In this article we are examining popular closed-end funds.

The Calamos Convertible Funds

Convertible bonds are a big beneficiary of Jay Powell’s money printing activity. Convertibles pay regular interest. In this way, they act like bonds. You buy them and “lock in” regular coupon payments.

But convertibles are also like stock options in that they can be “converted” from a bond to a share of stock by the holder. So, you can think of them as bonds with some stock-like upside. And equities, of course, do well when newly created money is flying around.

The SPDR® Bloomberg Barclays Convertible Securities ETF (NYSE:CWB) is the most popular mainstream (read: widely marketed) vehicle to purchase convertibles. It pays just 0.7% today. As you know, when we buy ETFs, we lock in:

- No discount to NAV (net asset value), and

- A low yield.

A better bet is a closed-end fund (CEF) like the Calamos Convertible and High Income Closed Fund (NASDAQ:CHY). CHY has been a great fund. Over the last decade, it’s returned a stellar 10% per year on its NAV.

Of course, the fund’s NAV and price are going to be correlated with the broader market. That is a good thing if you believe this rally is going to continue in the near-term. If, however, you believe a pullback is imminent, then you may want to wait on it.

From November through to January the CHY gained 25% and the Calamos Dynamic Convertible (NASDAQ:CCD)was up 29%.

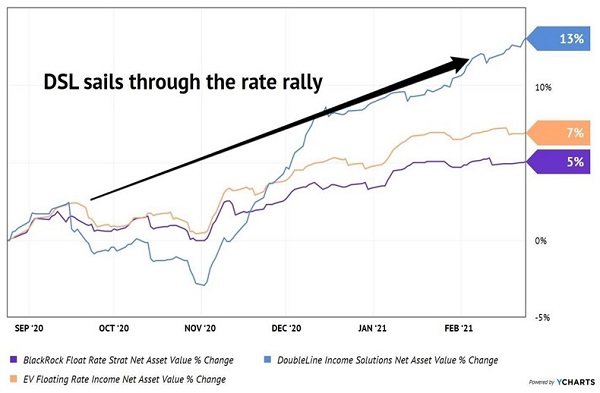

CEFs For Rising Interest Rates

Let’s consider the net asset values (NAVs) of two of my favorite floating rate CEFs, Blackrock Floating Rate Income Strategies Closed Fund (NYSE:FRA) and Eaton Vance Floating Rate Income Closed Fund (NYSE:EFT). They have enjoyed NAV gains of 5% and 7% over the last six months as the 10-year rate has risen. The coupons on their bonds have ticked up alongside the 10-year yield, so their portfolios have become more valuable.

When it comes to CEFs, we look at NAVs rather than prices. The CEF sector is a backwater of hidden gems where prices can often dip below their NAVs (or intrinsic values, market value of their bonds minus any debt). When we measure the performance of a portfolio, we get a way better reading by using NAV than the emotion-laden price.

We also need to keep in mind that these NAV gains are net of the dividends paid. FRA and ETF yield 6.2% and 5.4% respectively today.

But floating rate funds aren’t the only way to make money as rates rise. Let’s give a shout out to the “bond god” Jeffrey Gundlach because his DoubleLine Income Solutions Fund (NYSE:DSL) is absolutely sailing through the bond market drama.

Good Time to Be a Bond God

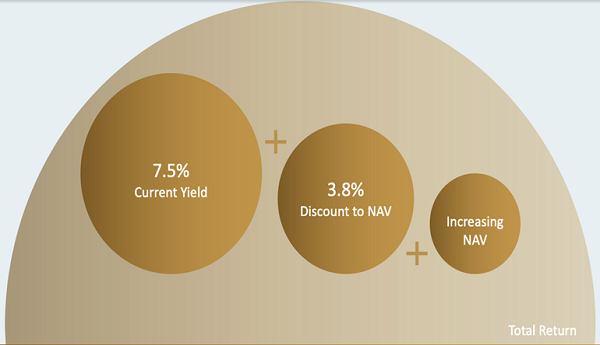

DSL yields 7.5% today. Its investors get paid every single month, and they have enjoyed 13% NAV gains on top of their payouts over the past six months. DSL also trades for a 3% discount to its NAV as I write. In other words, we’re able to buy its high-paying bond portfolio for just 97 cents on the dollar.

