Tensions in UK politics after local elections

- Theresa May’s Conservative party did better than expected on the local elections on Thursday and avoided new headaches. Despite that, tensions seem to continue within a deeply divided Conservative party about the customs union issue. Media suggested that in an effort to talk down the matter, a minister stated that Britain is still weeks away from making a decision on the customs union issue, however, new debates sparked. Should there be further negative headlines about UK politics we could see the pound weakening and increased volatility could rise.

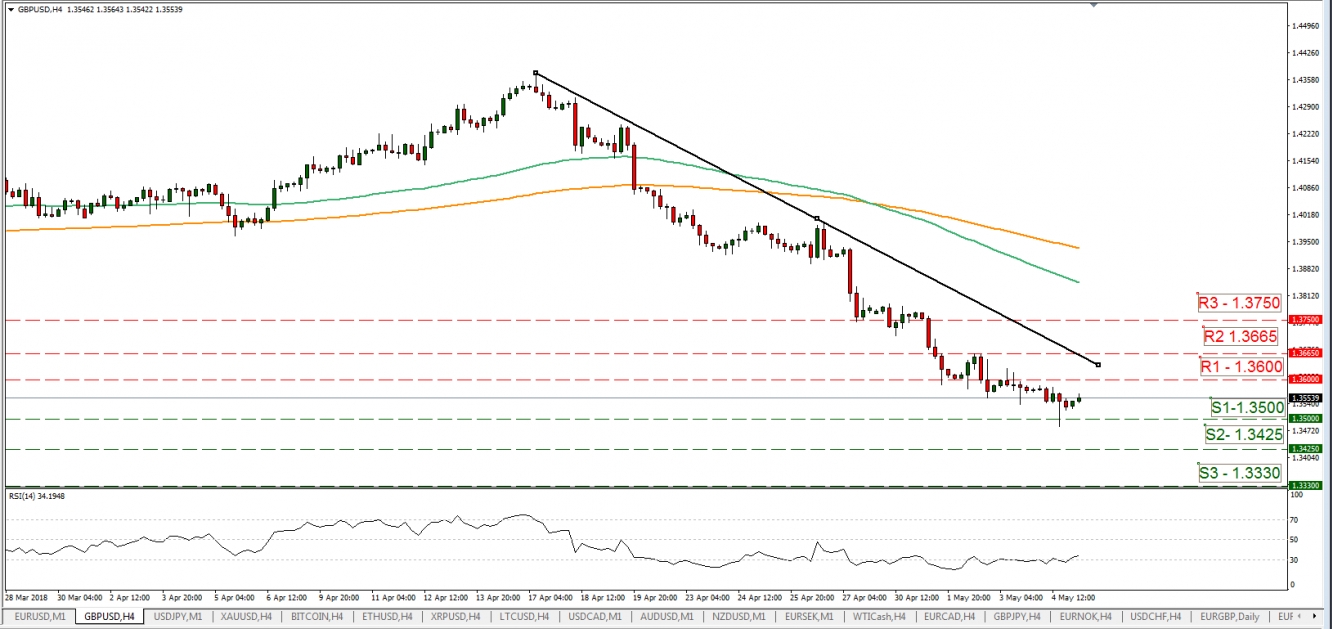

- Cable briefly broke the 1.3500 (S1) support line in a rather sideways movement, on Friday, as the US employment report was released. We see the case to continue to trade in a sideways movement with some bearish tendencies over the next few days. Technically the opinion could be supported by the fact that the pair has been trading below the downward trend-line incepted since the 17th of April. Should the pair come under selling interest we could see it breaking the 1.3500 (S1) support line and aim for the 1.3425 (S2) support barrier. Should it come to buying interest we could see it breaking the 1.3600 (R2) resistance line and even the aforementioned downward trend-line.

Some BoJ members were against the premature exit debate

- BoJ released its 8-9 March meeting minutes. It seems to be the case that a number of BoJ members warned against the premature debate of an exit for the ultra-loose policy. Also, some board members expressed their concern regarding the weakness in inflation and consumption. We see the importance of the release in that the bank seems to be consolidating behind the ultra-easing policy and generally keeps a dovish bias. Should there be further dovish comments on the issue we could see the JPY weakening.

