Terra’s UST stablecoin briefly lost its peg to the dollar yesterday due to intensified selling pressure and borrowing demand.

Key Takeaways

- Terra's UST lost its peg to the U.S. dollar again this weekend, dipping as low as $0.985.

- The depeg event came after a series of multi-million dollar UST selloffs.

- UST posted a slight recovery shortly after Terraform Labs CEO Do Kwon posted a tweet calling out the stablecoin's critics.

Terra’s UST experienced a similar depeg event during a market-wide meltdown in May 2021.

More Problems For UST

It’s been an eventful weekend for the Terra ecosystem.

The Layer 1 blockchain’s UST stablecoin depegged below $1 early Sunday amid high-pressure market conditions. The decentralized coin, which aims to track the price of the U.S. dollar using a dual token mechanism with Terra’s LUNA, briefly traded as low as $0.985 before posting a short-lived recovery.

Per data from CoinGecko, it’s trading at about $0.993 at press time.

The depeg came after UST was hit by a series of multi-million dollar selloffs. On-chain data shows that one account traded about $85 million worth of UST for USDC on Curve Finance, while another user reportedly sold $108 million worth on Binance.

The number of swaps on Curve later increased, initiating a minor form of a “bank run,” where holders of an asset collectively rush to withdraw their funds in fear of insolvency issues.

At one point, Curve’s 3pool was so imbalanced that UST represented over 60% of the pool (stablecoin pool ratios are generally considered much healthier if there’s an equal balance of each coin).

As Twitter user and crypto analyst 0xSisyphus noted, Binance briefly halted UST borrowing, likely to prevent customers from loaning out their assets to get discounted UST that they could arbitrage on Curve.

Elsewhere in the Terra ecosystem, UST borrowing on Anchor Protocol, the blockchain’s most used DeFi application, soared above $2 billion. Terra’s native asset LUNA also plummeted 13%, dipping as low as $62.60. It’s trading closer to $61.50 at press time.

Terra Stablecoin Revives As Do Kwon Surfaces

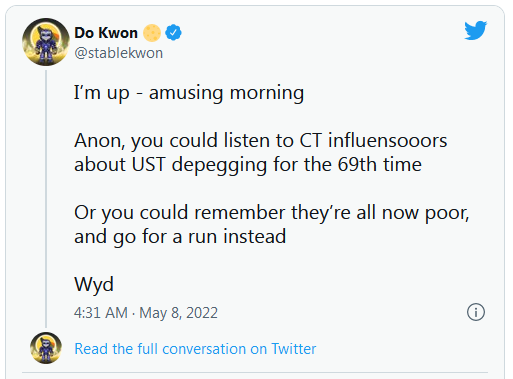

As rumors circulated on Twitter and the market began to show signs of panic, Terraform Labs CEO and the self-styled “master of stablecoin” Do Kwon surfaced to quash the concerns of a possible depeg crisis.

“I’m up—amusing morning… Anon, you could listen to CT influensooors about UST depegging for the 69th time… Or you could remember they’re all now poor, and go for a run instead… Wyd.”

He tweeted before posting what could be interpreted as a sexist comment asking his critics to show respect for his timezone. “if yall girls are gonna fud, try to do it during my waking hours pls,” he wrote, adding to a long list of controversial tweets he’s posted in recent months.

Shortly after Kwon’s tweet, UST started to recover. On-chain data shows that one address swapped over 57,000 Ethereum tokens worth over $146 million for USDT around the same time, then traded the stablecoin for UST on Curve, likely in an attempt to rebalance the pool and bring its price closer to $1. The same address also transferred 20,000 Ethereum to Binance.

Interestingly, this weekend’s chaos isn’t the first time UST has faced issues. In May 2021, when the cryptocurrency market experienced its last brutal crash, UST fell as low as $0.96. The incident sparked fears that the stablecoin could one day experience a full-on bank run and effectively kill Terra.

Besides the UST incident, it’s been something of a disastrous weekend for Kwon and Terraform Labs. On Saturday, Crypto Briefing revealed that the company had threatened legal action over a satirical April Fools’ Day article that mentioned Kwon.

Crypto Briefing’s Editor-in-Chief, Chris Williams, shared full details of the letter he received from Terraform Labs’ lawyers on Twitter, sparking widespread criticism of the company’s centralized nature and ill-judged PR blunder.