. But as resilient as this market’s been over these two weeks, most longer-viewed owners are refusing to sell their favorite stocks at a discount. When owners refuse to sell, it makes no difference what the headlines say or what the experts think prices should do.

That said, supply is only half of the pricing equation. While owners are supporting prices by refusing to sell, our upside momentum has been blunted by prospective buyers refusing to pay ever-increasing prices. Owners not selling and those with cash not buying is the recipe for a sideways grind.

Which side caves first? That’s a good question and unfortunately, I don’t have the answer. Bulls have a good case that many states are already starting to reopen their economies. On the other side, bears point to the sharpest economic contraction in modern history and a stock market that’s only down 15%. There’s something definitely wrong with that calculus. Either stocks are way too high or the economy will bounce back a lot quicker than the headlines portend.

Luckily for us, we don’t need to place our bets just yet. As independent investors, our greatest strength is the nimbleness of our size. Rather than commit to one side or the other, we should wait for the bandwagon to start rolling before we jump aboard. Only the partisans need to be right. The rest of us are satisfied collecting a few bucks jumping aboard this no matter which way it goes.

Until proven otherwise, assume any dip to 2,700 will bounce and rally to 2,900 will stall. Buy the bounce off the lower end and take profits at the upper edge. If the market breaks above the highs or breaks under the lows, close those positions and flip the other direction. By staying nimble, we can profit no matter what the market does next.