If that isn’t a bond bargain, I don’t know what is!

PIMCO’s Dynamic Credit and Mortgage Income Fund Has Outperformed

One aspect of the CEF structure lends itself perfectly to contrary-minded investing—fixed pools of shares.

Mutual funds issue more shares whenever they want. But closed ends have a fixed share count and trade like stocks. As a result, from time to time a fund will fall out of favor—I mentioned “emotion-laden” above—and find its shares trading at a discount to its NAV.

This is basically “free money” because these underlying assets are constantly marked to market. If a fund trades at a 10% discount, management could theoretically liquidate the fund and cash out everyone at $1.10 on the dollar immediately. Or it can buy back its own shares to close the discount window (and boost the share price).

I love both of these funds. But I’m also a contrarian. With DSL trading at a discount, we have three ways to make money (versus two for PCI).

DSL: Three Ways to Win

We have a generous current yield with PCI, plus a strong NAV, but not the discount that we prefer when we’re adding new money. And given the choice between two great CEFs, we’ll take the one in the bargain bin.

CEFs that return capital

Everyone generally assumes return of capital is bad because it’s simply shipping your money back to you. But if the fund trades at a significant discount, this can actually be a savvy way to kick-start the closing of a discount window because it often kick starts the price higher.

Also, some funds will classify distributions as “return of capital” because it is favorable for tax purposes. (Think of companies that strive to minimize their paper profits and tax liabilities—which is every firm ever.) Return of capital (or principal) is not necessarily a red flag. We can think of it as a yellow warning that warrants further attention to the specifics of that fund’s situation.

DSL is the only CEF that allows option trading

Options are financial creatures that feed on liquidity, something that is not as plentiful in CEFland. Investors interested in selling (“writing”) covered call options to boost income will generally be better off writing calls on stocks rather than CEFs like DSL.

How to determine the best mix of yield versus discount

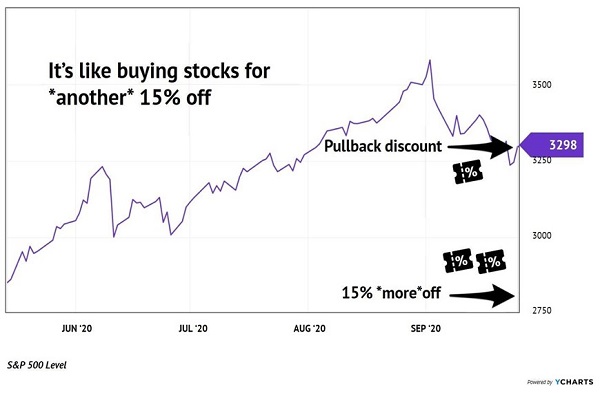

In October, for example, the Gabelli Dividend & Income Closed Fund (NYSE:GDV) fund traded post-pullback for 15% below its NAV. Yes, the fund run by legendary investor Mario Gabelli was selling for just $0.85 on the dollar. Buying GDV then was like buying stocks for another 15% below their pullback lows:

The Double-Discount: CEFs After a Pullback

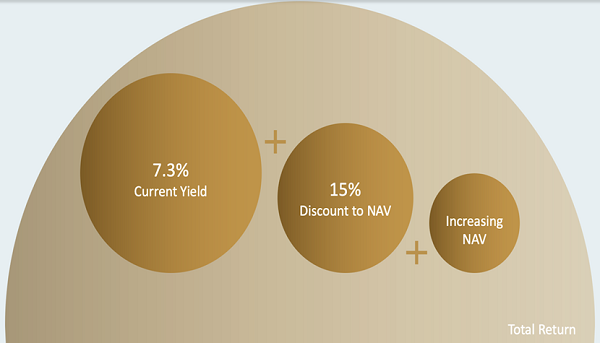

In buying an excellent fund like GDV at this impressive discount, we had three ways to profit:

- First, the fund was yielding a fat 7.3%,

- Plus, it was trading at a 15% discount to its intrinsic value (NAV), and

- Its NAV was likely to increase as the market bounced back (hence the importance of buying after the pullback was completed).

Total Returns = Current Yield + Discount Narrowing + NAV Gains

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."