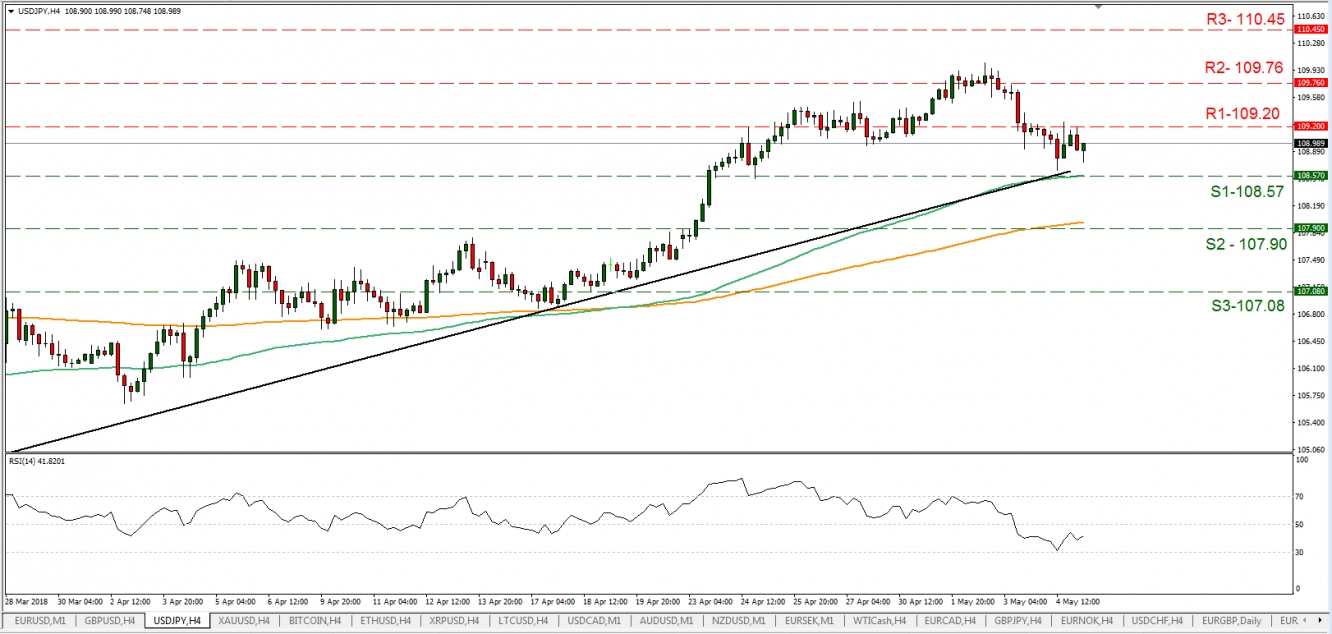

- USD/JPY traded in a sideways manner on Friday, constantly testing the 109.20 (R1) resistance line. We see the case for the pair to continue to trade in the same manner with some bullish tendencies. Technically the view could be supported by the fact that the pair has traded above the upward trend-line incepted since the 26th of March. Also please note, that the pair seems to be approaching a make or break position in regards to the prementioned trend-line. Should the bulls take over the pair, we could see it breaking the 109.20 (R1) resistance line and aim for the 109.76 (R2) resistance hurdle. Should the bears be in the driver’s seat, we could see the pair driving towards the 108.57 (S1) support line, breaking the aforementioned support level and upward trend-line and then aiming for the 107.90 (S2) support zone.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

In today’s other economic highlights:

- During today’s European session we get Germany’s Industrial Orders for March.

- As for speakers, FOMC members Bostic and Evans speak.

As for the rest of the week:

- On Tuesday from Australia, we get the Retail Sales for March and from Germany the Industrial Output and Trade Balance for March. On Wednesday we get from China the Trade Balance figure for April and from Sweden the CPI rate for April. On Thursday, early in the Asian morning, RBNZ’s interest rate decision will be released as well as Japan’s Current Account balance for March and China’s CPI rate for April. In the European session, we have BoE’s Interest rate decision and the Avast IPO on LSE while in the American session we get the US inflation data. On Friday, in the American session, we get Canada’s employment data for April and from the US the preliminary University of Michigan Sentiment indicator for May.

·Support: 1.3500 (S1), 1.3425 (S2), 1.3330 (S3)

·Resistance: 1.3600 (R1), 1.3665 (R2), 1.3750 (R3)

·Support: 108.57(S1), 107.90(S2), 107.08(S3)

·Resistance: 109.20(R1), 109.76(R2), 110.45(R3)